Get ready to dive into the world of compounding interest – a key financial concept that can help you grow your wealth over time. From understanding the basics to exploring its real-life applications, this guide has got you covered.

Definition of Compounding Interest

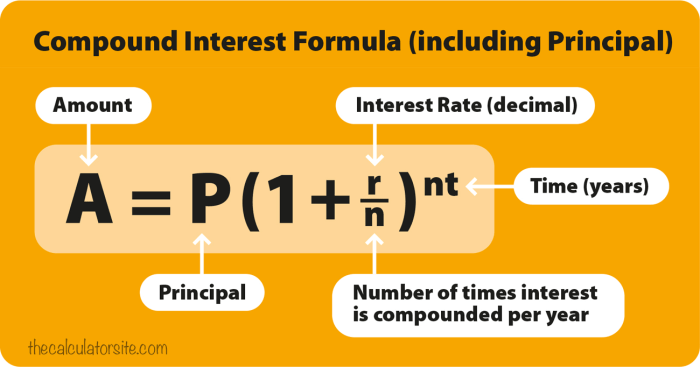

Compounding interest is the process where interest is calculated on the initial principal and any accumulated interest from previous periods, leading to exponential growth of the investment over time. This differs from simple interest, which is calculated only on the principal amount.

How Compounding Interest Works Over Time

- When you invest $1,000 at an annual interest rate of 5%, the compounding effect means that at the end of the first year, you’ll have $1,050. However, in the second year, you’ll earn 5% interest not just on your initial $1,000, but also on the $50 interest earned in the first year. This leads to a total of $1,102.50 at the end of the second year.

- Over a longer period, such as 10 years, the power of compounding becomes even more evident. Your initial $1,000 investment would grow to $1,628.89 without you having to do anything extra. This is because each year, the interest is calculated not just on the principal amount, but also on the accumulated interest from previous years.

Benefits of Compounding Interest

Compounding interest is like a money-making machine that works silently in the background, helping your savings or investments grow over time. The magic of compounding lies in reinvesting the interest earned so that you earn more interest on your principal amount as well as the interest already accumulated.

Long-Term Growth

- By reinvesting the interest earned, your savings or investments can grow exponentially over the long term.

- Even small contributions made regularly can snowball into a substantial sum due to the power of compounding.

- Starting early allows more time for your money to compound, leading to significant growth in wealth.

Wealth Accumulation

- Compounding interest can help individuals build wealth steadily and consistently without having to actively manage their investments.

- Over time, the growth from compounding can outpace inflation, ensuring your money retains its purchasing power.

- Reinvesting dividends or interest can accelerate the growth of your investment portfolio, creating a snowball effect of wealth accumulation.

Types of Compounding Interest

When it comes to compounding interest, there are various methods that can be used to calculate and accrue interest over time. Each type of compounding interest frequency can have different effects on the overall growth of an investment or savings account.

Daily Compounding

Daily compounding interest is calculated and added to the principal balance every day. This means that interest is earned on the principal amount plus any previously accumulated interest. Daily compounding can result in the highest overall return on investment due to the more frequent compounding periods.

Monthly Compounding

Monthly compounding interest is calculated and added to the principal balance once a month. While not as frequent as daily compounding, monthly compounding still allows for interest to be earned on the principal amount plus any previously accumulated interest. This method can still lead to significant growth over time.

Quarterly Compounding

Quarterly compounding interest is calculated and added to the principal balance once every three months. This means that interest is earned on the principal amount plus any previously accumulated interest every quarter. While less frequent than monthly compounding, quarterly compounding can still yield substantial growth.

Annual Compounding

Annual compounding interest is calculated and added to the principal balance once a year. This means that interest is earned on the principal amount plus any previously accumulated interest annually. While the least frequent compounding method, annual compounding still allows for the growth of investments over time.

Factors Affecting Compounding Interest

When it comes to compounding interest, several key factors play a crucial role in determining the growth of your investment over time. Understanding these factors is essential for maximizing the benefits of compounding interest.

Interest Rate:

The interest rate is perhaps the most significant factor that affects compounding interest. A higher interest rate will lead to faster growth of your investment, resulting in a larger sum at the end of the compounding period. On the other hand, a lower interest rate will result in slower growth and a smaller final amount.

Time:

Time is another crucial factor when it comes to compounding interest. The longer your money is allowed to compound, the greater the impact on your investment. This is due to the exponential growth that occurs over time, allowing your initial investment to snowball into a substantial sum.

Frequency of Compounding:

The frequency at which interest is compounded also plays a role in the overall outcome of compounding interest. The more frequently interest is compounded, the faster your investment will grow. For example, daily compounding will yield a higher final amount compared to monthly or annual compounding.

Adjusting these factors:

By adjusting these factors strategically, you can significantly impact the overall outcome of compounding interest. For instance, increasing the interest rate or choosing investments with higher rates of return can accelerate the growth of your investment. Similarly, allowing your money to compound over a longer period and opting for more frequent compounding can further boost your returns.

Impact of Adjusting Factors

- Increasing interest rate leads to faster growth of investment.

- Longer compounding periods result in exponential growth.

- More frequent compounding accelerates the growth of your investment.

Real-life Applications of Compounding Interest

Compounding interest is not just a theoretical concept but has real-life applications that impact various financial instruments. Understanding how compounding interest works can help individuals make informed decisions when it comes to savings, investments, and retirement planning.

Savings Accounts

In savings accounts, compounding interest allows your money to grow over time as the interest earned is added back to the principal amount. This means that not only do you earn interest on your initial deposit, but also on the interest already earned. For example, if you deposit $1,000 into a savings account with an annual interest rate of 5%, after one year, you would have $1,050. In the next year, you would earn interest not only on the initial $1,000 but also on the additional $50 earned in the first year.

Bonds

Bonds are another financial instrument where compounding interest plays a significant role. When you invest in bonds, you receive periodic interest payments along with the return of the principal amount at maturity. The interest earned on bonds can be reinvested to generate additional returns through compounding. This compounding effect can result in substantial growth in your investment over time.

Retirement Funds

Retirement funds such as 401(k) and Individual Retirement Accounts (IRAs) utilize compounding interest to help individuals save for retirement. By contributing regularly to these accounts and allowing the investments to grow over time through compounding, individuals can build a substantial nest egg for their retirement years. The power of compounding interest can significantly boost the value of retirement funds, especially when started early and maintained consistently.