Jump into the world of tax planning tips where we explore strategies to help individuals and businesses navigate the complex tax landscape. From maximizing deductions to retirement planning, get ready to uncover the secrets to optimizing your tax situation.

Get ready to dive deep into the realm of taxes and discover how you can take control of your financial future with these essential tax planning tips.

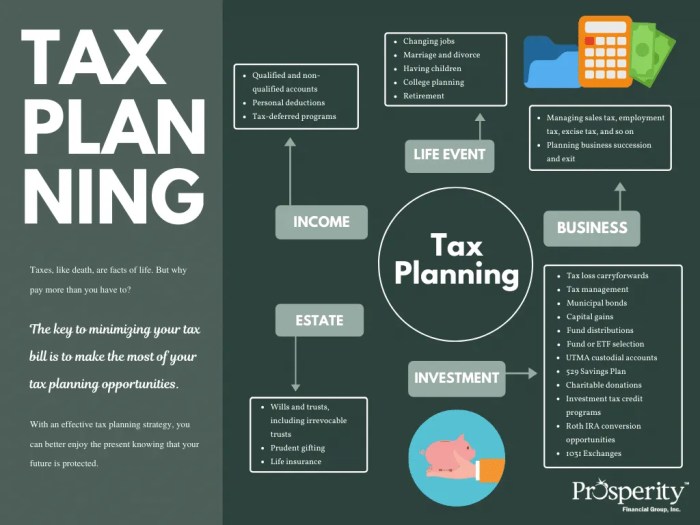

Importance of Tax Planning

Tax planning is a crucial aspect for both individuals and businesses to effectively manage their finances and minimize tax liabilities. By strategically planning ahead, individuals and businesses can take advantage of tax-saving opportunities, deductions, and credits to ensure they are not paying more taxes than necessary.

Benefits of Effective Tax Planning Strategies

- Maximizing tax savings: By utilizing tax planning strategies, individuals and businesses can optimize their tax situation to reduce the amount of taxes owed.

- Ensuring compliance: Proper tax planning helps individuals and businesses stay compliant with tax laws and regulations, avoiding any potential penalties or fines.

- Improving cash flow: By minimizing tax liabilities, individuals and businesses can free up more cash to reinvest in their operations or personal finances.

- Strategic decision-making: Tax planning can also influence important financial decisions, such as investments, retirement planning, and estate planning.

Examples of Minimizing Tax Liabilities

- Utilizing tax-deferred accounts like 401(k) or IRA to save for retirement while reducing taxable income.

- Claiming deductions for business expenses, home office expenses, medical expenses, and charitable contributions.

- Taking advantage of tax credits for education expenses, energy-efficient home improvements, or adopting children.

- Planning for capital gains tax by holding investments for the long term or offsetting gains with losses.

Tax Planning Tools and Strategies

Tax planning involves using various tools and strategies to minimize tax liabilities and maximize savings. Let’s explore some common tools and strategies used in tax planning.

Tax Planning Tools

- Tax-Deferred Accounts: These accounts allow individuals to contribute pre-tax dollars, reducing their taxable income. Examples include 401(k) and Traditional IRA.

- Tax Credits: Tax credits directly reduce the amount of tax owed. Examples include the Child Tax Credit and the Earned Income Tax Credit.

Tax Planning Strategies

- Income Level-Based Strategies: Depending on income levels, individuals can utilize strategies like income shifting to distribute income among family members in lower tax brackets.

- Financial Goal-Based Strategies: Tax planning can be tailored to achieve specific financial goals, such as saving for retirement or funding education. Utilizing tax-advantaged accounts can help reach these goals more efficiently.

- Tax-Loss Harvesting: This strategy involves selling investments that have experienced a loss to offset gains and reduce taxable income. It can be used to rebalance a portfolio while minimizing taxes.

Maximizing Deductions and Credits

When it comes to maximizing deductions and credits on your taxes, it’s crucial to identify eligible tax breaks and utilize them effectively to reduce your tax obligations. Proper record-keeping and documentation play a key role in ensuring you claim all the deductions and credits you’re entitled to.

Identifying Eligible Deductions and Credits

- Start by familiarizing yourself with the tax deductions and credits available to you based on your financial situation, such as education expenses, home office deductions, or retirement contributions.

- Consult with a tax professional or use tax software to ensure you are aware of all the deductions and credits you qualify for.

Maximizing Deductions through Record-Keeping

- Maintain organized records of all your expenses and income throughout the year to easily identify potential deductions during tax season.

- Keep receipts, invoices, and other relevant documents to support your claims for deductions, such as business expenses, charitable donations, or medical expenses.

- Consider using apps or software tools to track your expenses and receipts digitally, making it easier to access and categorize them when needed.

Utilizing Tax Credits Effectively

- Understand the difference between tax deductions and tax credits – while deductions reduce your taxable income, credits directly reduce your tax bill.

- Take advantage of refundable tax credits, such as the Earned Income Tax Credit or Child Tax Credit, which can result in a refund even if you have no tax liability.

- Explore any available tax credits for energy-efficient home improvements, education expenses, or adoption costs to maximize your tax savings.

Retirement Planning and Tax Efficiency

When it comes to tax planning, retirement accounts can be powerful tools in maximizing tax efficiency. By strategically utilizing retirement plans, individuals can not only save for the future but also reduce their taxable income in the present.

Tax Benefits of Contributing to Retirement Plans

- Contributing to retirement plans like IRAs and 401(k)s can lead to immediate tax benefits. The funds deposited into these accounts are often tax-deductible, meaning that the amount contributed is subtracted from your taxable income.

- By lowering your taxable income through retirement contributions, you can potentially decrease the amount of taxes you owe for the current year. This can result in significant savings come tax season.

- Additionally, the growth of funds within retirement accounts is tax-deferred, allowing your investments to compound without being subject to annual capital gains taxes. This can lead to substantial savings over time.

Optimizing Retirement Contributions for Tax Efficiency

- Consider maximizing your contributions to retirement accounts to take full advantage of the tax benefits they offer. The more you contribute, the greater the reduction in your taxable income.

- Review your current financial situation and tax bracket to determine the optimal amount to contribute to retirement plans. It’s important to strike a balance between maximizing contributions for tax savings and ensuring you have enough funds for current expenses.

- Explore different types of retirement accounts, such as Roth IRAs, which offer tax-free withdrawals in retirement. By diversifying your retirement savings across various account types, you can create a tax-efficient strategy for the future.