With Investment diversification at the forefront, this paragraph opens a window to an amazing start and intrigue, inviting readers to embark on a storytelling american high school hip style filled with unexpected twists and insights.

Investment diversification is like mixing up your playlist with different beats to keep the vibe fresh and exciting. It’s all about spreading your money across various investments to reduce risks and maximize gains. So, buckle up and get ready to dive into the world of smart investing!

Importance of Investment Diversification

Investment diversification is like having a squad with different skills to cover all bases. It’s crucial for managing risk and protecting your hard-earned money from unexpected market moves.

Risk Management

Diversification helps spread your investments across different asset classes, industries, and regions. If one investment takes a hit, the others can step up and cushion the blow. It’s like having multiple backup plans in case things go south.

Protecting Your Portfolio

For example, let’s say you have all your money in one tech stock, and suddenly the tech industry faces a downturn. Your whole portfolio could take a nosedive. But if you had diversified into other sectors like healthcare or real estate, those investments could balance out the losses.

Enhancing Long-Term Returns

Diversification not only helps protect your portfolio from big losses but also opens up opportunities for growth. By investing in a mix of assets with different risk levels, you can potentially increase your returns over the long run. It’s all about playing the long game and reaping the rewards.

Types of Investment Diversification

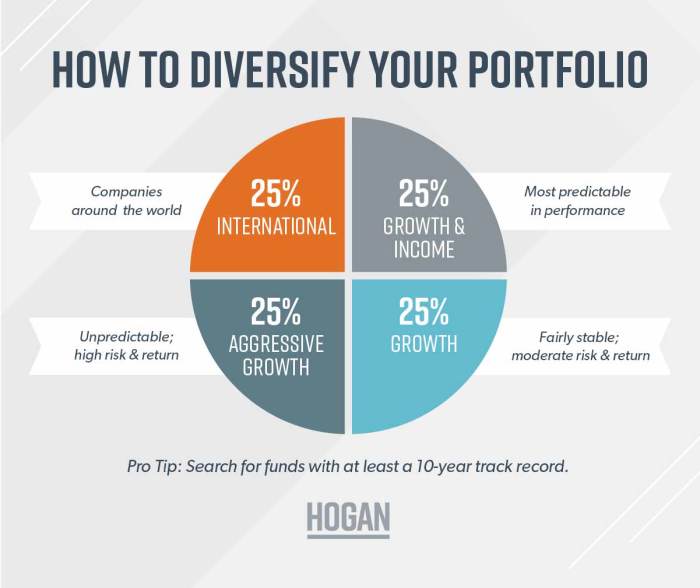

When it comes to diversifying your investments, there are several types of assets you can consider. Diversification can be achieved by spreading your investments across different asset classes, within the same asset class, and even geographically. Let’s explore these options further.

Diversifying Across Different Asset Classes

- Stocks: Investing in shares of publicly traded companies.

- Bonds: Purchasing debt securities issued by governments or corporations.

- Real Estate: Investing in properties, either directly or through real estate investment trusts (REITs).

- Commodities: Investing in physical goods such as gold, oil, or agricultural products.

Diversifying Within the Same Asset Class

- Stocks: Investing in a mix of large-cap, mid-cap, and small-cap stocks to reduce risk.

- Bonds: Diversifying across different types of bonds, such as government bonds, corporate bonds, and high-yield bonds.

- Real Estate: Investing in properties across different sectors like residential, commercial, and industrial real estate.

Geographical Diversification

Geographical diversification involves spreading your investments across different regions or countries to reduce risk associated with a single market. This can help protect your portfolio from country-specific risks, economic downturns, or political instability. For example, an investor may allocate funds to both developed and emerging markets, or invest in countries with varying economic cycles to achieve geographical diversification.

Strategies for Effective Diversification

When it comes to diversifying your investment portfolio, there are several strategies you can employ to maximize returns while minimizing risk. It’s important to determine the optimal level of diversification, understand the concept of correlation, and utilize rebalancing techniques to maintain a well-diversified portfolio over time.

Determining Optimal Diversification

- Assess your risk tolerance and investment goals to determine the level of diversification that aligns with your financial objectives.

- Consider the number of asset classes and individual investments in your portfolio to ensure you have a broad range of holdings.

- Monitor the performance of your investments regularly and make adjustments as needed to maintain an optimal level of diversification.

The Importance of Correlation

- Correlation measures the relationship between different investments in your portfolio. A correlation of +1 means two investments move in perfect unison, while a correlation of -1 means they move in opposite directions.

- Diversifying with assets that have low or negative correlations can help reduce overall portfolio risk, as losses in one investment may be offset by gains in another.

- By understanding correlation, you can strategically allocate your investments to achieve the desired level of diversification and risk management.

Rebalancing for Maintaining Diversification

- Periodically review your portfolio to ensure that the asset allocation still aligns with your diversification goals.

- Rebalance your portfolio by buying or selling assets to bring the allocation back to its target percentages. This helps maintain diversification and manage risk.

- Rebalancing also allows you to take advantage of market fluctuations and adjust your portfolio to capitalize on changing investment opportunities.

Risks Associated with Diversification

Diversification is a key strategy in investment management, but it does come with its own set of risks that investors need to be aware of to make informed decisions. Let’s delve into the potential drawbacks of over-diversification, the impact of economic factors on diversification effectiveness, and ways to mitigate risks while maintaining a diversified portfolio.

Over-Diversification Drawbacks

- Over-diversification can lead to diminished returns as the portfolio becomes too diluted with too many assets.

- It may increase complexity and monitoring efforts, making it harder to track individual investments effectively.

- Over-diversification can also result in higher transaction costs and lower overall portfolio performance.

Impact of Economic Factors

- Economic factors such as interest rates, inflation, and market volatility can impact the effectiveness of diversification.

- In times of economic uncertainty, correlations between asset classes may increase, reducing the benefits of diversification.

- Global economic events, such as trade wars or geopolitical tensions, can also influence the performance of different asset classes in a diversified portfolio.

Mitigating Risks in Diversification

- Regularly review and rebalance your portfolio to ensure it aligns with your investment goals and risk tolerance.

- Consider alternative investments like real estate or commodities to further diversify your portfolio beyond traditional asset classes.

- Monitor economic indicators and market trends to make informed decisions about your investment mix and allocation.