Dive into the world of stock market mastery with our guide on How to Read a Stock Quote. Whether you’re a seasoned investor or a curious beginner, understanding the ins and outs of stock quotes is essential for making informed decisions in the financial realm. Get ready to decode the numbers and symbols that drive the market!

In this guide, we’ll break down the components of a stock quote, explore the significance of stock symbols, delve into price and volume information, and uncover the power of historical performance data. By the end, you’ll be equipped with the knowledge to navigate the stock market with confidence and savvy.

Understanding Stock Quotes

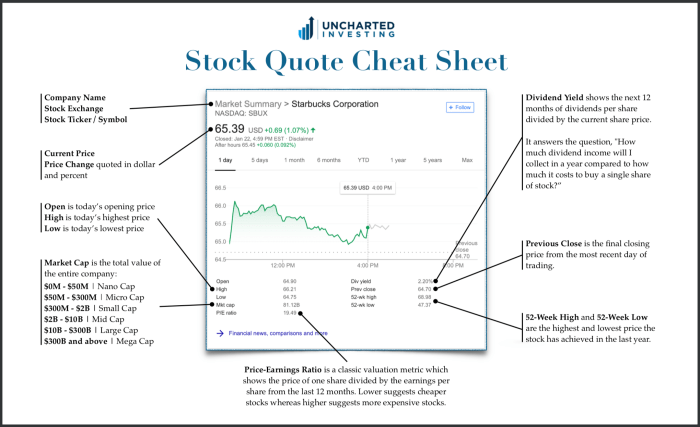

When it comes to understanding stock quotes, it’s important to know the key components that make up a stock quote. These components provide valuable information about a particular stock’s performance in the market.

Bid Price: The bid price represents the highest price that a buyer is willing to pay for a stock at a specific moment in time. It’s the price at which you can sell your shares.

Ask Price: On the other hand, the ask price is the lowest price that a seller is willing to accept for a stock. It’s the price at which you can buy shares.

Volume: Volume refers to the total number of shares of a particular stock that have been traded during a given period. High volume generally indicates a lot of interest in a stock.

Market Cap: Market capitalization, or market cap, is the total value of a company’s outstanding shares of stock. It’s calculated by multiplying the current stock price by the total number of outstanding shares.

Examples of Stock Quotes Display

When you visit financial websites or platforms, you will typically see stock quotes displayed in a standardized format. Here are some common examples of how stock quotes are presented:

– Company Name: XYZ Company

– Ticker Symbol: XYZ

– Current Price: $100.00

– Bid Price: $99.50

– Ask Price: $100.50

– Volume: 1,000,000

– Market Cap: $1 billion

These components provide a snapshot of the stock’s performance and can help investors make informed decisions about buying or selling shares. Remember, it’s essential to understand these components to interpret stock quotes accurately.

Interpreting Stock Symbols

When looking at a stock quote, one of the key components is the stock symbol. Stock symbols are unique combinations of letters assigned to companies trading publicly on the stock market. These symbols serve as a shorthand way to identify a particular company’s stock and are crucial for investors to track and trade stocks effectively.

Significance of Stock Symbols

Stock symbols are like the DNA of a company in the stock market. They provide a quick and easy way to identify a specific company’s stock among thousands of others. When you see a stock symbol, you can immediately recognize the company it represents and access relevant financial information. For example, “AAPL” is the stock symbol for Apple Inc., and “MSFT” represents Microsoft Corporation.

Assignment of Stock Symbols

Stock symbols are typically assigned by stock exchanges or financial regulatory bodies. Companies may request specific symbols, but ultimately, the assignment follows certain guidelines to ensure uniqueness and consistency. Companies with well-known names may have symbols that are easy to remember, while others may have more obscure symbols. For instance, “AMZN” stands for Amazon.com Inc., and “GOOGL” is the symbol for Alphabet Inc.

Examples of Stock Symbols

- AMZN – Amazon.com Inc.

- AAPL – Apple Inc.

- GOOGL – Alphabet Inc.

- MSFT – Microsoft Corporation

- TSLA – Tesla, Inc.

Price and Volume Information

Price and volume information are crucial components of a stock quote as they provide valuable insights into the market activity surrounding a particular stock. The price reflects the current value of a stock, while the volume indicates the number of shares being traded. Understanding how changes in price and volume can impact market trends is essential for making informed investment decisions.

Importance of Price and Volume

- Price: The price of a stock shows its perceived value in the market at a given time. It can indicate whether a stock is overvalued, undervalued, or trading at fair value.

- Volume: The volume of shares traded gives an indication of the level of interest and activity in a particular stock. High volume can suggest increased investor interest or potential price movement.

Impact on Market Trends

- Price and volume data together can help identify trends in the market. For example, a sharp increase in price accompanied by high volume may indicate a bullish trend, while a drop in price with high volume could signal a bearish trend.

- Changes in price and volume can also provide insights into market sentiment and investor behavior. For instance, a sudden spike in volume without a significant price change may suggest a potential trend reversal.

Influence on Investment Decisions

- Investors often use price and volume data to analyze stock performance and make decisions about buying or selling. For example, a stock with increasing price and volume might be seen as a good investment opportunity.

- Monitoring price and volume trends over time can help investors identify patterns and make informed decisions about when to enter or exit a position. It can also help in setting realistic profit targets and stop-loss levels.

Historical Performance Data

When looking at a stock quote, historical performance data is crucial for investors to assess how a stock has performed over time. This data typically includes information on the stock’s price movements, trading volume, and other key metrics for a specified period.

Importance of Historical Data

- Historical performance data allows investors to track a stock’s past performance and identify trends or patterns that may help predict future movements.

- It provides valuable insights into how a stock has reacted to different market conditions, economic events, or company-specific news in the past.

- Investors can use historical data to evaluate the volatility, stability, and overall risk associated with a particular stock.

Analyzing Stock Potential with Historical Data

- By analyzing historical performance data, investors can identify support and resistance levels where the stock has historically struggled or excelled.

- Looking at past price movements can help investors determine potential entry and exit points for trading or investing in a stock.

- Comparing a stock’s historical performance to its industry peers or benchmark indices can provide valuable insights into its relative strength or weakness.

- Examining historical volume data can help investors gauge market interest in a stock and assess the level of liquidity available for buying or selling shares.