Kicking off with Understanding inflation rates, we dive into a world of economic intricacies that affect our daily lives in ways we might not even realize. Brace yourself for a journey through the fascinating realm of inflation rates and their profound impact on our economy.

As we delve deeper, you’ll uncover the inner workings of inflation rates and how they shape our financial landscape. Get ready to be enlightened!

Overview of Inflation Rates

Inflation rates refer to the percentage increase in the general price level of goods and services over a period of time. It is typically calculated using the Consumer Price Index (CPI) or the Producer Price Index (PPI) by comparing the current prices to a base year.

Understanding inflation rates is crucial for individuals, businesses, and policymakers as it affects various aspects of the economy. For individuals, inflation rates impact their purchasing power, as rising prices mean they can buy fewer goods and services with the same amount of money. Businesses need to consider inflation when setting prices and wages to ensure profitability. Policymakers use inflation data to make decisions on monetary policy, interest rates, and economic stability.

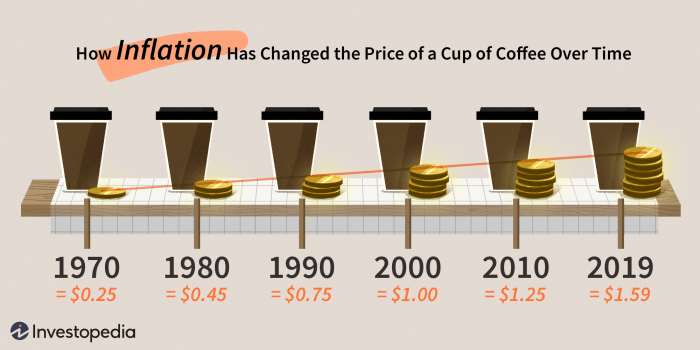

Impact on Purchasing Power

- Inflation decreases the purchasing power of consumers as prices rise, leading to a decrease in the real value of money.

- Individuals need to adjust their budgets and spending habits to cope with inflation and maintain their standard of living.

Effect on Investments

- Inflation can erode the value of investments over time, leading to lower real returns for investors.

- Investors need to consider inflation when choosing investment options that can outpace inflation and protect their wealth.

Influence on Interest Rates

- Inflation affects interest rates, with central banks adjusting rates to control inflation and stimulate or slow down economic growth.

- High inflation can lead to higher interest rates, making borrowing more expensive and impacting consumer spending and investment.

Types of Inflation

When it comes to inflation, there are different types that can impact the economy in various ways. Let’s take a closer look at three main types of inflation: demand-pull, cost-push, and built-in inflation.

Demand-Pull Inflation

Demand-pull inflation occurs when the demand for goods and services surpasses the economy’s ability to produce them, leading to an increase in prices. This type of inflation is often associated with strong economic growth and can be fueled by factors such as increased consumer spending, government spending, or investment. An example of demand-pull inflation is when there is a surge in housing demand, causing home prices to rise rapidly. The consequences of demand-pull inflation can include reduced purchasing power for consumers and potential asset bubbles.

Cost-Push Inflation

Cost-push inflation happens when the cost of production increases, leading to higher prices for goods and services. This type of inflation can be triggered by factors such as rising wages, higher energy costs, or supply chain disruptions. For instance, if there is a sudden increase in the cost of raw materials like oil, it can result in cost-push inflation. The effects of cost-push inflation may include reduced profit margins for businesses and potential unemployment due to higher costs of production.

Built-In Inflation

Built-in inflation, also known as wage-price spiral, occurs when workers demand higher wages to keep up with rising prices, leading to a cycle of wage increases followed by price hikes. This type of inflation is often the result of past inflationary trends and can create a self-reinforcing cycle of rising prices and wages. An example of built-in inflation is when labor unions negotiate for higher wages to match the cost of living, causing employers to raise prices to cover increased labor costs. The consequences of built-in inflation can include reduced competitiveness for businesses and potential income inequality.

Factors Influencing Inflation Rates

Inflation rates are influenced by a variety of factors that contribute to the overall rise in prices. Understanding these key factors can provide insight into how inflation rates are determined and how they can fluctuate over time.

Money Supply

The amount of money circulating in the economy plays a significant role in influencing inflation rates. When there is an increase in the money supply, consumers have more money to spend, leading to higher demand for goods and services. This increased demand can drive up prices, resulting in inflation.

