Diving into Strategies for paying off debt, this introduction immerses readers in a unique and compelling narrative, with a fresh perspective that is both engaging and thought-provoking from the get-go.

In a world filled with financial challenges, knowing how to effectively tackle debt is key to securing a stable future. Let’s explore some innovative strategies that can help you pay off debt and take control of your financial destiny.

Understanding Debt

Debt is money that is borrowed and must be repaid with interest over time. It can have a significant impact on personal finances, affecting savings, credit scores, and financial stability.

Types of Debt

- Credit Card Debt: Debt accumulated through credit card purchases, often carrying high interest rates.

- Student Loans: Loans taken out to pay for higher education expenses, with varying interest rates and repayment terms.

- Mortgage: A loan used to purchase a home, usually with a long repayment period and interest rates.

Interest Rates and Debt Repayment

Interest rates play a crucial role in debt repayment, as they determine the additional amount paid on top of the borrowed sum. Higher interest rates can significantly increase the total amount owed and the time it takes to pay off the debt.

Creating a Budget

Creating a budget is crucial when it comes to managing debt effectively. It allows you to track your expenses, set financial goals, and prioritize where your money goes each month.

Steps to Create a Budget

- Track Your Expenses: Start by recording all your income and expenses to get a clear picture of where your money is going.

- Set Financial Goals: Determine what you want to achieve financially, whether it’s paying off debt, saving for a big purchase, or building an emergency fund.

- Follow the 50/30/20 Rule: Allocate 50% of your income to essentials like housing, utilities, and groceries, 30% to wants like dining out or entertainment, and 20% to savings and debt repayment.

Debt Repayment Strategies

When it comes to paying off debt, having a solid strategy in place is key to achieving financial freedom. Here, we will explore three popular methods for tackling debt repayment.

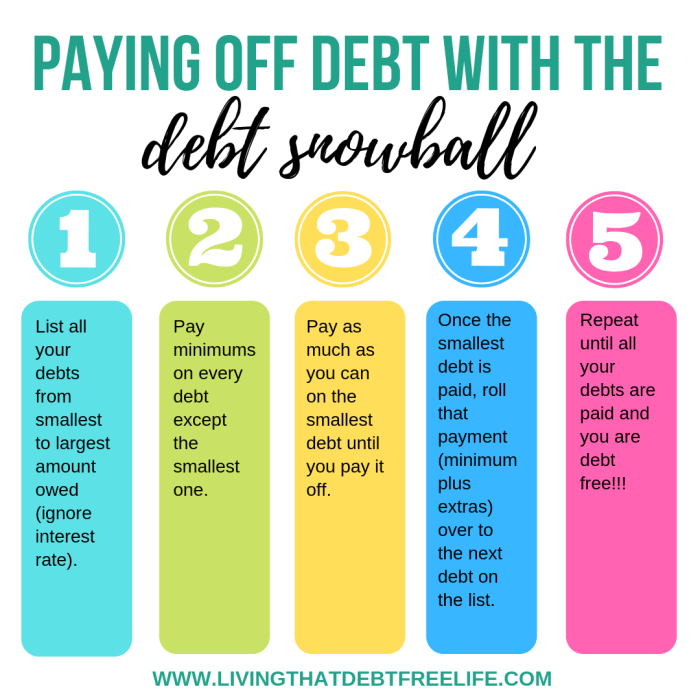

Snowball Method

The snowball method is a debt repayment strategy where you start by paying off your smallest debt first while making minimum payments on all other debts. Once the smallest debt is paid off, you roll that payment into the next smallest debt, creating a snowball effect. This method focuses on building momentum and motivation as you see debts being eliminated one by one.

Avalanche Method

The avalanche method, on the other hand, involves tackling debts based on their interest rates. You start by paying off the debt with the highest interest rate first while continuing to make minimum payments on the rest. Once the highest interest debt is paid off, you move on to the next highest interest debt. This method is more cost-effective in the long run as it helps you save on interest payments.

Debt Consolidation

Debt consolidation is a strategy where you combine multiple debts into a single loan with a lower interest rate. This simplifies your debt repayment process by having only one monthly payment to manage. It can also potentially lower your overall interest payments, making it easier to track your progress towards becoming debt-free.

Increasing Income and Cutting Expenses

In order to accelerate debt repayment, it is essential to find ways to increase your income and cut down on unnecessary expenses. By focusing on these two aspects, you can free up more money to put towards paying off your debts.

Increasing Income

- Consider taking on a part-time job or freelancing gigs to supplement your current income.

- Look for opportunities to advance in your current job or seek higher-paying employment elsewhere.

- Explore passive income streams, such as investing in stocks or real estate, to generate additional revenue.

Cutting Expenses

- Create a budget and track your spending to identify areas where you can cut back, such as dining out or unnecessary shopping.

- Cancel subscriptions or memberships that you no longer use or need.

- Shop for better deals on essentials like groceries and utilities to save money each month.

Prioritizing Debt Repayment

- Focus on paying off high-interest debt first to save money on interest payments in the long run.

- Avoid taking on more debt while you are in the process of repaying what you owe.

- Make debt repayment a priority over non-essential spending, such as luxury items or expensive vacations.

Seeking Professional Help

Seeking help from a financial advisor or credit counselor can be beneficial when you are struggling to manage your debt on your own. These professionals can provide guidance and expertise to help you develop a plan to pay off your debts efficiently.

Debt Management Plans

Debt management plans are agreements between you and your creditors, facilitated by a credit counseling agency. These plans typically involve creating a structured repayment schedule that helps you pay off your debts over time. Credit counselors negotiate with your creditors to potentially lower interest rates or waive fees, making it easier for you to manage your debt.

- Debt management plans consolidate multiple debts into one monthly payment.

- Credit counselors provide financial education and support throughout the process.

- These plans can help you become debt-free faster and more affordably.

It’s important to choose a reputable credit counseling agency to ensure the effectiveness of your debt management plan.

Debt Settlement

Debt settlement involves negotiating with creditors to pay a lump sum that is less than the total amount owed to settle the debt. While this can help you reduce your overall debt burden, it can have a negative impact on your credit score.

- Debt settlement may result in a lower credit score due to the settlement appearing on your credit report.

- It’s crucial to understand the potential consequences before pursuing debt settlement.

- Seek advice from a financial advisor or credit counselor to explore all options before deciding on debt settlement.