Get ready to dive into the world of loan consolidation strategies with this in-depth guide that will unveil the secrets to financial freedom. Exploring the ins and outs of consolidating loans, this journey is filled with tips, tricks, and expert advice to help you navigate your way to a debt-free future.

Understanding Loan Consolidation

When it comes to loan consolidation, it’s all about bringing together multiple loans into a single new loan. This can help simplify your payments and potentially save you money in the long run.

Types of Loans Eligible for Consolidation

- Student Loans

- Credit Card Debt

- Personal Loans

Benefits of Loan Consolidation

- Lower Interest Rates: By consolidating your loans, you may qualify for a lower interest rate which can save you money over time.

- Simplified Payments: Instead of juggling multiple due dates, consolidation allows you to make a single payment each month.

- Potential Lower Monthly Payments: Depending on the terms of your new loan, you may be able to reduce your monthly payment amount.

Strategies for Loan Consolidation

When it comes to consolidating loans, having a clear plan is essential to effectively manage your debt. By combining multiple loans into one, you can streamline your payments and potentially save money on interest. Here is a step-by-step guide on how to consolidate loans effectively.

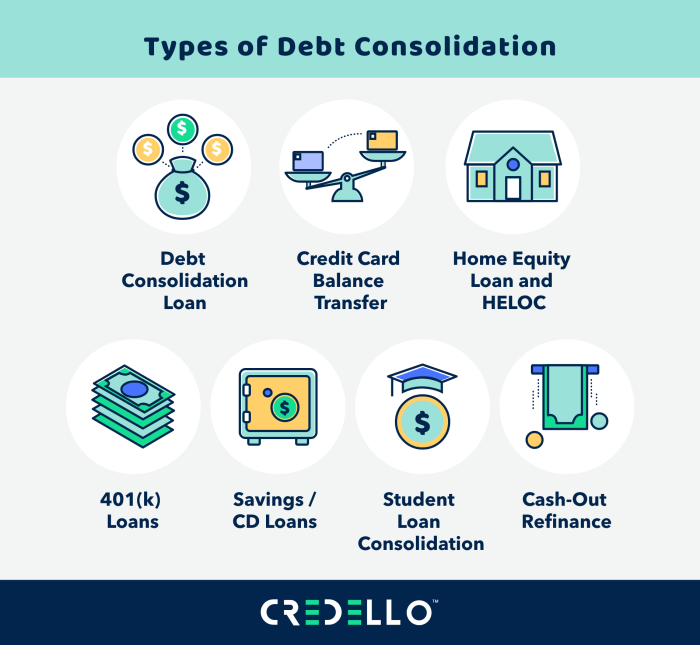

Comparing Loan Consolidation Options

When looking at loan consolidation options, it’s important to compare the interest rates, repayment terms, and fees associated with each. Here are some common options to consider:

- Debt Consolidation Loan: This involves taking out a new loan to pay off all existing debts. The new loan typically has a lower interest rate, which can save you money in the long run.

- Balance Transfer Credit Card: Some credit cards offer introductory 0% APR periods for balance transfers. This can be a good option if you can pay off the balance before the promotional period ends.

- Home Equity Loan: If you own a home, you may be able to use the equity to secure a loan with a lower interest rate. However, it’s important to consider the risk of losing your home if you can’t make the payments.

Impact of Interest Rates on Loan Consolidation

Interest rates play a significant role in loan consolidation strategies. A lower interest rate can save you money over time, while a higher rate may not provide as much benefit. It’s important to calculate the total cost of each consolidation option, including any fees, to determine the best choice for your financial situation.

Factors to Consider

Before opting for loan consolidation, individuals should carefully consider several key factors that can impact their financial situation.

Credit Score and Financial History

Maintaining a good credit score and having a strong financial history are crucial when deciding on loan consolidation. Lenders often look at these factors to determine the interest rate and terms of the consolidated loan. A higher credit score can lead to a lower interest rate, saving the borrower money in the long run.

- Check your credit score before applying for loan consolidation to see if you qualify for better terms.

- Review your financial history to ensure you have a good track record of making payments on time.

- Consider taking steps to improve your credit score before consolidating your loans to secure better rates.

Potential Risks

While loan consolidation can offer benefits such as a single monthly payment and lower interest rates, there are also risks that individuals should be aware of before proceeding.

Consolidating loans may extend the repayment period, resulting in paying more interest over time.

- Calculate the total cost of the consolidated loan, including interest, to determine if it is a cost-effective option.

- Be cautious of fees associated with loan consolidation that could add to the overall cost of the loan.

- Understand the terms and conditions of the consolidated loan to avoid any surprises or hidden fees.

Tips for Successful Loan Consolidation

When it comes to managing your finances after consolidating your loans, it’s crucial to have a plan in place. Here are some expert tips to help you navigate the post-consolidation phase smoothly.

1. Budgeting Strategies

- Start by creating a detailed budget that Artikels your income and expenses.

- Identify areas where you can cut back on spending to free up more money for loan repayments.

- Consider using budgeting apps or tools to track your expenses and stay on top of your financial goals.

2. Repayment Plan

- Work with your lender to create a repayment plan that aligns with your financial situation and goals.

- Set up automatic payments to ensure you never miss a due date and incur late fees.

- Consider making extra payments whenever possible to pay off your consolidated loan faster and save on interest.