Loan application process explained sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with american high school hip style and brimming with originality from the outset.

Get ready to dive into the world of loan applications, where financial jargon meets real-life decisions, and the quest for funds begins.

Overview of Loan Application Process

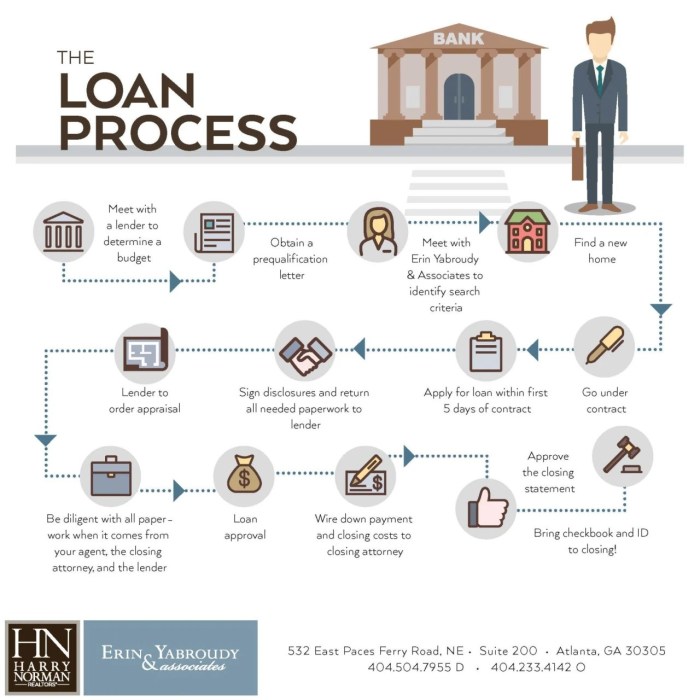

When applying for a loan, there are several steps you need to follow to ensure a smooth process and increase your chances of approval. It is essential to have a good understanding of the typical documents required, the importance of credit scores, and how your financial history plays a crucial role in the entire process.

General Steps in Loan Application

- Research and Compare Lenders: Start by researching different lenders and comparing their interest rates, terms, and fees.

- Check Eligibility Criteria: Make sure you meet the lender’s eligibility criteria before applying.

- Complete Application: Fill out the loan application form accurately with all the required information.

- Submit Documents: Prepare and submit the necessary documents such as identification, proof of income, and bank statements.

- Wait for Approval: After submitting your application, wait for the lender to review and approve your loan.

- Receive Funds: If approved, you will receive the funds in your bank account as per the agreed terms.

Typical Documents Required

- Identification: A valid government-issued ID such as a driver’s license or passport.

- Proof of Income: Recent pay stubs, tax returns, or bank statements to verify your income.

- Bank Statements: Statements from your checking or savings account to show your financial stability.

- Credit Report: Lenders may request a copy of your credit report to assess your creditworthiness.

Importance of Credit Scores and Financial History

Your credit score and financial history are crucial factors that lenders consider when evaluating your loan application. A good credit score demonstrates your ability to manage debt responsibly, while a positive financial history reflects your past financial behavior. These factors can influence the interest rate you are offered and the loan amount you can qualify for.

Types of Loans Available

When it comes to applying for a loan, there are various types available to individuals based on their specific needs and financial situations.

- Personal Loans: Personal loans are unsecured loans that can be used for various purposes, such as debt consolidation, home improvement, or unexpected expenses. These loans are typically based on the borrower’s creditworthiness.

- Auto Loans: Auto loans are specifically designed for purchasing a vehicle. The loan amount is based on the price of the car, and the vehicle itself serves as collateral for the loan.

- Mortgage Loans: Mortgage loans are long-term loans used to finance the purchase of a home. These loans are secured by the property being purchased.

Secured vs. Unsecured Loans

When it comes to loans, they can be categorized as either secured or unsecured.

