Budgeting for Families takes center stage in the world of financial management, offering crucial insights and strategies for families to thrive financially. From creating a budget to managing expenses, this topic covers it all in a way that resonates with the everyday family dynamic.

Importance of Budgeting for Families

Budgeting is like the secret sauce for families to thrive financially. It’s not just about tracking expenses, but it’s a game plan to make sure everyone’s needs are met while building a solid financial future.

Financial Stability

Budgeting helps families maintain financial stability by ensuring that expenses are in line with income. It prevents overspending and helps in saving for emergencies or unexpected expenses.

Debt Management

Having a budget allows families to keep track of their debt and make a plan to pay it off. By allocating funds towards debt repayment, families can work towards becoming debt-free and saving on interest payments.

Goal Achievement

Budgeting helps families set and achieve financial goals, whether it’s saving for a vacation, buying a new home, or funding a child’s education. It provides a roadmap to prioritize spending and saving to reach these goals.

Communication and Unity

By creating a budget together, families are able to communicate openly about their financial situation and goals. It promotes unity and teamwork in making financial decisions, leading to a stronger family bond.

Financial Education

Budgeting teaches valuable financial lessons to family members, especially children. It instills the importance of saving, budgeting, and responsible spending from a young age, setting them up for financial success in the future.

Creating a Family Budget

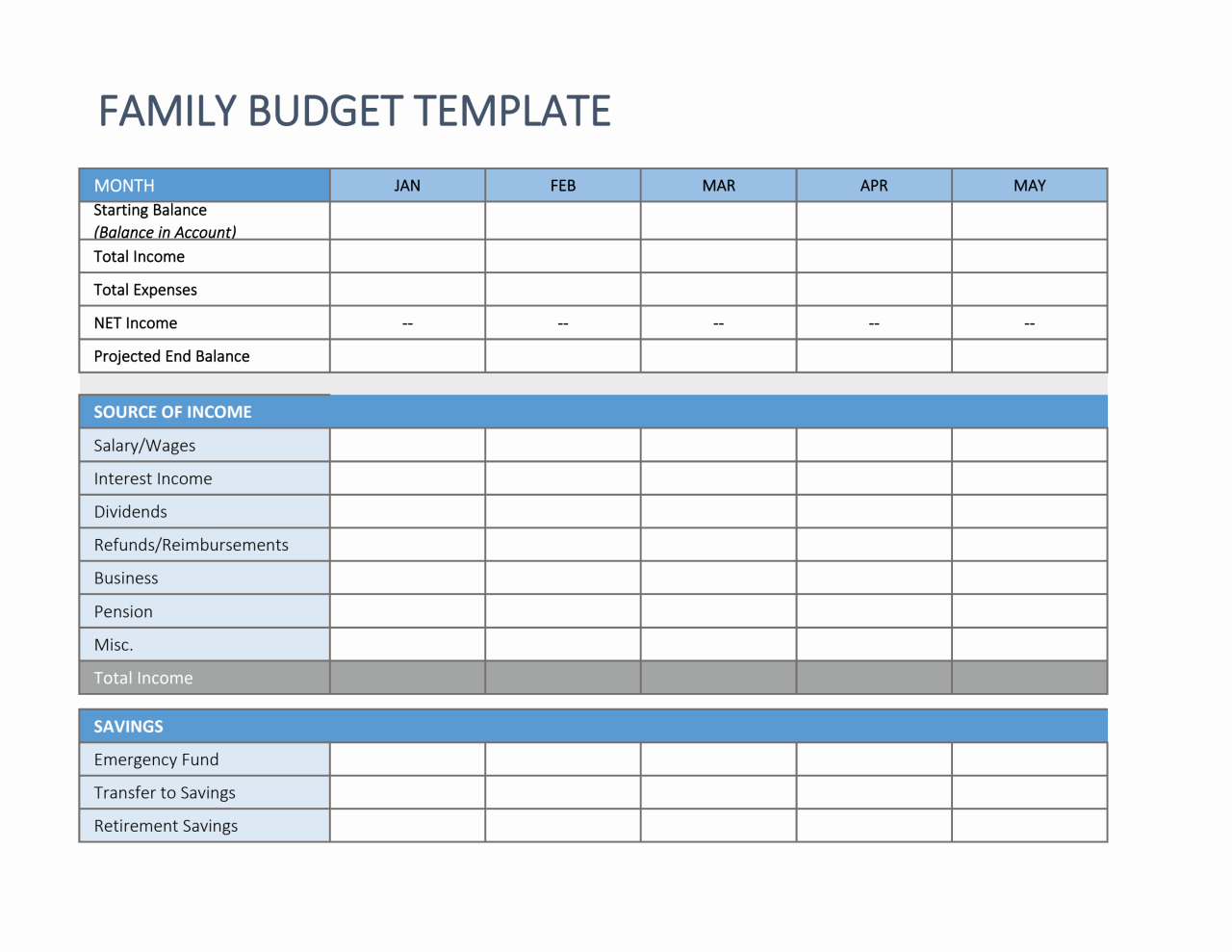

Budgeting for a family involves careful planning and consideration of various expenses and income sources. Here are some steps to help you create a family budget:

Step 1: Calculate Your Income

- List all sources of income for your family, including salaries, bonuses, child support, and any other financial assistance.

- Calculate the total monthly income to understand how much money you have to work with.

Step 2: Track Your Expenses, Budgeting for Families

- Document all your expenses, including fixed costs like rent/mortgage, utilities, groceries, and variable expenses like entertainment, dining out, and shopping.

- Categorize your expenses to identify areas where you can cut back.

Step 3: Set Financial Goals

- Determine short-term and long-term financial goals for your family, such as saving for a vacation, college fund, or emergency fund.

- Allocate a portion of your income towards these goals to ensure progress.

Step 4: Create a Budget

- Use a budgeting method that works best for your family, such as the zero-based budget, envelope system, or 50/30/20 rule.

- Allocate funds for essential expenses, savings, and discretionary spending while ensuring you stay within your total income.

