Machine learning in finance applications opens up a world of possibilities, transforming the way we analyze and interpret financial data. From fraud detection to investment strategies, the impact of machine learning is reshaping the financial industry as we know it.

Introduction to Machine Learning in Finance Applications

Machine learning in finance involves using algorithms and statistical models to make predictions and decisions based on data. In the context of finance, machine learning can be applied to tasks such as risk management, fraud detection, trading strategies, and customer service.The significance of applying machine learning in financial tasks lies in its ability to analyze vast amounts of data quickly and accurately, leading to more informed decisions and improved outcomes.

By leveraging machine learning techniques, financial institutions can gain insights into market trends, customer behavior, and risk factors, enabling them to optimize their operations and enhance their competitive advantage.

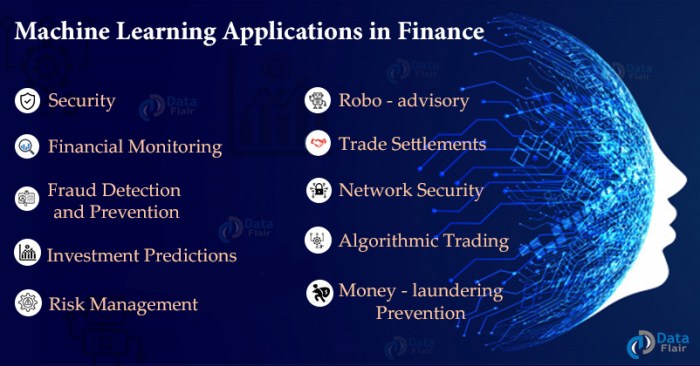

Examples of Machine Learning Applications in the Finance Industry

- Algorithmic Trading: Machine learning algorithms are used to analyze market data and execute trades at optimal times to maximize profits.

- Credit Scoring: Machine learning models are employed to assess the creditworthiness of individuals and determine loan approval decisions.

- Fraud Detection: Machine learning algorithms can detect unusual patterns in financial transactions to identify and prevent fraudulent activities.

- Portfolio Management: Machine learning techniques are utilized to create diversified investment portfolios that maximize returns while minimizing risks.

Types of Machine Learning Models Used in Finance

Machine learning models play a crucial role in the financial industry, helping institutions make better decisions, manage risks, and predict market trends. Let’s explore some of the popular machine learning algorithms commonly used in finance and how they are utilized.

Supervised Learning

Supervised learning is a type of machine learning where the algorithm is trained on labeled data. In finance, supervised learning algorithms such as linear regression, decision trees, and support vector machines are widely used for tasks like stock price prediction, credit risk assessment, and fraud detection.

Unsupervised Learning

Unsupervised learning involves training the algorithm on unlabeled data to find hidden patterns or relationships. In finance, unsupervised learning algorithms like clustering and principal component analysis are used for customer segmentation, market basket analysis, and anomaly detection.

Reinforcement Learning

Reinforcement learning is a type of machine learning where the algorithm learns to make decisions by interacting with an environment and receiving rewards or penalties. In finance, reinforcement learning is applied in algorithmic trading to optimize trading strategies and portfolio management.

Deep Learning in Financial Forecasting and Risk Management

Deep learning, a subset of machine learning, uses artificial neural networks to process complex data and extract meaningful insights. In finance, deep learning models like recurrent neural networks (RNNs) and long short-term memory (LSTM) networks are used for time series forecasting, sentiment analysis, and risk assessment.

Challenges and Limitations of Implementing Machine Learning in Finance

Machine learning has revolutionized the finance industry, but it also comes with its own set of challenges and limitations. Let’s explore some of the key issues faced when implementing machine learning in financial institutions.

Challenges Faced in Implementing Machine Learning Models

- Lack of Quality Data: Financial data can be complex and messy, making it challenging to find clean and reliable data for training machine learning models.

- Interpretability: Machine learning models like neural networks are often considered as ‘black boxes’, making it difficult for financial institutions to explain the reasoning behind the model’s decisions to regulators or customers.

- Regulatory Compliance: Financial regulations are strict and constantly changing, requiring machine learning models to comply with legal requirements, which can be a challenge.

