Navigating the world of taxes can be daunting, but fear not! How to file taxes is here to demystify the process and empower you with the knowledge needed to tackle your taxes like a pro. From understanding different tax forms to maximizing deductions, this guide has got you covered. So, let’s dive in and unravel the complexities of filing taxes together.

Introduction to Filing Taxes

When it comes to taxes, filing them is a crucial part of being a responsible citizen. It ensures that the government receives the necessary funds to provide public services and maintain infrastructure. Filing taxes is not only a legal requirement, but it also helps individuals and businesses stay organized and avoid penalties.

Basic Concept of Filing Taxes

- Individuals and businesses report their income, deductions, and credits to calculate the amount of tax they owe or are owed by the government.

- Forms such as W-2 for employees and 1099 for self-employed individuals are used to report income to the IRS.

- By filing taxes, individuals can claim deductions and credits to lower their taxable income and potentially receive a tax refund.

Who Needs to File Taxes

- All U.S. citizens and residents are required to file a federal income tax return if their income exceeds a certain threshold set by the IRS.

- Even if you don’t meet the income threshold, it may still be beneficial to file taxes to claim credits or refunds.

- Self-employed individuals, freelancers, and independent contractors must also file taxes, as they are responsible for reporting their income and paying self-employment taxes.

Types of Taxes

When it comes to filing taxes, individuals may encounter various types of taxes depending on their financial situation. It is essential to understand the differences between federal and state taxes, as well as the implications of not filing taxes.

Federal Taxes

Federal taxes are imposed by the government on income, profits, and other financial transactions at the national level. These taxes fund government programs and services at the federal level, such as national defense, social security, and healthcare. Individuals are required to file a federal tax return annually with the Internal Revenue Service (IRS), reporting their income and calculating the amount of tax owed.

State Taxes

State taxes, on the other hand, are imposed by individual states on income, sales, property, and other transactions within the state’s jurisdiction. Each state has its own tax laws and rates, which can vary significantly from one state to another. Taxpayers must file a state tax return with their respective state revenue department, in addition to filing their federal tax return. State taxes help fund state-specific programs and services, such as education, transportation, and public safety.

Implications of Not Filing Taxes

Failing to file taxes can have serious consequences, including penalties, fines, and legal action by the government. Individuals who do not file their taxes on time may incur late filing penalties and interest on any unpaid taxes. In some cases, the IRS or state revenue department may issue a tax lien or levy against the taxpayer’s assets to collect the unpaid taxes. It is crucial to file taxes accurately and on time to avoid these negative repercussions and stay compliant with tax laws.

