Get ready to dive into the world of credit repair strategies, where we break down the secrets to improving your credit score in a cool and informative way. Brace yourself for some serious knowledge!

In this guide, we’ll walk you through the ins and outs of credit repair strategies, from understanding credit reports to managing debt like a pro. Let’s get started!

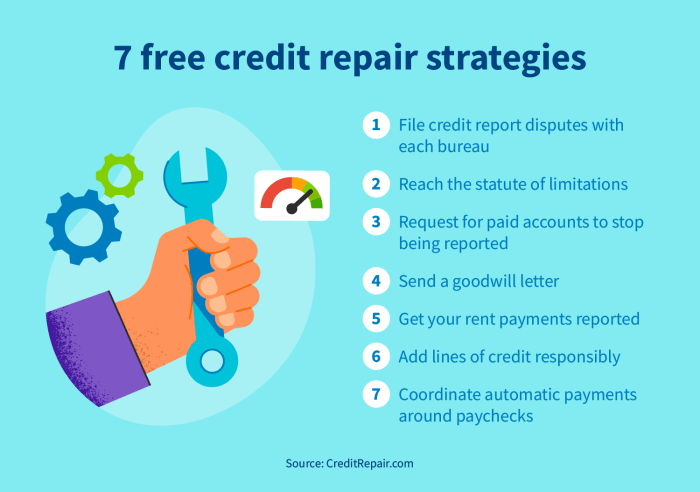

Overview of Credit Repair Strategies

Credit repair strategies are crucial for individuals looking to improve their financial health and access better opportunities. Poor credit can lead to various challenges, including higher interest rates, limited access to loans, and difficulty securing housing or employment. By implementing effective credit repair strategies, individuals can work towards boosting their credit scores, which can lead to lower interest rates, increased borrowing power, and improved financial stability.

Common Challenges with Poor Credit

- Difficulty securing loans or credit cards

- Higher interest rates on existing debt

- Limited access to housing or rental options

- Negative impact on employment opportunities

Benefits of Improving Credit Scores

- Access to lower interest rates on loans and credit cards

- Increased borrowing power for major purchases

- Improved chances of securing housing or rental properties

- Enhanced employment opportunities with credit checks

Understanding Credit Reports

Yo, let’s break it down – what’s a credit report and why should you care about it?

A credit report is like a report card for your financial life, showing your credit history, payment history, and current credit accounts. It’s a big deal because it’s used by lenders, landlords, and even potential employers to evaluate your creditworthiness.

Key Components of a Credit Report

Alright, here’s the lowdown on the main components of a credit report that can make or break your credit repair game:

- Your Payment History: This is a biggie, showing whether you’ve paid your bills on time or if you’ve missed any payments.

- Amounts Owed: This part shows how much debt you have compared to your credit limits. Keeping this ratio low is key for a healthy credit score.

- Length of Credit History: The longer you’ve had credit accounts open, the better it looks on your report.

- New Credit: Opening too many new credit accounts in a short period can raise red flags on your report.

- Credit Mix: Having a mix of different types of credit (credit cards, loans, etc.) can show you can manage different financial responsibilities.

Building a Strong Credit Repair Plan

Creating a personalized credit repair plan is crucial for improving your credit score and overall financial health. By following a structured plan, you can effectively address any issues on your credit report and work towards a better financial future.

Steps to Create a Personalized Credit Repair Plan

- Obtain a copy of your credit report from all three major credit bureaus.

- Review your credit reports carefully to identify any errors or inaccuracies.

- Create a budget to track your income and expenses, ensuring you have enough to cover your bills and make payments on time.

- Contact creditors and debt collectors to negotiate payment plans or settlements for any outstanding debts.

- Set realistic goals for improving your credit score and monitor your progress regularly.

Role of Budgeting and Financial Management

Effective budgeting and financial management play a crucial role in credit repair strategies. By creating a budget and tracking your expenses, you can ensure that you have enough funds to make timely payments on your debts and bills. This, in turn, helps improve your credit score over time.

