Embark on a journey towards a financially secure retirement with a solid plan in place. Let’s delve into the world of setting and achieving financial goals for retirement, unraveling the key strategies and factors to consider along the way.

As we navigate through the intricacies of financial planning for retirement, you’ll discover the importance of clarity and foresight in securing your future financial well-being.

Importance of Financial Goals for Retirement

Setting financial goals for retirement is crucial for ensuring a secure and comfortable future. By establishing clear objectives and plans for your finances during retirement, you can better prepare for any unexpected circumstances and have peace of mind knowing that you are financially stable.

Benefits of Having Clear Financial Goals for Retirement

- Provides a roadmap: Setting financial goals helps you create a roadmap for your retirement savings and investment strategies.

- Ensures financial security: Clear goals enable you to save and invest wisely, ensuring financial security during retirement.

- Helps in decision-making: Having well-defined financial goals helps you make informed decisions about your finances and lifestyle choices in retirement.

- Reduces stress: Knowing that you have set financial goals in place can reduce stress about your financial future and retirement planning.

How Financial Goals Help in Planning for a Secure Future

Financial goals act as a guidepost, allowing you to track your progress, make adjustments as needed, and stay focused on your long-term financial well-being.

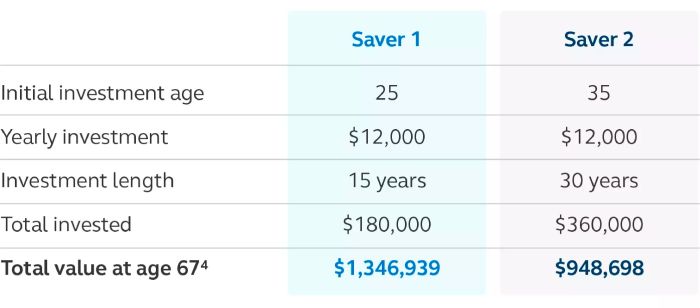

- Encourages saving and investing: Having specific financial goals motivates you to save and invest regularly to achieve those goals.

- Creates discipline: Setting financial goals instills discipline in your financial habits and encourages responsible money management.

- Allows for flexibility: While goals provide structure, they also allow for flexibility in adjusting your plans based on changing circumstances or priorities.

Types of Financial Goals for Retirement

When planning for retirement, it is crucial to set specific financial goals to secure your future. These goals can fall into different categories, such as savings, investments, and debt management. Each category plays a vital role in ensuring a comfortable retirement.

Savings Goals

Setting aside a portion of your income regularly for retirement is a fundamental savings goal. This can include contributing to retirement accounts like a 401(k) or IRA, building an emergency fund, or saving for specific expenses like healthcare or travel.

Investment Goals

Investing for retirement involves growing your money over time to beat inflation and provide a source of income in retirement. Common investment goals include diversifying your portfolio, maximizing returns while managing risk, and adjusting investments based on your risk tolerance and time horizon.

Debt Management Goals

Paying off debt before retirement can significantly impact your financial security. Debt management goals may include eliminating high-interest debt, such as credit card balances or loans, before retiring. This can free up more funds for retirement savings and reduce financial stress in retirement.

Short-term and Long-term Goals

Short-term financial goals for retirement typically involve immediate actions like increasing contributions to retirement accounts, creating a budget, or paying off high-interest debt. Long-term goals focus on building a substantial retirement nest egg, ensuring a steady income stream, and preserving wealth throughout retirement.

Diversifying Financial Goals

Diversifying financial goals for retirement planning is essential to mitigate risks and adapt to changing economic conditions. By spreading out your goals across savings, investments, and debt management, you can build a resilient retirement plan that can withstand market fluctuations and unexpected expenses.

Strategies for Setting and Achieving Financial Goals

Setting financial goals for retirement is crucial for ensuring a secure and comfortable future. Here are some strategies to help you set and achieve these goals:

Setting Realistic Financial Goals

- Start by assessing your current financial situation, including income, expenses, assets, and debts.

- Define specific and measurable goals, such as saving a certain amount for retirement or paying off debt by a certain date.

- Consider your risk tolerance and time horizon when setting investment goals.

- Break down larger goals into smaller, manageable milestones to track your progress.

Monitoring and Adjusting Financial Goals

It’s important to regularly review your financial goals and make adjustments as needed. Here’s how:

- Track your spending and savings to ensure you’re on target to meet your goals.

- Revisit your goals annually or when significant life changes occur, such as a job change or unexpected expenses.

- Be flexible and willing to adjust your goals based on changes in your financial situation or market conditions.

Staying Motivated to Achieve Financial Goals

Staying motivated can be challenging, but these strategies can help you stay on track:

- Reward yourself for reaching milestones along the way to your larger financial goals.

- Visualize the benefits of achieving your goals, such as a worry-free retirement or financial independence.

- Stay connected with a financial advisor or support group to stay motivated and accountable.

Factors to Consider when Setting Financial Goals for Retirement

Setting financial goals for retirement requires careful consideration of several key factors. These factors include income, expenses, lifestyle choices, and healthcare needs. It is essential to analyze these aspects to ensure a secure and comfortable retirement.

Impact of Inflation and Market Fluctuations

Inflation and market fluctuations can significantly impact financial goals for retirement. Inflation erodes the purchasing power of money over time, meaning that retirees may need more funds to maintain their standard of living. Market fluctuations can affect investment returns and the value of retirement accounts, highlighting the importance of diversification and risk management strategies.

Role of Risk Tolerance and Investment Options

Risk tolerance plays a crucial role in setting financial goals for retirement. Retirees with a low risk tolerance may opt for conservative investment options that prioritize capital preservation, while those with a higher risk tolerance may choose more aggressive strategies to potentially achieve higher returns. It is essential to align investment choices with risk tolerance and overall financial goals to build a well-rounded retirement portfolio.