Secured loans require collateral, such as a car or a home, to secure the loan. If the borrower fails to repay the loan, the lender can take possession of the collateral to cover the outstanding debt.

Unsecured loans, on the other hand, do not require any collateral. These loans are approved based on the borrower’s creditworthiness and ability to repay.

Specific Requirements for Each Type of Loan

Each type of loan has specific requirements that borrowers must meet in order to qualify:

| Loan Type | Requirements |

|---|---|

| Personal Loans | Good credit score, stable income, and low debt-to-income ratio. |

| Auto Loans | Proof of insurance, proof of income, and a down payment. |

| Mortgage Loans | Good credit score, stable income, and a down payment. |

Preparing for a Loan Application

Before applying for a loan, it’s crucial to prepare yourself financially. This involves getting your finances in order to increase your chances of approval and secure favorable loan terms. Here are some tips to help you prepare effectively:

Establish a Budget and Financial Goals

Prior to applying for a loan, it’s essential to have a clear budget in place. A budget will give you a comprehensive overview of your income, expenses, and savings, allowing you to determine how much you can afford to borrow and repay each month. Additionally, setting financial goals can help you stay focused and disciplined in managing your finances.

Review Credit Reports

Reviewing your credit reports before applying for a loan is crucial. Your credit score plays a significant role in the loan approval process and the interest rate you’ll receive. By checking your credit reports, you can identify any errors or discrepancies that may be negatively impacting your score. This gives you the opportunity to correct any inaccuracies and improve your creditworthiness before submitting your loan application.

Completing the Application

When filling out a loan application form, accuracy is key to ensure a smooth process and increase your chances of approval. Here is a guide on how to complete the application accurately, avoid common mistakes, and submit all necessary documentation efficiently.

Filling Out the Application Form

- Read the instructions carefully before starting to fill out the form.

- Provide accurate information about your personal details, employment status, income, and expenses.

- Double-check all entries for errors or missing information before submitting the form.

Avoiding Common Mistakes

- Do not provide false information or exaggerate your financial status.

- Avoid leaving any sections blank unless they are not applicable to you.

- Do not forget to sign and date the form before submitting it.

Gathering and Submitting Documentation

- Make a checklist of all the required documents, such as pay stubs, bank statements, tax returns, and identification.

- Organize the documents in a clear and orderly manner to make it easier for the lender to review them.

- Submit all the required documentation at once to speed up the processing of your application.

Submitting the Application

When you’ve completed all the necessary information on your loan application, it’s time to submit it to the lender. This is a crucial step in the process, as it officially starts the review process of your application.

Sending Your Application

- Most lenders offer online submission options, where you can upload your application and supporting documents directly through their website.

- If you prefer a traditional approach, you can also mail or hand-deliver your application to the lender’s physical location.

After Submitting

- After submitting your application, you can expect to receive a confirmation email or message acknowledging the receipt of your documents.

- The lender will then begin reviewing your application to assess your eligibility for the loan.

Timelines

- The timelines for the application review process can vary depending on the lender and the type of loan you’re applying for.

- Generally, you can expect a decision within a few days to a few weeks after submitting your application.

- If additional information or documentation is required, the lender will reach out to you to provide these details.

Loan Approval and Disbursement

After the loan application process is complete, the lender will review the application to determine if the borrower meets all the necessary requirements. Once the loan is approved, the borrower will receive notification of the approval along with the terms and conditions of the loan.

Disbursement Process

- Once the loan is approved, the lender will work on disbursing the funds to the borrower.

- The disbursement process involves transferring the approved loan amount to the borrower’s account.

- Some lenders may disburse the funds directly to the institution or vendor for which the loan was taken.

Managing Disbursed Funds

- It is essential to use the disbursed funds responsibly and for the intended purpose.

- Make a budget outlining how you plan to utilize the loan amount to avoid overspending or misuse.

- Consider setting up automatic payments to ensure timely repayment of the loan amount.

- Regularly monitor your expenses and adjust your budget as needed to stay on track with loan repayments.