With Understanding economic cycles at the forefront, this paragraph opens a window to an amazing start and intrigue, inviting readers to embark on a storytelling journey filled with unexpected twists and insights.

Economic cycles are like the heartbeat of a nation’s financial health, pulsating through different phases and impacting everything from businesses to everyday consumers. Let’s dive into the rhythm of these cycles and explore the fascinating world of economic trends and patterns.

Definition of Economic Cycles

Economic cycles refer to the recurring patterns of expansion and contraction in the economy. These cycles are characterized by fluctuations in economic activity, such as GDP growth, employment rates, and consumer spending.

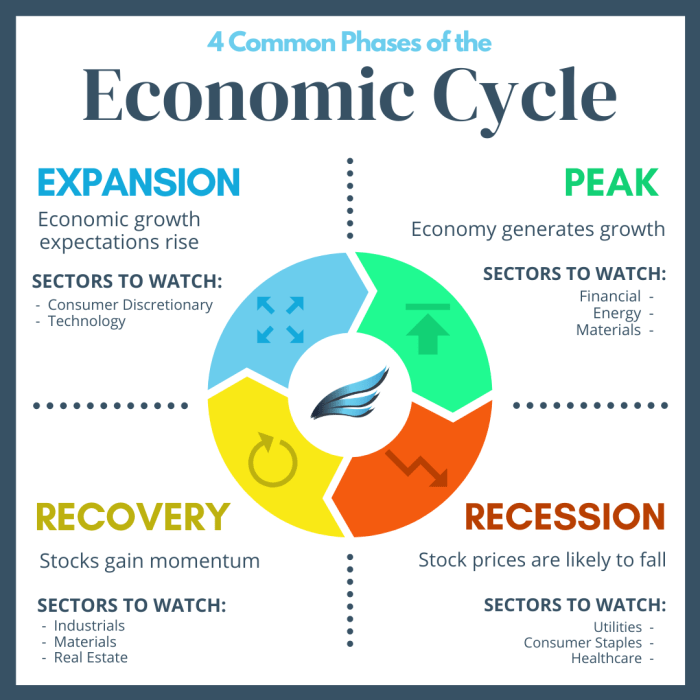

Phases of Economic Cycles

- The Expansion Phase: This phase is marked by economic growth, increased production, rising employment rates, and higher consumer confidence. Businesses are thriving, and investments are on the rise.

- The Peak Phase: In this phase, the economy reaches its highest point of growth. However, it also signifies a slowdown in the rate of growth, as resources become scarce, leading to inflation and potential asset bubbles.

- The Contraction Phase: Also known as a recession, this phase sees a decline in economic activity, with decreased production, rising unemployment, and reduced consumer spending. Businesses may cut back on investments and lay off workers.

- The Trough Phase: This marks the lowest point of the economic cycle, with high unemployment rates and low consumer confidence. However, it also sets the stage for recovery and a new cycle of growth.

Factors Influencing Economic Cycles

- Monetary Policy: Actions taken by central banks to control interest rates, money supply, and credit conditions can influence the direction of economic cycles.

- Fiscal Policy: Government spending, taxation, and budget decisions can impact economic cycles by stimulating or dampening economic growth.

- External Shocks: Events such as natural disasters, geopolitical tensions, or global economic crises can disrupt the normal course of economic cycles.

- Consumer Confidence: The sentiment and behavior of consumers play a significant role in shaping economic cycles, as their spending patterns affect overall economic activity.

Types of Economic Cycles

When it comes to economic cycles, there are various types that impact the overall economic landscape. Let’s delve into some of the key ones and see how they differ from each other.

Business Cycles

Business cycles refer to the recurring periods of expansion and contraction in economic activity. These cycles typically consist of four phases: expansion, peak, contraction, and trough. During an expansion phase, the economy grows, leading to increased production and spending. The peak marks the highest point of economic activity before a downturn occurs during the contraction phase. Finally, the trough is the lowest point before the economy starts to recover.

Kondratiev Waves

Kondratiev waves, also known as long waves, are long-term economic cycles that last between 40 to 60 years. These waves are characterized by periods of prosperity and growth followed by periods of stagnation or decline. Some experts believe that technological advancements and innovations drive these cycles, shaping the overall economic landscape over decades.

Comparison and Contrast

While business cycles are shorter-term and typically last a few years, Kondratiev waves span several decades. Business cycles are more frequent and can be influenced by various factors such as consumer confidence, government policies, and global events. On the other hand, Kondratiev waves are more tied to structural changes in the economy, driven by major innovations and shifts in technology.

Historical Examples

An example of a business cycle is the Great Depression in the 1930s, where the economy experienced a severe contraction leading to high unemployment rates and a decline in production. As for Kondratiev waves, the Industrial Revolution in the 18th and 19th centuries marked a period of significant technological advancements that shaped the economic landscape for decades to come.