Step 5: Review and Adjust

- Regularly review your budget to track your progress towards financial goals and make adjustments as needed.

- Involve all family members in budget planning to ensure everyone is on board and committed to the financial plan.

Managing Family Expenses

Managing family expenses is crucial for maintaining financial stability and achieving long-term financial goals. By tracking and managing expenses effectively, families can avoid overspending, save money, and plan for the future.

Tracking and Managing Expenses

- Keep a record of all expenses, including both fixed (such as rent or mortgage payments) and variable expenses (like groceries or entertainment).

- Use budgeting apps or spreadsheets to track expenses and categorize them for better organization.

- Review your spending regularly to identify areas where you can cut back or save money.

Common Expenses to Budget For

- Housing costs, including rent or mortgage payments, property taxes, and homeowner’s insurance.

- Utilities such as electricity, water, heating, and internet services.

- Transportation expenses like car payments, gas, insurance, and maintenance.

- Groceries and household essentials.

- Healthcare costs, including insurance premiums, copays, and prescriptions.

- Educational expenses for children, such as school supplies, tuition, and extracurricular activities.

Tips for Reducing Unnecessary Expenses

- Avoid impulse purchases by creating a shopping list before going to the store.

- Cut back on dining out and prepare meals at home to save money on food expenses.

- Cancel unused subscriptions or memberships to reduce monthly expenses.

- Comparison shop for big-ticket items to find the best deals and save money.

- Set financial goals and prioritize saving to avoid unnecessary spending.

Teaching Children about Budgeting: Budgeting For Families

Teaching children about budgeting is crucial for their financial future. It helps them understand the value of money, the importance of saving, and the impact of spending decisions. By introducing budgeting concepts early on, children can develop good money habits that will benefit them throughout their lives.

Age-Appropriate Ways to Introduce Budgeting Concepts

- Start with simple concepts like saving money in a piggy bank or setting aside a portion of their allowance for a specific goal.

- Use real-life examples to explain the value of money, such as comparing prices at the grocery store or discussing the cost of activities they enjoy.

- Create a visual budgeting tool, like a chart or jar system, to help children track their spending and savings.

Involving Children in Budgeting for Financial Literacy

By involving children in the budgeting process, they can learn firsthand how to make financial decisions and prioritize their spending. This hands-on experience helps them develop critical thinking skills and a better understanding of the consequences of their choices.