Hey there, ready to dive into the realm of financial asset classes? Buckle up as we explore the ins and outs of different investment opportunities, from equities to real assets, in a way that’s as cool as your favorite high school playlist.

Get ready to level up your financial knowledge with this breakdown of various asset classes that could shape your investment game.

Overview of Financial Asset Classes

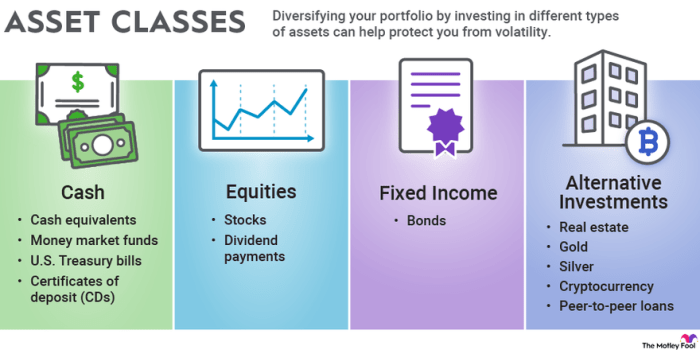

In the world of finance, asset classes refer to different categories of investments that share similar characteristics. These asset classes are crucial for investors to build a well-diversified portfolio to manage risk and achieve their financial goals.

Main Types of Financial Asset Classes

- Equities: Also known as stocks, equities represent ownership in a company. Investors buy shares of a company’s stock with the expectation of earning returns through capital appreciation and dividends.

- Bonds: Bonds are debt securities issued by governments, municipalities, or corporations to raise capital. Investors who purchase bonds are effectively lending money to the issuer in exchange for periodic interest payments and the return of the principal amount at maturity.

- Real Estate: Real estate investments involve purchasing properties such as residential, commercial, or industrial real estate. Investors can earn returns through rental income, property appreciation, or real estate development.

- Commodities: Commodities are physical goods such as gold, oil, wheat, or coffee that are traded on commodity exchanges. Investors can gain exposure to commodities through futures contracts, exchange-traded funds (ETFs), or physical ownership.

Diversification across different asset classes is essential to reduce the overall risk in an investment portfolio. By spreading investments across various asset classes, investors can mitigate the impact of market fluctuations in any one particular asset class.

Equities

Equities, also known as stocks, represent ownership in a company. When you purchase equities, you become a shareholder and have a claim on the company’s assets and earnings.

Risks and Potential Returns

Investing in equities comes with risks such as market volatility, company-specific risks, and economic uncertainties. However, equities also offer the potential for high returns over the long term compared to other asset classes like bonds or cash investments.

- Market Volatility: Stock prices can fluctuate greatly in response to market conditions, economic factors, and company performance.

- Company-specific risks: Factors such as management changes, competition, or legal issues can impact the value of a company’s stock.

- Economic Uncertainties: Changes in interest rates, inflation, or geopolitical events can affect the overall stock market.

Examples of Equities in Different Sectors

Technology Sector

Example: Apple Inc. (AAPL)

- Apple is a leading technology company known for its innovative products like iPhones, iPads, and Mac computers.

Healthcare Sector

Example: Johnson & Johnson (JNJ)

- Johnson & Johnson is a diversified healthcare company that produces pharmaceuticals, medical devices, and consumer health products.

Financial Sector

Example: JPMorgan Chase & Co. (JPM)

- JPMorgan Chase is a global financial services firm offering a range of banking, investment, and asset management services.

Fixed Income Securities

Fixed income securities are investment vehicles that provide a fixed return over a specified period of time. Investors receive regular interest payments, and the principal amount is repaid at maturity. These securities are considered less risky than equities because of their fixed returns.

Bonds, Treasury Bills, and Corporate Bonds

Bonds, treasury bills, and corporate bonds are all types of fixed income securities, but they have different characteristics:

- Bonds: Bonds are debt securities issued by governments or corporations to raise capital. They have a fixed interest rate, known as the coupon rate, and a maturity date when the principal is repaid. Bonds are typically less risky than stocks but offer lower returns.

- Treasury Bills: Treasury bills, or T-bills, are short-term government securities with maturities of one year or less. They are considered one of the safest investments because they are backed by the U.S. government. T-bills are sold at a discount and do not pay interest but are redeemed at full face value at maturity.

- Corporate Bonds: Corporate bonds are issued by corporations to raise funds for various purposes. They typically offer higher yields than government bonds to compensate for the increased risk. Corporate bonds can be investment-grade (lower risk) or high-yield (higher risk).

Impact of Interest Rates

Changes in interest rates have a significant impact on the value of fixed income securities:

- Rising interest rates typically lead to a decrease in the value of existing fixed income securities. This is because new securities will offer higher yields, making older securities with lower yields less attractive.

- Conversely, falling interest rates can increase the value of fixed income securities. Investors are willing to pay more for securities with higher yields than the current market rate.

It’s essential for investors to consider the impact of interest rates when investing in fixed income securities to make informed decisions based on market conditions.

Real Assets

Real assets are tangible assets that have intrinsic value and can provide a hedge against inflation. They play a crucial role in a diversified investment portfolio by adding diversification and potentially reducing overall risk.

Examples of Real Assets

- Real Estate: This includes residential, commercial, and industrial properties that can generate rental income and appreciate in value over time.

- Commodities: Raw materials or primary agricultural products like gold, silver, oil, and crops that can be traded in the market.

- Infrastructure: Physical assets like roads, bridges, airports, and utilities that provide essential services and have long-term revenue potential.

Benefits and Risks of Investing in Real Assets

- Benefits:

- Diversification: Real assets have a low correlation with traditional financial assets like stocks and bonds, providing diversification benefits.

- Inflation Hedge: Real assets tend to retain their value or even appreciate during inflationary periods, acting as a hedge against inflation.

- Income Generation: Real assets like real estate and infrastructure can generate regular income through rental payments or dividends.

- Risks:

- Liquidity Risk: Real assets are not as easily traded as stocks or bonds, making them less liquid and potentially harder to sell quickly.

- Market Volatility: Prices of real assets can be influenced by market factors and economic conditions, leading to price fluctuations.

- Regulatory Risk: Changes in regulations or government policies can impact the value and returns of real assets investments.

Cash Equivalents

Cash equivalents are low-risk, highly liquid assets that are easily convertible to cash. They play a crucial role in the investment landscape as they provide investors with a safe haven for short-term needs while still earning some returns.

Role of Cash Equivalents

Cash equivalents are typically short-term investments that include Treasury bills, certificates of deposit, and money market funds. These assets offer higher returns than traditional checking or savings accounts, making them attractive options for investors looking to preserve capital while maintaining liquidity.

- Cash equivalents provide a safe and stable investment option for investors who need quick access to funds.

- They offer higher interest rates compared to regular savings accounts, making them a viable option for short-term investments.

- Investors can easily convert cash equivalents into cash without incurring significant losses, making them a valuable asset for managing short-term financial needs.

Investors often utilize cash equivalents as a parking place for funds they may need in the near future or as a safe haven during volatile market conditions.