Yo, check it – investment portfolio management is where the real money moves are made. Get ready to dive into a world of finance and strategy like never before. This ain’t your typical high school math class, this is the real deal.

Now, let’s break it down for you.

Introduction to Investment Portfolio Management

Investment Portfolio Management involves the process of overseeing and making decisions about a group of investments held by an individual or an organization. This includes asset allocation, risk management, and performance evaluation to achieve financial goals.

The Importance of Managing an Investment Portfolio Effectively

Managing an investment portfolio effectively is crucial for several reasons:

- Maximizing Returns: Proper management can help optimize returns on investments.

- Minimizing Risks: By diversifying and monitoring investments, risks can be reduced.

- Achieving Financial Goals: Effective management aligns investments with financial objectives.

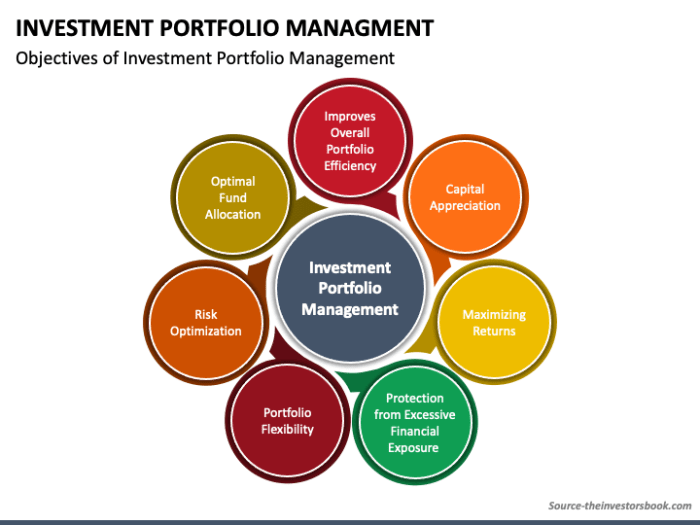

Primary Goals of Investment Portfolio Management

The primary goals of investment portfolio management include:

- Capital Preservation: Protecting the initial investment is a key goal.

- Capital Growth: Increasing the value of the portfolio over time is essential for long-term financial growth.

- Risk Management: Balancing risk and return to achieve optimal investment outcomes.

Types of Investment Portfolios

Investment portfolios come in various types, each with its own set of characteristics and objectives. Understanding the differences between these types can help investors make informed decisions based on their financial goals and risk tolerance.

Growth Portfolio

A growth portfolio is designed for investors seeking capital appreciation over the long term. This type of portfolio typically consists of stocks or mutual funds with high growth potential. The main objective is to maximize returns by investing in companies that are expected to experience significant growth in the future. While growth portfolios offer the potential for high returns, they also come with higher risk due to the volatility of growth stocks.

Income Portfolio

An income portfolio is focused on generating regular income through dividends, interest payments, or rental income. Investors who prioritize a steady stream of income often opt for this type of portfolio. Income portfolios usually include bonds, dividend-paying stocks, and real estate investment trusts (REITs). The primary objective is to provide a consistent cash flow while maintaining a lower level of risk compared to growth portfolios.

Balanced Portfolio

A balanced portfolio aims to strike a balance between growth and income by diversifying investments across different asset classes. This type of portfolio typically includes a mix of stocks, bonds, and cash equivalents. The objective is to achieve steady growth while minimizing risk through diversification. Balanced portfolios are suitable for investors looking for a moderate level of risk and return.

By comparing and contrasting the risk levels associated with different types of investment portfolios, investors can choose the one that aligns best with their financial goals and risk tolerance.

Asset Allocation Strategies

Asset allocation is a crucial component of portfolio management that involves dividing investments among different asset classes to achieve specific objectives while managing risk. It plays a significant role in determining the overall performance of an investment portfolio.

Strategic Asset Allocation

Strategic asset allocation involves setting a long-term target mix of asset classes based on an investor’s goals, risk tolerance, and time horizon. This strategy aims to maintain the desired portfolio balance over time through periodic rebalancing.

- Diversification is a key principle in strategic asset allocation, spreading investments across different asset classes (such as stocks, bonds, real estate, and cash) to reduce risk.

- By allocating assets strategically, investors can capture the potential returns of different asset classes while minimizing the impact of market volatility.

