Diving into the world of Understanding mutual funds opens up a realm of financial possibilities that can shape your investment journey. From deciphering the basics to navigating the complexities, this exploration promises to be both enlightening and empowering.

As we delve deeper, let’s unravel the mysteries surrounding mutual funds and equip ourselves with the knowledge needed to make informed investment decisions.

What are mutual funds?

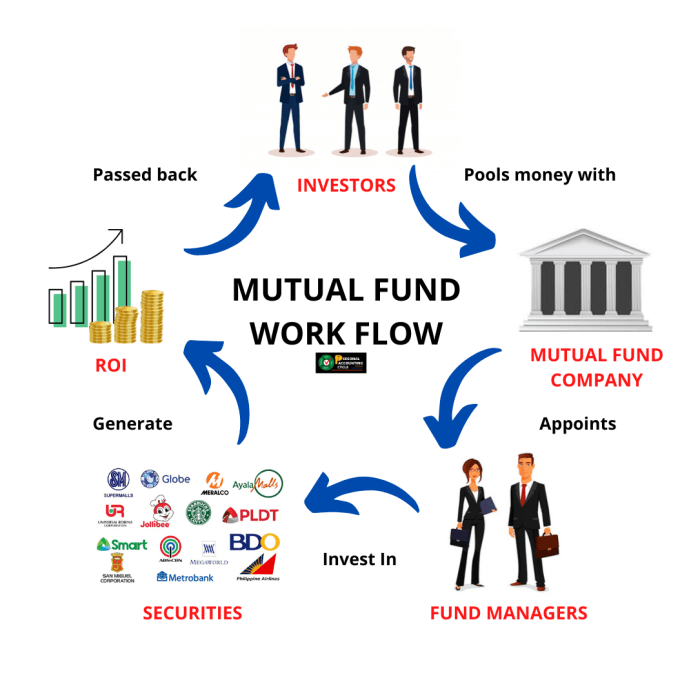

Mutual funds are investment vehicles that pool money from multiple investors to purchase a diversified portfolio of stocks, bonds, or other securities. They are managed by professional fund managers who make decisions on behalf of the investors.

How mutual funds work

- Mutual funds work by collecting money from investors and using it to buy a variety of securities.

- Investors in mutual funds own shares of the fund rather than owning the underlying assets directly.

- Profits from the investments are distributed among the investors in the form of dividends or capital gains.

Examples of different types of mutual funds

- Equity Funds: These funds invest in stocks and are suitable for investors seeking long-term growth.

- Bond Funds: These funds invest in bonds and are less risky than equity funds.

- Index Funds: These funds aim to replicate the performance of a specific market index.

Benefits of investing in mutual funds

Investing in mutual funds offers several advantages that make them a popular choice among investors. Let’s explore some of the key benefits below:

Diversification

One of the main advantages of mutual funds is diversification. By pooling money from multiple investors, mutual funds spread out investments across a wide range of securities, reducing the risk of putting all your eggs in one basket.

Professional Management

Mutual funds are managed by professional fund managers who make investment decisions on behalf of investors. These experts conduct research, analyze market trends, and actively manage the fund’s portfolio to maximize returns.

Liquidity

Mutual funds offer high liquidity, allowing investors to buy or sell their shares at the end of each trading day at the fund’s net asset value (NAV). This provides flexibility and easy access to your money when needed.

Cost-Effective

Compared to investing directly in individual securities, mutual funds are often more cost-effective. The fees and expenses associated with mutual funds are typically lower due to economies of scale and shared costs among investors.

Access to Markets

Mutual funds provide access to a wide range of markets and asset classes that may be difficult for individual investors to access on their own. This allows investors to diversify their portfolios and take advantage of various investment opportunities.

Overall, the benefits of investing in mutual funds make them a popular choice for both novice and experienced investors looking to grow their wealth over the long term.

Risks associated with mutual funds

Investing in mutual funds comes with certain risks that investors should be aware of in order to make informed decisions. Market fluctuations, economic downturns, and other factors can impact the performance of mutual fund investments. It is important to understand these risks and have strategies in place to mitigate them.

Market Fluctuations Impact

Market fluctuations can have a significant impact on the value of mutual fund investments. When the market is volatile, the value of the securities held by the mutual fund can decrease, leading to a decline in the overall value of the fund. This can result in losses for investors, especially if they need to redeem their investments during a market downturn. It is crucial for investors to be prepared for these fluctuations and have a long-term investment horizon to ride out market ups and downs.

Strategies to Mitigate Risks

One strategy to mitigate risks when investing in mutual funds is diversification. By spreading investments across different asset classes, sectors, and regions, investors can reduce the impact of a downturn in any single investment. Additionally, investors can regularly review and rebalance their portfolios to ensure they align with their risk tolerance and investment goals. It is also important to conduct thorough research on the mutual fund and its historical performance before making an investment decision. By staying informed and being proactive, investors can better navigate the risks associated with mutual funds.

How to choose the right mutual fund

Choosing the right mutual fund is crucial for achieving your investment goals. It requires careful consideration of various factors to ensure alignment with your risk tolerance and investment horizon.

Factors to consider when selecting a mutual fund

- Assess your investment goals: Determine whether you are looking for long-term growth, income generation, or a balanced approach.

- Evaluate your risk tolerance: Understand how much risk you are willing to take on and choose a fund that matches your comfort level.

- Consider the investment horizon: Decide whether you are investing for the short-term or long-term and select a fund with a corresponding time frame.

- Review the fund’s performance: Look at the historical performance of the fund to gauge its consistency and potential for future growth.

Methods for evaluating mutual funds

- Expense ratio: Compare the expenses of different funds to ensure you are not paying excessive fees that can eat into your returns.

- Historical performance: Analyze how the fund has performed in various market conditions to assess its track record.

- Asset allocation: Understand the fund’s investment strategy and holdings to see if it aligns with your financial objectives.

- Risk assessment: Consider the level of risk associated with the fund and determine if it matches your risk tolerance.

Understanding mutual fund expenses

When it comes to investing in mutual funds, it’s crucial to understand the various fees and expenses that come along with it. These costs can impact your overall returns, so it’s important to be aware of them and learn how to minimize them.

Breakdown of fees and expenses

- Expense Ratio: This is the annual fee charged by mutual funds to cover operating expenses. It is expressed as a percentage of the fund’s total assets.

- Front-end Load: This is a sales charge paid when purchasing shares of a mutual fund.

- Back-end Load: This is a sales charge paid when selling shares of a mutual fund.

- Transaction Fees: These are charges incurred when buying or selling shares of a mutual fund.

Impact of expense ratios on returns

High expense ratios can eat into your returns over time, so it’s important to choose funds with lower expense ratios to maximize your investment gains.

Recommendations to minimize expenses

- Choose no-load funds: Avoid funds with sales charges to reduce costs.

- Consider index funds: These funds have lower expense ratios compared to actively managed funds.

- Look for fee waivers: Some funds offer waivers on certain fees, so make sure to take advantage of them.