Demand

Consumer demand for goods and services can also impact inflation rates. When demand outweighs supply, prices tend to rise as businesses seek to capitalize on the increased demand. This can create an inflationary pressure on the economy, pushing prices higher.

Production Costs

The cost of producing goods and services can also influence inflation rates. When production costs, such as labor or raw materials, increase, businesses may pass these costs onto consumers in the form of higher prices. This can contribute to overall inflation in the economy.

Consumer Behavior

Consumer behavior, such as spending habits and saving rates, can impact inflation rates as well. When consumers are more willing to spend and less inclined to save, it can lead to increased demand and higher prices. On the other hand, if consumers are more cautious with their spending, it can help moderate inflation rates.

Global Events, Government Policies, and Market Forces

External factors like global events, government policies, and market forces can also have a significant impact on inflation rates. Events such as natural disasters, political instability, or changes in trade agreements can disrupt supply chains and affect prices. Government policies, such as monetary and fiscal measures, can also influence inflation rates. Market forces like competition, technological advancements, and shifts in consumer preferences can further impact inflation dynamics.

Relationship Between Inflation Rates and Unemployment Rates

There is often an inverse relationship between inflation rates and unemployment rates known as the Phillips Curve. When inflation is high, unemployment tends to be lower as businesses expand and hire more workers to meet the increased demand. Conversely, when inflation is low, unemployment rates may rise as businesses scale back production and reduce their workforce. Understanding this relationship is crucial in analyzing the overall health of the economy.

Measuring Inflation

Inflation is a crucial economic indicator that affects the purchasing power of consumers and the overall economy. To measure inflation accurately, economists use different metrics such as the Consumer Price Index (CPI) and the Producer Price Index (PPI).

Consumer Price Index (CPI)

The Consumer Price Index (CPI) is a widely used measure of inflation that tracks the average change in prices paid by consumers for goods and services over time. It includes a basket of goods and services commonly purchased by households, such as food, housing, transportation, and healthcare. By monitoring changes in the CPI, policymakers can assess the cost of living and adjust policies accordingly.

The CPI is calculated by comparing the current prices of the basket of goods to a base year, and then expressing this change as a percentage increase or decrease.

Producer Price Index (PPI)

The Producer Price Index (PPI) measures the average change in prices received by producers for their goods and services. It tracks price movements at the wholesale level, providing insights into inflationary pressures in the production process. Businesses use the PPI to adjust pricing strategies, anticipate cost changes, and make informed decisions about production levels.

Unlike the CPI, which focuses on consumer prices, the PPI reflects changes in input costs for businesses and can signal potential changes in consumer prices in the future.

Limitations and Criticisms

– One of the limitations of the CPI is that it may not fully capture changes in consumer behavior, as it relies on a fixed basket of goods.

– Critics argue that the CPI overestimates inflation due to factors like substitution bias and quality adjustments.

– The PPI may not account for changes in the quality of goods or services, leading to potential inaccuracies in measuring inflation at the producer level.

Effects of Inflation

Inflation can have significant impacts on consumers, businesses, and the overall economy. Let’s explore how high and low inflation rates affect various aspects of our financial lives.

Impact on Consumers

- Inflation erodes the purchasing power of consumers, meaning that the same amount of money buys fewer goods and services over time.

- It can lead to an increase in the cost of living, making it more challenging for individuals to maintain their standard of living.

- Individuals on fixed incomes, such as retirees, may find it difficult to keep up with rising prices.

Impact on Businesses

- Businesses may face higher production costs due to inflation, which can eat into their profit margins.

- They may also struggle to predict future costs and revenues, making it challenging to plan for the future.

- Inflation can affect consumer demand, as individuals may cut back on spending if prices rise too quickly.

Impact on the Economy

- High inflation rates can lead to economic instability, as uncertainty about future prices can disrupt investment and growth.

- Low inflation, on the other hand, can signal weak demand in the economy, potentially leading to stagnation or deflation.

- Central banks often aim for a moderate level of inflation to support economic growth while maintaining price stability.

Protecting Against Inflation

- Investing in assets that tend to increase in value with inflation, such as real estate or stocks, can help preserve wealth.

- Adjusting wages and prices periodically to keep up with inflation can help businesses maintain profitability.

- Diversifying investments and savings can reduce the impact of inflation on an individual’s financial well-being.