Looking to score that personal loan but not sure where to start? We got you covered with all the insider tips and tricks you need to know. From understanding the basics to navigating the application process like a pro, this guide will have you flexing your financial muscles in no time.

Get ready to dive into the world of personal loans and emerge as a savvy borrower with our comprehensive breakdown of everything you need to know.

Introduction to Personal Loans

A personal loan is a type of loan that individuals borrow from a financial institution, such as a bank or online lender, to meet various personal financial needs. Unlike specific loans like home loans or auto loans, personal loans can be used for a wide range of purposes.

There are two main types of personal loans: secured and unsecured. Secured personal loans require collateral, such as a car or savings account, to back the loan. On the other hand, unsecured personal loans do not require collateral but may have higher interest rates due to the increased risk for the lender.

Common Uses of Personal Loans

- Consolidating high-interest debt from credit cards

- Home improvement projects

- Medical expenses

- Wedding expenses

Factors to Consider Before Applying

When applying for a personal loan, there are several important factors to consider to increase your chances of approval and secure favorable loan terms.

Credit Score

Your credit score plays a crucial role in determining whether you qualify for a personal loan and the interest rate you will be offered. A higher credit score indicates to lenders that you are a responsible borrower, making you more likely to be approved for a loan with lower interest rates. On the other hand, a lower credit score may result in higher interest rates or even rejection of your loan application.

Income, Employment Status, and Debt-to-Income Ratio

Lenders will also consider your income, employment status, and debt-to-income ratio when evaluating your loan application. A stable income and employment history demonstrate your ability to repay the loan on time. Additionally, a lower debt-to-income ratio indicates that you have sufficient income to cover your existing debts and the new loan payments.

Impact of Interest Rates

Interest rates have a significant impact on the total cost of borrowing and your monthly loan repayments. Even a small difference in interest rates can result in substantial savings or additional costs over the life of the loan. It’s essential to compare offers from different lenders and choose the one with the most competitive interest rate to minimize the overall cost of your personal loan.

Researching Personal Loan Options

When looking for a personal loan, it’s crucial to explore different sources to find the best option that suits your needs. Here are some key factors to consider when researching personal loan options:

Bank Loans

- Pros: Typically offer competitive interest rates for those with good credit scores.

- Cons: May have strict eligibility criteria and longer approval processes.

Online Lenders

- Pros: Quick and convenient application process, ideal for those with less-than-perfect credit.

- Cons: Interest rates may be higher, and there could be potential for predatory lending.

Credit Unions

- Pros: Member-owned, often offering lower interest rates and more personalized service.

- Cons: Membership requirements and limited branch locations may be a drawback.

Comparing Interest Rates and Loan Terms

When comparing personal loan options, it’s essential to look beyond the interest rate. Consider factors like repayment terms, fees, and any penalties for early repayment. Use an online loan comparison tool to easily compare multiple offers side by side. Remember to focus on the Annual Percentage Rate (APR), which includes both the interest rate and any fees associated with the loan.

Applying for a Personal Loan

When applying for a personal loan, there are certain documents that you will typically need to provide. These documents help the lender assess your financial situation and determine your eligibility for the loan.

Typical Documents Required

- Proof of identity (such as driver’s license or passport)

- Proof of income (such as pay stubs or tax returns)

- Bank statements

- Proof of address (such as utility bills or lease agreement)

- Employment verification

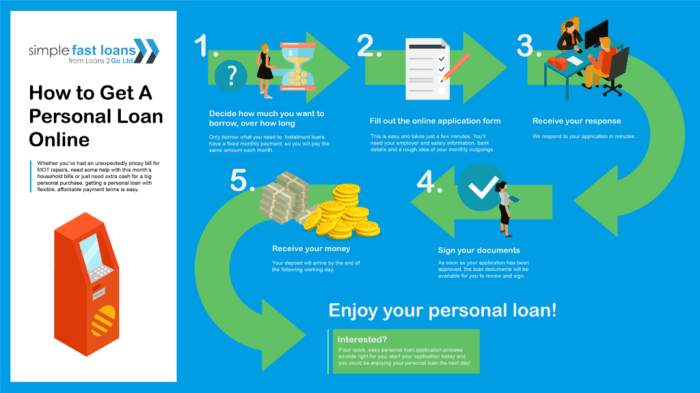

Loan Application Process

- Start by researching different lenders and their loan options to find the best fit for your needs.

- Fill out the loan application form provided by the lender, either online or in person.

- Submit all required documents along with your application form.

- Wait for the lender to review your application and make a decision.