Tactical Asset Allocation

Tactical asset allocation involves making short-term adjustments to the portfolio based on market conditions or economic outlook. This strategy allows investors to capitalize on opportunities or manage risks that may arise in the short term.

- Investors using tactical asset allocation may increase or decrease exposure to certain asset classes based on their assessment of market trends, valuations, or geopolitical events.

- While tactical asset allocation can potentially enhance returns, it also introduces more active decision-making and may increase transaction costs.

Dynamic Asset Allocation

Dynamic asset allocation combines elements of both strategic and tactical approaches, allowing for flexibility in adjusting the portfolio based on changing market conditions or investment opportunities.

- Dynamic asset allocation strategies typically involve a rules-based approach that triggers adjustments when specific criteria or indicators are met.

- This approach aims to capture short-term opportunities while maintaining a long-term strategic asset allocation framework.

Diversification Techniques

When it comes to investment portfolios, diversification is a key strategy that involves spreading your investments across different asset classes, industries, and geographic regions to reduce risk.

Asset Class Diversification

Asset class diversification involves investing in a mix of different types of assets such as stocks, bonds, real estate, and commodities. By spreading your investments across various asset classes, you can reduce the impact of a downturn in any one asset class on your overall portfolio.

Geographic Diversification

Geographic diversification involves investing in securities from different countries and regions. This strategy helps reduce the risk associated with a particular country’s economic or political issues. By spreading your investments globally, you can potentially benefit from growth opportunities in different markets.

Sector Diversification

Sector diversification involves investing in companies from different industries such as technology, healthcare, consumer goods, and energy. By diversifying across sectors, you can reduce the impact of a downturn in a specific industry on your portfolio. This strategy allows you to benefit from growth in different sectors of the economy.

Portfolio Rebalancing

Portfolio rebalancing is the process of realigning the weightings of assets in a portfolio to maintain the desired level of risk and return. It plays a crucial role in ensuring that the portfolio remains consistent with the investor’s goals and risk tolerance.

Importance of Periodic Rebalancing

- Periodic rebalancing helps in keeping the portfolio in line with the investor’s target asset allocation. As market fluctuations occur, the original asset allocation may deviate, leading to increased risk or lower returns.

- By rebalancing, investors can sell off assets that have performed well and buy assets that have underperformed. This “buy low, sell high” approach helps in maximizing returns over the long term.

- Rebalancing also helps in managing risk by preventing the portfolio from becoming too heavily weighted in one asset class, which could expose it to higher volatility.

Examples of Rebalancing an Investment Portfolio

- Rebalancing based on time: Investors can set specific time intervals, such as quarterly or annually, to review and rebalance their portfolios. For example, if stocks have outperformed bonds, the investor may sell some stocks and buy more bonds to maintain the target asset allocation.

- Rebalancing based on thresholds: Investors can also set percentage thresholds for each asset class in their portfolio. If an asset class deviates by a certain percentage from the target allocation, the investor can rebalance to bring it back in line.

- Rebalancing based on life events: Major life events such as retirement, marriage, or a child’s education can also trigger the need to rebalance a portfolio. For example, as retirement approaches, an investor may shift towards more conservative investments to minimize risk.

Performance Evaluation

When it comes to evaluating the performance of an investment portfolio, it is essential to analyze how well the portfolio has performed in terms of returns in comparison to the set goals and benchmarks. This helps investors make informed decisions about the effectiveness of their investment strategy.

Key Performance Indicators (KPIs)

- Return on Investment (ROI): This measures the profitability of the portfolio by comparing the net profit to the overall investment.

- Sharpe Ratio: This indicates the risk-adjusted performance of the portfolio, considering the volatility of returns.

- Alpha: This measures the excess return of the portfolio compared to the expected return based on its risk profile.

- Beta: This shows the sensitivity of the portfolio’s returns to market movements.

Methods of Measuring and Analyzing Performance

- Time-Weighted Return: This method eliminates the impact of external cash flows on performance, providing a more accurate measure of the portfolio’s performance.

- Money-Weighted Return: This considers the timing and amount of cash flows into and out of the portfolio, giving a comprehensive view of the investor’s actual returns.

- Portfolio Attribution Analysis: This breaks down the sources of portfolio returns to identify the key drivers of performance, such as asset allocation, security selection, and market timing.