Indicators of Economic Cycles

Understanding economic cycles involves tracking various indicators that provide insights into the current state of the economy. These indicators help analysts, policymakers, and investors anticipate changes in economic activity. By identifying key indicators and understanding their significance, stakeholders can make informed decisions to navigate through different phases of the economic cycle.

Key Indicators for Tracking Economic Cycles

- Gross Domestic Product (GDP): GDP is a primary indicator used to measure the overall economic performance of a country. It reflects the total value of goods and services produced within its borders.

- Employment Data: Unemployment rates, job creation, and labor force participation rates are crucial indicators of economic health.

- Consumer Confidence Index: This index measures consumers’ optimism about the state of the economy and their willingness to spend.

- Business Inventories: Changes in business inventories can signal shifts in production levels and consumer demand.

Leading, Lagging, and Coincident Indicators

- Leading Indicators: Leading indicators change before the economy as a whole changes. They help forecast future trends and include data such as building permits, stock prices, and consumer expectations.

- Lagging Indicators: Lagging indicators change after the economy as a whole changes. Examples include unemployment rates and corporate profits, reflecting past economic trends.

- Coincident Indicators: Coincident indicators change at the same time as the economy changes. They provide real-time insights into economic activity, such as personal income and industrial production.

Policy Implications of Economic Cycle Indicators

- Central banks and policymakers use economic cycle indicators to make decisions on monetary policy, such as interest rates adjustments, to stabilize the economy.

- Government agencies rely on these indicators to develop fiscal policies that promote economic growth, manage inflation, and address unemployment.

- Investors use economic cycle indicators to make investment decisions and adjust their portfolios based on anticipated economic trends.

Impacts of Economic Cycles

When it comes to economic cycles, the effects are felt far and wide, impacting businesses, consumers, and governments alike. Let’s delve into how these cycles influence various aspects of the economy.

Businesses

Businesses often face challenges during economic downturns. Reduced consumer spending leads to lower revenues, forcing companies to cut costs through layoffs or reduced investments. This can result in decreased profitability and potential closures.

Consumers

For consumers, economic cycles directly affect their purchasing power. During economic booms, consumers tend to have more disposable income, leading to increased spending. Conversely, during recessions, job losses and wage cuts can constrain spending, impacting overall economic growth.

Governments

Governments also feel the impact of economic cycles through changes in tax revenues and social welfare spending. During economic downturns, governments may experience lower tax collections due to reduced economic activity, while simultaneously facing higher demands for social assistance programs.

Employment Rates and Inflation

Economic cycles play a significant role in shaping employment rates and inflation. During economic expansions, businesses tend to hire more workers to meet growing demand, leading to lower unemployment rates. Conversely, during recessions, job losses can result in increased unemployment. In terms of inflation, economic booms can lead to rising prices due to increased consumer demand, while recessions may result in deflation as demand weakens.

Mitigating Strategies

To mitigate the impact of economic downturns, businesses can diversify their revenue streams, maintain healthy cash reserves, and focus on operational efficiency. Consumers can prioritize saving, reduce debt, and invest wisely to weather economic uncertainties. Governments can implement fiscal stimulus measures, such as infrastructure projects or tax cuts, to stimulate economic growth during recessions.

Investing During Economic Cycles

Investing during economic cycles requires a strategic approach to capitalize on opportunities and mitigate risks. Understanding how different phases of the economic cycle impact various asset classes is crucial for successful investing.

Investment Strategies Tailored to Different Phases of Economic Cycles

- During a recession, defensive strategies like investing in bonds or defensive stocks can help protect your portfolio.

- As the economy begins to recover, growth-oriented investments such as equities or real estate tend to perform well.

- In the peak phase, it may be wise to consider profit-taking and rebalancing your portfolio to lock in gains.

- During a contraction phase, alternative investments like commodities or precious metals can serve as a hedge against market volatility.

Risks and Opportunities Associated with Investing in Different Economic Cycles

- Opportunity: Buying undervalued assets during a recession can lead to substantial gains when the economy rebounds.

- Risk: Economic downturns can lead to significant losses in equity markets, so careful risk management is essential.

- Opportunity: High-growth sectors can outperform during expansion phases, offering the potential for above-average returns.

- Risk: Overexposure to a specific sector can lead to losses if that sector underperforms or faces regulatory challenges.

How Diversification Can Help Protect Investments During Economic Volatility

Diversification involves spreading your investments across different asset classes to reduce risk. By holding a mix of assets with low correlation, you can minimize the impact of economic downturns on your overall portfolio. For example, combining stocks, bonds, real estate, and commodities can help cushion the impact of market fluctuations and provide stability during turbulent times.