- If approved, review the terms of the loan including interest rates, repayment schedule, and any fees.

- Sign the loan agreement if you agree to the terms and conditions.

- Receive the funds in your bank account once the loan is finalized.

Preparing a Strong Application

- Check your credit score before applying and work on improving it if needed.

- Provide accurate and complete information on your application form to avoid delays or rejections.

- Include any additional documents or explanations that can strengthen your application, such as a letter of explanation for any negative marks on your credit report.

- Show stability in your employment and income to demonstrate your ability to repay the loan.

- Consider applying with a cosigner if you have a limited credit history or a low credit score to increase your chances of approval.

Managing Personal Loan Repayments

When it comes to managing personal loan repayments, it is crucial to have a solid plan in place to ensure you stay on track with your payments. Failing to make timely loan repayments can lead to serious financial consequences, including damage to your credit score and increased debt due to late fees and penalties.

Creating a Repayment Plan

One of the first steps in managing personal loan repayments is to create a repayment plan. This plan should Artikel how much you need to pay each month, when payments are due, and how you will allocate your budget to cover the loan repayments.

Budgeting Strategies for Timely Repayments

- Track your expenses: Keep a record of your monthly expenses to identify where you can cut back to allocate more funds towards loan repayments.

- Create a dedicated loan repayment fund: Set aside a specific amount each month solely for loan repayments to ensure you have the necessary funds available.

- Avoid unnecessary expenses: Prioritize loan repayments over non-essential purchases to avoid falling behind on payments.

Consequences of Missing Loan Payments

Missing loan payments can have serious repercussions, such as:

- Damage to your credit score: Late payments can negatively impact your credit score, making it harder to secure loans in the future.

- Accumulation of late fees: Missing payments often results in additional fees and penalties, increasing the overall cost of the loan.

- Risk of default: Continued failure to make loan repayments can lead to default, which can have long-lasting effects on your financial health.

Avoiding Default

- Communicate with your lender: If you are struggling to make payments, reach out to your lender to discuss possible solutions, such as a repayment plan or loan modification.

- Explore refinancing options: Consider refinancing your loan to extend the repayment period or lower the interest rate to make payments more manageable.

- Seek financial counseling: If you are facing financial difficulties, consider seeking assistance from a financial counselor to help you manage your debt effectively.

Understanding the Impact on Credit Score

Taking out a personal loan can have a significant impact on your credit score, both positively and negatively. It’s important to understand how personal loans affect your creditworthiness.

Difference between Installment Credit and Revolving Credit

- Installment Credit: Personal loans are a form of installment credit where you borrow a fixed amount of money and repay it in fixed monthly installments over a predetermined period. This type of credit can demonstrate your ability to manage debt responsibly.

- Revolving Credit: On the other hand, revolving credit, such as credit cards, allows you to borrow up to a certain limit and make monthly payments based on your balance. Personal loans can help diversify your credit mix if you primarily have revolving credit accounts.

Tips for Responsible Use of Personal Loans

- Make Timely Payments: Paying your personal loan on time each month can help boost your credit score and show lenders that you are a reliable borrower.

- Avoid Borrowing More Than You Need: Only borrow what you need and can afford to repay to prevent overextending yourself and potentially damaging your credit score.

- Monitor Your Credit Report: Regularly check your credit report for any errors or discrepancies that could negatively impact your score. Reporting and resolving these issues promptly is crucial for maintaining good credit health.

Alternatives to Personal Loans

When it comes to borrowing money, personal loans are not the only option available. There are several alternatives that individuals can consider depending on their financial situation and borrowing needs.

Credit Cards:

Credit Cards

- Credit cards offer a revolving line of credit that can be used for various purchases and expenses.

- They often come with rewards programs, cashback offers, and introductory 0% APR promotions.

- However, credit cards typically have higher interest rates compared to personal loans, making them more expensive in the long run if not managed properly.

Home Equity Loans:

Home Equity Loans

- Home equity loans allow homeowners to borrow against the equity in their property.

- They usually come with lower interest rates compared to personal loans because they are secured by the value of the home.

- Borrowers should be aware that failure to repay a home equity loan could result in the loss of their home through foreclosure.

Peer-to-Peer Lending:

Peer-to-Peer Lending

- Peer-to-peer lending platforms connect borrowers with individual investors willing to fund their loan requests.

- Interest rates on peer-to-peer loans can be competitive, but they may vary based on the borrower’s creditworthiness.

- Peer-to-peer lending may be a good option for those who do not qualify for traditional bank loans but still need access to funds.