Real Estate Investing Tips: Get ready to dive into the world of real estate investing with insider tips and tricks to help you succeed in the market. From finding the best deals to managing rental properties effectively, this guide has got you covered.

Overview of Real Estate Investing: Real Estate Investing Tips

Real estate investing involves purchasing, owning, managing, renting, or selling properties with the goal of generating profit. This form of investment can include residential, commercial, or industrial properties, and it has become a popular choice for many individuals looking to grow their wealth.

Reasons for Choosing Real Estate as an Investment

Investing in real estate offers several advantages that attract investors:

- Income Generation: Rental properties can provide a steady stream of income through monthly rent payments.

- Appreciation: Real estate properties tend to increase in value over time, allowing investors to benefit from capital appreciation.

- Tax Benefits: Property owners can take advantage of tax deductions, depreciation, and other tax benefits associated with real estate investments.

- Diversification: Real estate can serve as a diversification tool in an investment portfolio, reducing overall risk.

Benefits and Risks of Real Estate Investing

Real estate investing comes with its own set of benefits and risks that investors should consider:

- Benefits:

- Steady Income: Rental properties can provide a consistent source of income.

- Appreciation: Properties have the potential to increase in value over time.

- Tax Advantages: Investors can benefit from tax deductions and other tax advantages.

- Portfolio Diversification: Real estate can help diversify an investment portfolio.

- Risks:

- Market Fluctuations: Real estate values can fluctuate based on market conditions.

- Vacancy Risk: Rental properties may experience periods of vacancy, leading to loss of income.

- Maintenance Costs: Property maintenance and repairs can be costly and impact profitability.

- Liquidity Issues: Real estate is not as liquid as other investments, making it harder to sell quickly if needed.

Types of Real Estate Investments

When it comes to real estate investments, there are several types to consider, each with its own set of characteristics, potential returns, and risks. Understanding the different types can help you make informed decisions about where to invest your money.

Residential Real Estate

Residential real estate includes properties such as single-family homes, condominiums, townhouses, and apartments. These properties are typically used as living spaces for individuals and families. Investing in residential real estate can provide steady rental income and potential for property appreciation over time. However, it also comes with the challenge of dealing with tenants and property maintenance.

Commercial Real Estate

Commercial real estate refers to properties used for business purposes, such as office buildings, retail spaces, and industrial warehouses. Investing in commercial real estate can offer higher rental income compared to residential properties, but it also comes with higher upfront costs and longer lease agreements. The value of commercial properties is often tied to the success of the businesses leasing the space.

Industrial Real Estate, Real Estate Investing Tips

Industrial real estate includes properties like manufacturing facilities, distribution centers, and storage warehouses. Investing in industrial real estate can provide stable long-term income from tenants with long lease agreements. However, it can also come with higher maintenance costs and the risk of economic downturns affecting demand for industrial space.

Land Investments

Land investments involve buying undeveloped land with the intention of holding it for future development or resale. While land investments do not generate immediate income like rental properties, they can offer substantial returns if the land appreciates in value due to factors like location, zoning changes, or infrastructure development. However, land investments also come with the risk of zoning restrictions, environmental issues, and fluctuating market conditions.

Financial Considerations

When it comes to real estate investing, financial considerations play a crucial role in determining the success of your investments. From calculating potential returns to managing expenses, here are some key factors to keep in mind.

Calculating Potential Return on Investment (ROI)

Calculating the potential return on investment (ROI) in real estate is essential to determine the profitability of a property. To calculate ROI, use the following formula:

(Net Profit / Cost of Investment) x 100

Net profit includes rental income, appreciation, and tax benefits, while the cost of investment includes purchase price, closing costs, and any renovation expenses.

Financing Options for Real Estate Investments

When it comes to financing real estate investments, you have several options to consider. These include:

- Mortgages: Borrowing money from a bank or financial institution to purchase a property.

- Loans: Obtaining a loan from a private lender or hard money lender for short-term financing.

- Partnerships: Collaborating with other investors or partners to pool resources and invest in properties together.

Each financing option has its own benefits and drawbacks, so it’s essential to carefully evaluate which option aligns best with your investment goals.

Budgeting and Managing Expenses

Proper budgeting and expense management are crucial for the success of your real estate investments. Here are some tips to help you stay on track:

- Create a detailed budget that includes all expenses such as mortgage payments, property taxes, insurance, and maintenance costs.

- Track your expenses regularly to ensure you are staying within budget and making adjustments as needed.

- Consider setting aside a contingency fund for unexpected expenses or vacancies to avoid financial strain.

By carefully managing your finances and staying on top of your budget, you can set yourself up for success in the world of real estate investing.

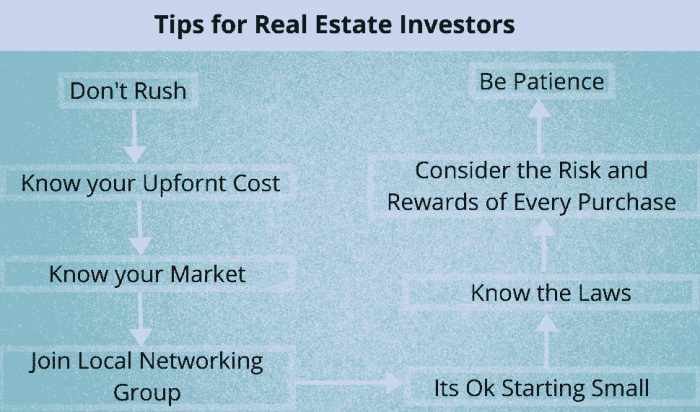

Tips for Successful Real Estate Investing

Investing in real estate can be a lucrative venture if done right. Here are some tips to help you succeed in the real estate market.

Finding Profitable Real Estate Deals

- Look for distressed properties that can be renovated and sold for a profit.

- Attend local auctions or sheriff sales to find properties at below-market prices.

- Build relationships with real estate agents who can help you find off-market deals.

Importance of Location, Market Research, and Due Diligence

- Location is key in real estate investing. Invest in properties in desirable neighborhoods with good schools and amenities.

- Conduct thorough market research to understand trends and demand in the area you are investing in.

- Always perform due diligence before purchasing a property to avoid any hidden issues or liabilities.

Managing Rental Properties Effectively

- Screen tenants carefully to avoid problematic renters and ensure timely rent payments.

- Maintain your properties regularly to keep them in good condition and retain their value.

- Have a clear and comprehensive lease agreement to protect your interests as a landlord.