When it comes to Real estate investment strategies, buckle up as we dive into a world where financial prowess meets property potential, creating a narrative that’s as thrilling as it is enlightening.

In this guide, we’ll explore the ins and outs of different strategies, from long-term wealth building to short-term gains, providing you with the tools to navigate the dynamic landscape of real estate investing.

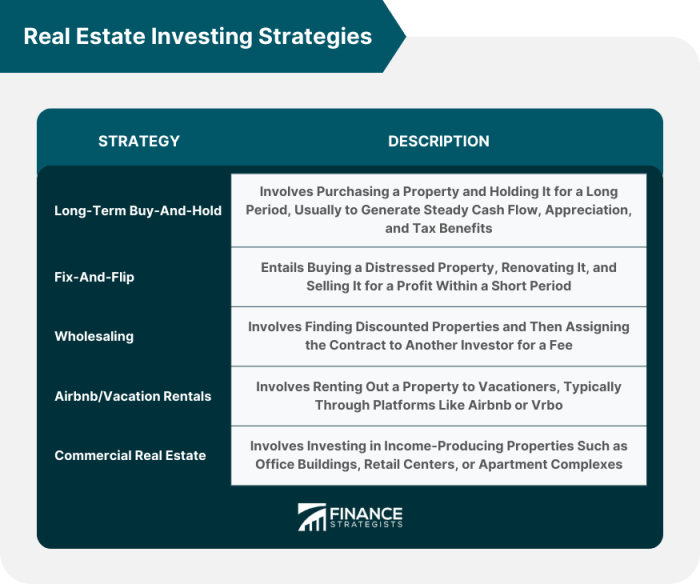

Real Estate Investment Strategies

Real estate investment strategies refer to the plans and approaches that investors use to maximize their returns and achieve their financial goals through property investments. These strategies can vary based on factors such as investment goals, risk tolerance, and market conditions.

Having a well-thought-out real estate investment strategy is crucial for success in the property market. It helps investors make informed decisions, mitigate risks, and optimize their returns. Without a clear strategy, investors may struggle to achieve their financial objectives and may be more susceptible to market fluctuations and unexpected challenges.

Variety of Real Estate Investment Strategies

- Long-Term Wealth Building: This strategy involves acquiring properties with the goal of holding onto them for an extended period to build equity and generate rental income over time.

- Short-Term Gains: Investors following this strategy focus on buying properties at a lower price, adding value through renovations or improvements, and then selling them quickly for a profit.

- Fix and Flip: This strategy involves purchasing distressed properties, renovating them, and selling them at a higher price within a short period to maximize profits.

- Buy and Hold: Investors using this strategy aim to purchase properties in stable markets with the intention of renting them out for consistent cash flow and long-term appreciation.

Types of Real Estate Investment Strategies

Real estate investment strategies come in various forms, each with its own set of risks and potential rewards. Let’s explore some common types of real estate investment strategies and compare their risk levels.

Buy and Hold Strategy

The buy and hold strategy involves purchasing a property with the intention of holding onto it for an extended period of time. Investors who use this strategy typically generate income through rental payments and benefit from property appreciation over time.

Fix and Flip Strategy

The fix and flip strategy involves purchasing a property, making renovations or improvements, and then selling it for a profit in a relatively short period of time. This strategy requires a keen eye for potential value-add opportunities and a good understanding of the local real estate market.

Rental Properties Strategy

Investors who focus on rental properties acquire properties with the goal of generating rental income. This strategy can provide a steady stream of passive income but comes with the responsibilities of managing tenants and property maintenance.

Comparison of Risk Levels

– Buy and hold strategy: Generally considered lower risk due to the long-term nature of the investment and potential for property appreciation.

– Fix and flip strategy: Higher risk due to the need for successful renovations and market timing to sell at a profit.

– Rental properties strategy: Moderate risk due to potential tenant issues and market fluctuations affecting rental income.

Successful Real Estate Investors

– Barbara Corcoran: Known for her successful buy and hold strategy, investing in properties in prime locations and holding onto them for long-term gain.

– Scott McGillivray: Utilizes the fix and flip strategy to renovate properties and sell them for a profit, showcasing a keen eye for value-add opportunities.