Gathering Necessary Documents

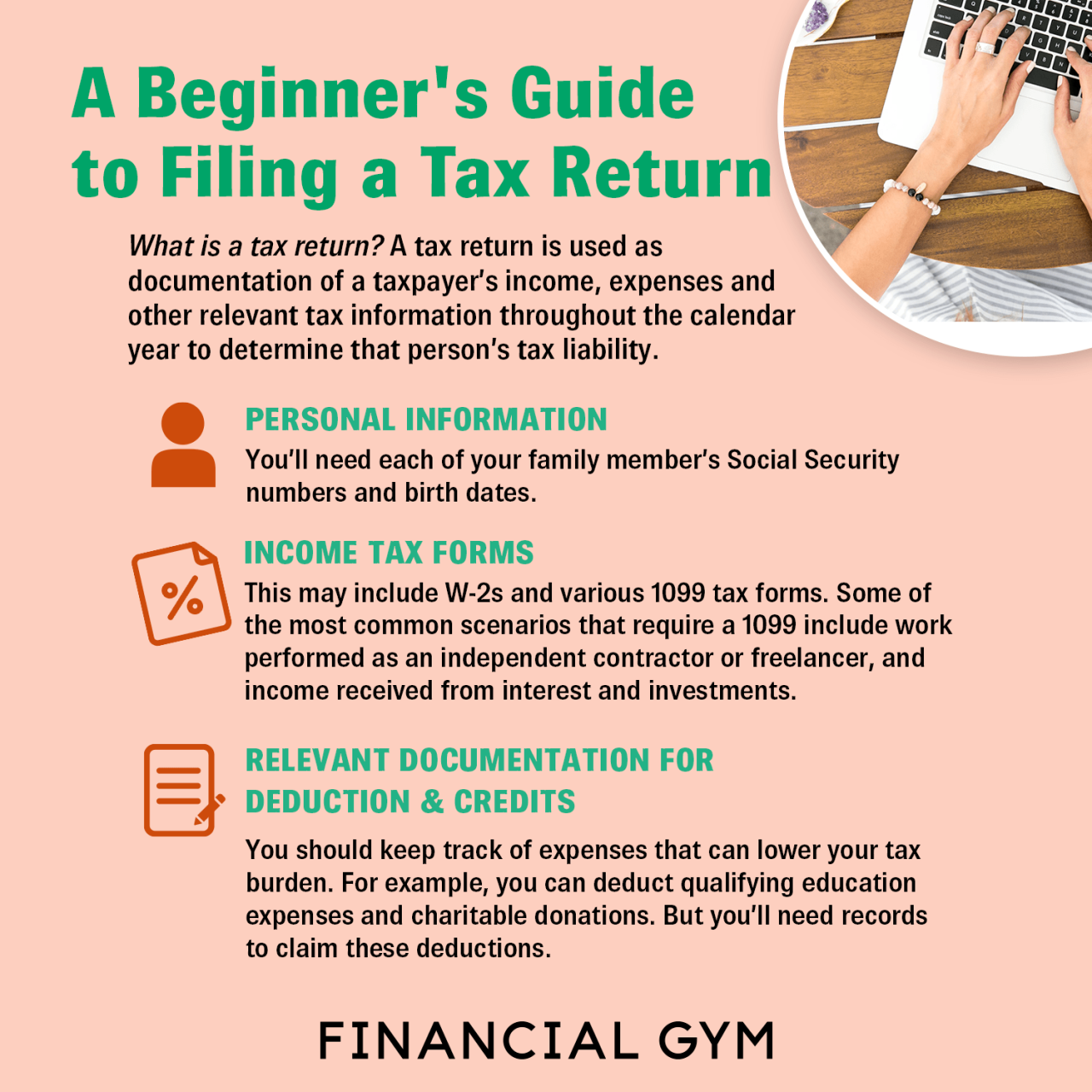

When it comes to filing taxes, having all the necessary documents in order is key to a smooth process. Here’s a breakdown of the essential documents you’ll need, how to obtain missing documents, and some tips for organizing and storing them.

List of Essential Documents

- W-2 forms: These are provided by your employer and show your income and taxes withheld.

- 1099 forms: If you’re self-employed or have other sources of income, you’ll need these to report earnings.

- Receipts for deductible expenses: Keep receipts for expenses like medical bills, charitable donations, and business expenses.

- Bank statements: You may need these to report interest income or account balances.

- Property tax records: If you own a home, you’ll need these records for deductions.

Obtaining Missing Documents

- Contact your employer or financial institutions: Reach out to get duplicate copies of any missing forms.

- Check online accounts: Many financial institutions provide access to tax-related documents online.

- Request copies: If you can’t obtain a document, reach out to the relevant organization to request a copy.

Tips for Organizing and Storing Tax Documents

- Create a dedicated folder: Keep all tax-related documents in one place to prevent losing important paperwork.

- Label documents clearly: Use categories like income, deductions, and receipts to easily identify documents when needed.

- Back up digital copies: Consider scanning important documents and storing them securely on a hard drive or in the cloud.

- Keep records for several years: It’s a good idea to hold onto tax documents for at least three to seven years in case of an audit.

Choosing the Right Form

When it comes to filing taxes, choosing the right form is crucial to ensure accurate reporting and compliance with the IRS. Different forms cater to various financial situations, so it’s essential to understand the differences between forms like 1040, 1040A, and 1040EZ.

Comparing Different Tax Forms

- The Form 1040 is the standard form for individual income tax returns and allows for various types of income, deductions, and credits.

- The Form 1040A is a shorter version of the 1040 and is suitable for individuals with less complex financial situations.

- The Form 1040EZ is the simplest form and is typically used by individuals with no dependents and straightforward income sources.

Choosing the Suitable Form

- If you have multiple sources of income, itemized deductions, or tax credits, the Form 1040 is likely the best choice for you.

- For individuals with a more straightforward financial situation and who do not itemize deductions, the Form 1040A may be sufficient.

- If you have a simple tax situation with no dependents and only a few income sources, the Form 1040EZ could be the right form for you.

Filling Out the Chosen Form

- You can find the necessary tax forms on the IRS website or at local IRS offices.

- Make sure to carefully read the instructions provided with the form to ensure you are filling it out correctly.

- Gather all the required documents, including W-2s, 1099s, and any other income statements, before starting to fill out the form.