Strategies for Negotiating with Creditors and Debt Collectors

- Communicate openly and honestly with creditors about your financial situation.

- Offer to make payment arrangements or settlements that you can afford.

- Get any agreements in writing to avoid misunderstandings in the future.

- Consider working with a credit counseling agency for additional support and guidance.

Disputing Errors on Credit Reports

When it comes to disputing errors on credit reports, it’s crucial to have a clear understanding of the process to effectively improve your credit score. Identifying inaccuracies and taking the necessary steps to resolve them can make a significant difference in your financial well-being.

Identifying Errors on Credit Reports

- Check for incorrect personal information such as your name, address, or social security number.

- Review the list of accounts and verify that all information is accurate, including balances and payment history.

- Look out for any fraudulent activity or accounts that you don’t recognize.

Disputing Inaccuracies with Credit Bureaus

- Write a formal dispute letter to the credit bureau reporting the error, clearly explaining the inaccuracies and providing supporting documentation.

- Keep a record of all communication and correspondence with the credit bureau, including any responses or updates.

- Allow the credit bureau 30 days to investigate the dispute and make corrections to your credit report.

Tips for Resolving Disputes and Improving Credit Scores

- Regularly monitor your credit report to catch errors early and take immediate action to dispute them.

- Be persistent and follow up with the credit bureau if you don’t see a resolution within the specified timeframe.

- Focus on making timely payments and reducing outstanding debts to improve your credit score overall.

Utilizing Credit Building Tools

Building credit is essential for improving your financial health. Utilizing credit building tools can help you establish a positive credit history and increase your credit score.

Secured Credit Cards

Secured credit cards are a great option for individuals with poor or limited credit history. These cards require a security deposit, which acts as collateral for the credit limit. By using a secured credit card responsibly and making on-time payments, you can demonstrate your creditworthiness and improve your credit score over time.

Credit Builder Loans

Credit builder loans are designed to help individuals establish or rebuild credit. These loans work by borrowing a small amount of money, which is then placed in a savings account. As you make regular payments on the loan, your on-time payments are reported to the credit bureaus, helping you build a positive credit history and improve your credit score.

Authorized User on Someone Else’s Credit Card

Becoming an authorized user on someone else’s credit card can be beneficial for individuals looking to boost their credit score. As an authorized user, you can piggyback off the primary cardholder’s positive credit history and utilization rate. However, it’s important to ensure that the primary cardholder has a good credit history and makes on-time payments to reap the benefits of being an authorized user.

Managing Debt and Utilization

When it comes to managing debt and credit utilization, it’s crucial to have a solid plan in place to improve your credit score and financial health.

Paying Off Debts Strategically

One effective strategy for paying off debts is the snowball method, where you focus on paying off the smallest debts first while making minimum payments on larger debts. This can help build momentum and motivation as you see progress being made.

- Set a budget and stick to it to allocate funds towards debt repayment.

- Consider debt consolidation or negotiating with creditors for lower interest rates or payment plans.

- Avoid taking on new debt while working on paying off existing debts.

Understanding Credit Utilization

Credit utilization refers to the percentage of your available credit that you are currently using. It’s important to keep this ratio low, ideally below 30%, to show lenders that you can manage credit responsibly.

- Regularly monitor your credit card balances and aim to pay them off in full each month to keep utilization low.

- Avoid maxing out your credit cards, as high utilization can negatively impact your credit score.

- If you have high balances, consider making multiple payments throughout the month to keep utilization in check.

Avoiding Common Pitfalls

There are certain pitfalls to avoid when managing debt and credit utilization to prevent setbacks in your credit repair efforts.

- Avoid closing old credit accounts, as this can shorten your credit history and increase credit utilization.

- Be cautious when applying for new credit, as multiple inquiries can lower your credit score.

- Regularly review your credit reports for errors and discrepancies that could be impacting your credit score negatively.