Potential Limitations of Using Machine Learning in Finance

- Overfitting: Machine learning models trained on historical data may overfit and fail to generalize well to new, unseen data, leading to inaccurate predictions.

- Model Bias: Machine learning algorithms can inherit biases present in the data, leading to unfair or discriminatory outcomes in financial decision-making processes.

- Data Security and Privacy: Handling sensitive financial data raises concerns about data security and privacy, especially with the increasing risk of data breaches and cyber attacks.

Ethical Considerations Related to Deploying Machine Learning in Finance

- Transparency: Financial institutions must ensure transparency in how machine learning models are used to make decisions, especially when it comes to customer data and privacy.

- Fairness: Ensuring that machine learning models do not discriminate against certain groups or individuals based on protected characteristics is crucial for ethical deployment in finance.

- Accountability: Establishing accountability for the decisions made by machine learning models is essential to address any potential harm caused by biased or flawed algorithms.

Benefits of Machine Learning in Financial Decision Making

Machine learning offers numerous advantages when it comes to financial decision making, revolutionizing the way businesses operate in the finance sector. From enhancing fraud detection to optimizing investment strategies, machine learning is reshaping the landscape of financial services.

Enhanced Fraud Detection and Prevention

Machine learning algorithms play a crucial role in detecting and preventing fraud in financial transactions. By analyzing patterns and anomalies in large datasets, machine learning models can quickly identify suspicious activities and alert financial institutions to potential fraudulent behavior. This proactive approach helps safeguard the integrity of financial transactions and protect both businesses and consumers from fraudulent activities.

Optimized Investment Strategies through Predictive Analytics

Machine learning enables financial organizations to leverage predictive analytics to optimize their investment strategies. By analyzing historical market data and identifying trends, machine learning algorithms can provide valuable insights into potential investment opportunities and risks. This data-driven approach empowers financial professionals to make informed decisions and maximize returns on investments, ultimately leading to more successful and profitable outcomes.

Role of Machine Learning in Algorithmic and High-Frequency Trading

Machine learning is instrumental in algorithmic trading, where automated systems execute trades based on predefined criteria and algorithms. By leveraging machine learning algorithms, financial institutions can develop sophisticated trading strategies that capitalize on market inefficiencies and trends. Additionally, in high-frequency trading, machine learning enables traders to analyze vast amounts of market data in real-time and make split-second decisions to execute trades at optimal prices.

This speed and efficiency give traders a competitive edge and allow them to capitalize on fleeting market opportunities.

Future Trends and Innovations in Machine Learning for Finance: Machine Learning In Finance Applications

In the rapidly evolving field of finance, machine learning continues to play a crucial role in driving innovation and efficiency. Let’s delve into some exciting future trends and innovations that are shaping the landscape of machine learning in finance.

Emerging Technologies Shaping the Future of Machine Learning in Finance

As we look ahead, emerging technologies like quantum computing, natural language processing, and blockchain are set to revolutionize the way machine learning is applied in finance. These cutting-edge technologies offer enhanced computational power, improved data analysis capabilities, and increased security measures, paving the way for more sophisticated and accurate financial predictions and decision-making processes.

Integration of Artificial Intelligence with Machine Learning for Personalized Financial Services, Machine learning in finance applications

The integration of artificial intelligence (AI) with machine learning is set to transform the delivery of personalized financial services. By leveraging AI algorithms and deep learning techniques, financial institutions can gain deeper insights into customer behavior, preferences, and risk profiles, enabling them to tailor financial products and services to meet individual needs effectively. This integration will not only enhance customer experience but also drive customer loyalty and retention in the highly competitive financial market.

Potential Advancements in Machine Learning Applications within the Finance Sector

Looking ahead, we can expect significant advancements in machine learning applications within the finance sector. These advancements may include the development of more sophisticated predictive models, the automation of complex trading algorithms, and the enhancement of fraud detection systems. By harnessing the power of machine learning, financial institutions can streamline operations, mitigate risks, and capitalize on new business opportunities in a rapidly changing global economy.