– Robert Kiyosaki: Focuses on rental properties strategy, building a portfolio of rental properties to generate passive income and long-term wealth.

Factors Influencing Real Estate Investment Strategies

When considering real estate investment strategies, various factors come into play that can significantly impact the decision-making process. These factors can be broadly categorized into external and internal influences, as well as the overarching economic trends that shape the real estate market.

External Factors

External factors refer to outside influences that are beyond the control of individual investors but can greatly affect the real estate market and investment strategies. These factors include market conditions, interest rates, government policies, and economic indicators. Market conditions, such as supply and demand dynamics, can determine whether it’s a buyer’s or seller’s market, influencing the type of investment strategy that would be most profitable. Interest rates set by central banks can impact borrowing costs, affecting the affordability of real estate investments and the return on investment. Government policies, such as tax incentives or zoning regulations, can also shape investment strategies by creating opportunities or limitations for investors. Economic indicators like GDP growth, unemployment rates, and inflation can signal the overall health of the economy, impacting investor confidence and risk appetite.

Internal Factors

Internal factors are personal considerations that vary from one investor to another and play a crucial role in determining the most suitable investment strategy. These factors include the investor’s risk tolerance, financial goals, investment horizon, and liquidity needs. Risk tolerance refers to the level of uncertainty an investor is willing to endure in pursuit of higher returns. Investors with a high risk tolerance may opt for aggressive strategies like property flipping or development, while those with a lower risk tolerance may prefer more conservative approaches like rental properties. Financial goals, such as wealth preservation, income generation, or capital appreciation, can guide investors towards specific strategies aligned with their objectives. The investment horizon, or the length of time an investor plans to hold onto a property, can influence the choice of strategy, with long-term investors favoring buy-and-hold approaches. Lastly, liquidity needs, or the investor’s requirement for cash flow or access to funds, can impact the selection of strategies that offer regular income or quick returns.

Economic Trends

Economic trends encompass broader patterns and cycles that shape the real estate market and investment strategies over time. These trends can include demographic shifts, urbanization, technological advancements, and global economic conditions. Demographic changes, such as population growth or aging demographics, can create new opportunities for real estate investments in certain regions or sectors. Urbanization trends, with more people moving to cities, can drive demand for residential and commercial properties in urban centers. Technological advancements, like smart home technologies or virtual tours, can impact property valuations and marketing strategies. Global economic conditions, such as trade agreements or currency fluctuations, can influence investor sentiment and capital flows in the real estate market.

Developing a Real Estate Investment Strategy

When it comes to creating a personalized real estate investment strategy, there are several key steps to consider. Research and due diligence play a crucial role in formulating an effective plan, while the ability to adapt and adjust based on changing market conditions is essential for long-term success.

Steps to Create a Personalized Real Estate Investment Strategy

- Define Your Investment Goals: Determine what you want to achieve with your real estate investments, whether it’s passive income, long-term appreciation, or a combination of both.

- Assess Your Risk Tolerance: Understand how much risk you are willing to take on and how it aligns with your financial goals.

- Conduct Market Research: Analyze market trends, demographics, and economic indicators to identify potential investment opportunities.

- Develop a Budget and Financial Plan: Set a budget for your investments and create a financial plan that Artikels your funding sources and investment timeline.

- Choose Your Investment Strategy: Decide on the type of real estate investments that best align with your goals, whether it’s rental properties, fix-and-flip projects, or commercial real estate.

The Importance of Research and Due Diligence

Research and due diligence are critical components of any successful real estate investment strategy. By thoroughly researching market conditions, property values, and potential risks, investors can make informed decisions that mitigate potential losses and maximize returns. Due diligence involves conducting property inspections, reviewing financial statements, and verifying property ownership to ensure that the investment is sound and aligns with your goals.

Tips for Adapting and Adjusting Your Strategy

- Stay Informed: Keep up-to-date with market trends, regulatory changes, and economic indicators that may impact your investments.

- Be Flexible: Be prepared to adjust your strategy based on changing market conditions, interest rates, or unexpected events that may affect your investments.

- Diversify Your Portfolio: Spread your investments across different property types, locations, and investment strategies to reduce risk and maximize returns.

- Seek Professional Advice: Consider working with real estate professionals, financial advisors, or property management companies to help guide your investment decisions and navigate complex market conditions.