Yo, check it – Capital gains tax rates are no joke. From figuring out how they work to diving into different types and strategies, this topic is about to school you on all things tax-related. So, buckle up and let’s dive in deep!

Now, let’s break down the nitty-gritty details of how capital gains tax rates roll, from short-term to long-term rates and everything in between.

Overview of Capital Gains Tax Rates

Capital gains tax rates are taxes imposed on the profits earned from the sale of assets such as stocks, bonds, real estate, or other investments. These rates are typically lower than ordinary income tax rates and are designed to incentivize long-term investments.

How Capital Gains Tax Rates are Determined

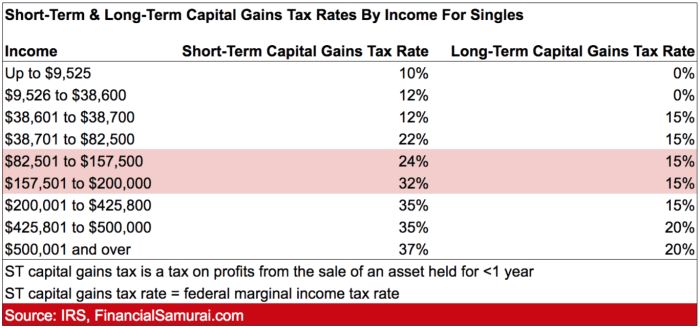

Capital gains tax rates are determined based on the holding period of the asset and the individual’s income bracket. Short-term capital gains, from assets held for less than a year, are taxed at higher rates similar to ordinary income. On the other hand, long-term capital gains, from assets held for more than a year, are taxed at lower rates, usually ranging from 0% to 20%.

Examples of Different Capital Gains Tax Rates Across Various Jurisdictions

- In the United States, capital gains tax rates range from 0% to 20% depending on the taxpayer’s income level.

- In the United Kingdom, capital gains tax rates can go up to 28% for higher rate taxpayers.

- In Australia, individuals are eligible for a 50% discount on capital gains tax if the asset has been held for more than a year.

Types of Capital Gains Tax Rates

When it comes to capital gains tax rates, there are different rules depending on whether you have short-term or long-term gains. Additionally, different asset classes are taxed at varying rates, including investments like stocks, real estate, and collectibles.

Short-term vs. Long-term Capital Gains Tax Rates

Short-term capital gains are profits made on assets held for one year or less and are taxed at ordinary income tax rates. On the other hand, long-term capital gains are gains from assets held for more than one year and are subject to lower tax rates, typically ranging from 0% to 20% depending on your income level.

Tax Rates on Different Asset Classes, Capital gains tax rates

- Stocks: Capital gains on stocks are taxed at the same rates as other assets, with long-term gains generally taxed at lower rates.

- Real Estate: Gains from the sale of real estate are considered long-term if the property was held for more than one year, and are subject to capital gains tax rates.

- Collectibles: Collectibles like art, coins, and antiques are taxed at a maximum rate of 28%, higher than the rate for other long-term capital gains.

Factors Influencing Capital Gains Tax Rates

When it comes to capital gains tax rates, there are several key factors that can influence how they are determined and implemented. These factors can range from economic conditions to political decisions and even international agreements.

Economic Factors

- The state of the economy plays a significant role in determining capital gains tax rates. In times of economic growth, governments may choose to increase tax rates to generate more revenue. Conversely, during economic downturns, tax rates may be lowered to stimulate investment and economic activity.

- Interest rates and inflation levels can also impact capital gains tax rates. Higher interest rates may lead to higher tax rates to curb inflation, while lower interest rates might prompt a decrease in tax rates to encourage investment.

Political Decisions

- Political decisions and government policies can have a direct impact on capital gains tax rates. Changes in administration or shifts in political ideology can result in fluctuations in tax rates. For example, a government that prioritizes economic growth may lower tax rates to incentivize investment, while a different government may raise rates to fund social programs.

- Lobbying efforts from special interest groups and lobbying organizations can also influence political decisions regarding capital gains tax rates. These groups may advocate for lower tax rates to benefit their members or higher rates to increase government revenue.

International Agreements

- International agreements, such as trade deals and tax treaties, can impact capital gains tax rates in a global context. Countries may enter into agreements to avoid double taxation on capital gains or to promote cross-border investment. These agreements can lead to changes in tax rates to align with the terms of the agreement and ensure fair treatment of taxpayers across borders.

- Global economic conditions and international financial markets can also influence capital gains tax rates. Fluctuations in currency exchange rates, trade policies, and economic indicators can prompt governments to adjust tax rates to remain competitive and attract foreign investment.

Strategies for Managing Capital Gains Tax Rates

Investors can employ various strategies to minimize their capital gains tax liability and optimize their investment returns. One common approach is tax-efficient investment strategies that focus on reducing taxable gains. Another effective technique is tax-loss harvesting, a method that involves selling investments at a loss to offset capital gains and reduce overall tax obligations. Additionally, utilizing tax-deferred accounts can also help investors reduce their capital gains tax liability by allowing them to defer taxes on investment gains until withdrawal.

Tax-Efficient Investment Strategies

- Investing in tax-advantaged accounts like IRAs and 401(k)s to defer taxes on investment gains.

- Utilizing index funds or ETFs with lower turnover rates to minimize capital gains distributions.

- Holding investments for the long term to qualify for lower long-term capital gains tax rates.

Tax-Loss Harvesting

- Definition: Selling investments at a loss to offset capital gains and reduce taxable income.

- Example: Selling a losing stock to offset gains from the sale of another investment, thereby reducing overall taxable gains.

- Impact: Helps investors lower their capital gains tax liability and optimize their after-tax returns.

Tax-Deferred Accounts

- Types: Traditional IRAs, Roth IRAs, 401(k) plans, and 403(b) plans are examples of tax-deferred accounts.

- Benefits: Investors can defer taxes on investment gains until withdrawal, allowing for potential growth of investments without immediate tax implications.

- Impact: Reduces current tax obligations and provides a tax-efficient way to save for retirement or other financial goals.