Compound interest calculator kicks off this rad journey, giving you a sneak peek into a world full of financial possibilities. Get ready to dive into the ins and outs of this crucial tool with an American high school hip twist that’ll keep you hooked from start to finish.

As we delve deeper, you’ll uncover the secrets of how compound interest can supercharge your savings and financial goals.

Introduction to Compound Interest Calculator

Yo, listen up! Let’s break it down for you. Compound interest is like when you make money on your initial investment, and then you make even more money on the interest you’ve already earned. It’s like money-making magic!

A compound interest calculator is a tool that helps you figure out how much money you can make over time by taking into account the initial investment, interest rate, and the frequency of compounding. It’s like having a money crystal ball!

Scenarios where Compound Interest Calculators are Useful

Check it – Compound interest calculators come in handy in a bunch of situations. Here are a few examples:

- When you’re planning for retirement and want to see how your investments can grow over time.

- If you’re thinking about taking out a loan and want to know how much you’ll end up paying back with interest.

- When you’re saving up for a big purchase, like a car or a house, and want to see how much you need to put aside each month.

How Compound Interest Calculators Work

When it comes to understanding compound interest calculators, it’s essential to grasp the formula used for calculating compound interest. By knowing how the variables come into play, you can make informed decisions about your financial future.

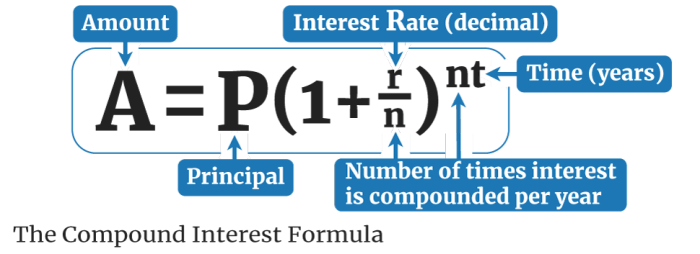

Formula for Calculating Compound Interest

Compound Interest = P(1 + r/n)^(nt) – P

- P = Principal Amount (initial investment)

- r = Annual Interest Rate (in decimal form)

- n = Number of times interest is compounded per year

- t = Time the money is invested for (in years)

Variables Involved in the Calculation

Principal Amount, Interest Rate, Compounding Frequency, Time Period

- Principal Amount: The initial amount of money you invest.

- Interest Rate: The annual rate at which interest is applied to the principal amount.

- Compounding Frequency: How often the interest is calculated and added to the principal amount each year.

- Time Period: The length of time the money is invested or borrowed for.

Step-by-Step Guide on How to Use a Compound Interest Calculator

- Enter the Principal Amount you want to calculate compound interest on.

- Input the Annual Interest Rate as a decimal.

- Specify the Compounding Frequency (monthly, quarterly, semi-annually, annually).

- Enter the Time Period in years for which the money will be invested.

- Click on the calculate button to see the total amount with compound interest.

Types of Compound Interest Calculators

When it comes to calculating compound interest, there are several types of calculators available online. These calculators can vary in terms of features, ease of use, and the specific financial scenarios they cater to.

Basic Compound Interest Calculator

A basic compound interest calculator allows you to input the principal amount, interest rate, compounding frequency, and the time period. It then calculates the future value of your investment based on these parameters. This type of calculator is great for simple interest calculations and quick projections.

Advanced Compound Interest Calculator

An advanced compound interest calculator goes beyond the basic features and may include additional options such as inflation rate adjustment, variable interest rates, and the ability to add regular contributions to your investment. This calculator is ideal for more complex financial planning scenarios.

Retirement Planning Calculator

A retirement planning calculator is specifically designed to help you estimate how much you need to save for retirement based on your current savings, expected rate of return, and retirement age. It takes into account factors like inflation and varying income levels over time. This calculator is essential for long-term financial planning.

Loan Calculator

A compound interest loan calculator helps you determine the total cost of a loan over time, including interest payments. It allows you to input the loan amount, interest rate, and repayment term to calculate your monthly payments and total interest paid. This calculator is crucial for understanding the true cost of borrowing.

Benefits of Using a Compound Interest Calculator

Using a compound interest calculator can be a game-changer when it comes to financial planning. These calculators provide a clear picture of how your money can grow over time, helping you make informed decisions for a secure financial future.

Financial Planning Aid

- Compound interest calculators help you visualize the impact of regular contributions on your savings. By inputting the principal amount, interest rate, and time period, you can see how your money will grow exponentially.

- They assist in setting realistic savings goals by showing the power of compounding. This allows you to plan ahead and allocate your funds wisely to achieve your financial objectives.

Long-Term Savings Goals

- Compound interest calculators highlight the benefits of long-term investments. By demonstrating the growth potential over extended periods, they encourage you to stay committed to your savings plan.

- These calculators emphasize the importance of starting early, as they reveal the significant difference in outcomes between investing for a longer versus a shorter duration.

Real-Life Examples

- For instance, if you start investing $100 monthly at an interest rate of 5% for 30 years, a compound interest calculator can show you how your initial contributions can multiply several times over, resulting in substantial wealth accumulation.

- Another example could be comparing the outcomes of saving in a regular savings account versus a high-yield investment using a compound interest calculator. The difference in total returns can be eye-opening and motivate you to make smarter financial choices.