Understanding Deductions and Credits

Tax deductions and credits play a crucial role in reducing your overall tax liability. Deductions are expenses that you can subtract from your taxable income, while credits directly reduce the amount of tax you owe.

Common Tax Deductions and Credits

- Standard Deduction: A set amount that reduces your taxable income, available to most taxpayers.

- Itemized Deductions: Expenses like mortgage interest, medical expenses, and charitable donations that you can deduct if they exceed the standard deduction.

- Child Tax Credit: A credit for each qualifying child under the age of 17 that can reduce your tax bill dollar-for-dollar.

- Earned Income Tax Credit (EITC): A refundable credit for low to moderate-income individuals and families.

Maximizing Deductions and Credits

- Keep detailed records of all potential deductions and credits throughout the year to ensure you don’t miss any opportunities.

- Consider consulting a tax professional or using tax software to help identify all eligible deductions and credits.

- Take advantage of tax-advantaged accounts like IRAs and HSAs to increase your potential deductions.

- E-Filing: This method allows you to submit your tax return electronically using tax software or through a tax professional. It is quick, convenient, and can help you receive your refund faster.

- Mailing: You can also choose to file your taxes by mailing a physical copy of your tax return to the IRS. Make sure to send it to the correct address and allow for additional processing time.

- Gather all necessary documents, including W-2s, 1099s, and receipts for deductions.

- Choose the right tax form based on your filing status and income level.

- Fill out the form accurately, double-checking all information before submission.

- If e-filing, follow the instructions on the software and submit your return electronically.

- If mailing, ensure all forms are signed and dated before sending them to the IRS.

- Keep a copy of your tax return for your records and track the status of your refund if applicable.

- April 15th: Deadline for filing your federal tax return.

- October 15th: Deadline if you requested an extension, but remember, this is only an extension to file, not an extension to pay any taxes owed.

- Various deadlines for state taxes, so make sure to check with your state’s tax agency.

- Expertise: Tax professionals have in-depth knowledge of tax laws and regulations, ensuring that your taxes are filed accurately and in compliance with the law.

- Maximizing Deductions: A tax professional can help you identify deductions and credits you may have overlooked, potentially saving you money.

- Time-Saving: By outsourcing your tax preparation to a professional, you can save time and focus on other aspects of your life or business.

- Audit Support: In the event of an audit, a tax professional can provide guidance and support throughout the process.

- Credentials: Look for a tax professional who is a Certified Public Accountant (CPA), Enrolled Agent (EA), or tax attorney, as they have the necessary qualifications and expertise.

- Experience: Consider the professional’s experience in handling similar tax situations to ensure they can effectively address your specific needs.

- Reputation: Read reviews, ask for referrals, and research the professional’s reputation to ensure they are trustworthy and competent.

- Communication: Choose a tax professional who communicates effectively and is responsive to your questions and concerns.

Filing Process

When it comes to filing your taxes, there are different methods you can use. Whether you prefer to e-file or mail your documents, it’s essential to understand the filing process to ensure accuracy and compliance with tax laws.

Different Ways to File Taxes

Step-by-Step Guide on How to File Taxes

What to Do After Filing Taxes

After filing your taxes, it’s essential to keep track of important dates and deadlines. If you owe taxes, make sure to pay them on time to avoid penalties and interest. If you’re expecting a refund, you can check the status of your refund online or through the IRS website. Remember to keep all tax-related documents organized for future reference or in case of an audit.

Tax Deadlines and Extensions

When it comes to filing your taxes, it’s crucial to be aware of the important deadlines to avoid penalties. If you find yourself needing more time, there is also an option to request an extension. Let’s dive into the details!

Important Tax Deadlines

Here are some key tax deadlines to keep in mind:

Requesting an Extension

If you need more time to file your taxes, you can request an extension by filing Form 4868. This will give you an additional six months to file your return, moving the deadline to October 15th. However, remember that this extension only applies to filing your return, not to paying any taxes owed. Make sure to estimate your tax liability and pay any amount due to avoid penalties.

Penalties for Late Filing and Payment

It’s important to file your taxes on time to avoid penalties. The penalty for late filing is usually 5% of the unpaid taxes for each month your return is late, up to a maximum of 25%. If you owe taxes and don’t pay on time, you may also face a penalty of 0.5% of the unpaid taxes per month.

Seeking Professional Help

When it comes to filing taxes, there may be instances where seeking help from a tax professional is advisable. This can be particularly beneficial for individuals with complex tax situations, business owners, freelancers, or those who simply prefer to have an expert handle their taxes.