Diving deep into the world of bonds, this introduction sets the stage for an exciting exploration of what bonds are all about. Get ready to ride the wave of financial knowledge with a hip, high school vibe that’ll keep you hooked till the end.

Let’s break down the complexities of bonds and get a solid grip on how they function in the financial realm.

What are Bonds?

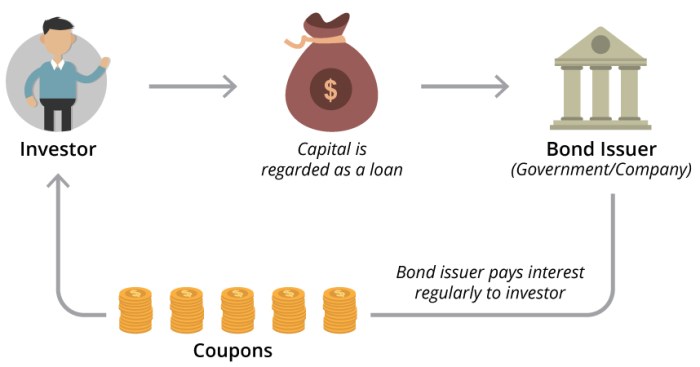

Bonds are debt securities issued by governments, corporations, or municipalities to raise capital. Investors who purchase bonds are essentially lending money to the issuer in exchange for periodic interest payments and the return of the bond’s face value at maturity.

Bonds differ from stocks in that while stocks represent ownership in a company, bonds represent a loan to the issuer. Bondholders are creditors of the issuer and have a priority claim on the issuer’s assets in case of bankruptcy.

Types of Bonds

- Government Bonds: Issued by national governments to fund public projects and services. Examples include US Treasury Bonds.

- Corporate Bonds: Issued by corporations to raise capital for business operations or expansion. Examples include bonds issued by Apple Inc. or Coca-Cola.

- Municipal Bonds: Issued by local governments or agencies to finance infrastructure projects or public services. Examples include bonds issued by the city of New York.

How do Bonds Work?

When it comes to understanding how bonds work, it’s important to know how they are issued, traded, and what factors influence their prices. Let’s dive into the world of bonds to gain a better understanding.

Issuance and Trading of Bonds

Bonds are typically issued by governments, municipalities, or corporations as a way to raise capital. When a bond is issued, the issuer borrows money from investors who purchase the bond. In return, the issuer promises to pay back the initial investment amount (the principal) along with periodic interest payments over a specified period.

- Bonds are traded in the secondary market, where investors can buy and sell them to other investors.

- Prices of bonds in the secondary market fluctuate based on factors such as interest rates, credit quality, and market conditions.

Bond Maturity and Significance

Bond maturity refers to the length of time until the bond issuer repays the principal amount to the bondholder. Bonds can have varying maturity periods, ranging from short-term (less than one year) to long-term (over 30 years).

- Short-term bonds typically offer lower interest rates compared to long-term bonds, as they are less risky.

- Long-term bonds carry higher interest rates to compensate investors for the risk of tying up their money for an extended period.

Determination of Bond Prices

The prices of bonds in the market are influenced by a variety of factors, including interest rates, inflation expectations, credit ratings, and overall economic conditions.

As interest rates rise, bond prices tend to fall, and vice versa. This is because newer bonds issued in a higher interest rate environment offer higher yields, making existing bonds with lower yields less attractive to investors.

- Bonds with higher credit ratings typically trade at higher prices than bonds with lower credit ratings, as they are considered less risky investments.

- Inflation expectations play a significant role in bond pricing, as investors demand higher yields to offset the erosion of purchasing power caused by inflation.

Bond Features and Characteristics

When it comes to understanding bonds, it’s crucial to grasp the key features and characteristics that define these financial instruments. From coupon rates to yields, each element plays a significant role in how bonds work and how they can impact your investment portfolio.

Coupon Rate, Face Value, and Yield

One of the fundamental features of a bond is the coupon rate, which represents the annual interest rate that the issuer pays to the bondholder. This rate is typically fixed at the time of issuance and is based on the face value of the bond. The face value, also known as the par value, is the amount that the issuer agrees to repay the bondholder at maturity.

Yield, on the other hand, is a crucial metric that reflects the return on investment for the bondholder. It takes into account not only the coupon rate but also the current market price of the bond. A higher yield indicates a higher return, while a lower yield suggests a lower return.

Risks of Investing in Bonds

- Bond Default Risk: There is always a risk that the issuer may default on its payments, leading to potential losses for bondholders.

- Interest Rate Risk: Fluctuations in interest rates can impact bond prices and yields. When interest rates rise, bond prices tend to fall, and vice versa.

- Inflation Risk: Inflation can erode the purchasing power of the fixed interest payments received from bonds, affecting the real return on investment.

Impact of Interest Rates on Bond Prices and Yields

When interest rates rise, existing bonds with lower coupon rates become less attractive to investors, causing their prices to decrease. This inverse relationship between interest rates and bond prices highlights the importance of understanding market dynamics when investing in bonds.

Benefits and Risks of Investing in Bonds

Investing in bonds can offer several advantages, such as providing a regular income stream, diversifying your investment portfolio, and offering more stability compared to stocks. However, there are also risks involved that investors should be aware of in order to make informed decisions.

Benefits of Including Bonds in an Investment Portfolio

- Bonds can provide a steady and predictable income through interest payments.

- They can help diversify your investment portfolio, reducing overall risk.

- Bonds are generally less volatile than stocks, offering more stability in times of market fluctuations.

- Some bonds offer tax advantages, such as municipal bonds that are often exempt from federal taxes.

Risks to Consider When Investing in Bonds

- Interest rate risk: Bond prices can fluctuate inversely with interest rates, impacting the value of your investment.

- Credit risk: There is a chance that the bond issuer may default on payments, resulting in loss of principal.

- Inflation risk: Inflation can erode the purchasing power of your fixed interest payments over time.

- Liquidity risk: Some bonds may be illiquid, making it difficult to sell them at a fair price when needed.

Strategies for Managing Risks Associated with Bond Investments

- Diversification: Spread your investments across different types of bonds to reduce specific risks.

- Monitor interest rate movements: Be aware of how changes in interest rates can affect your bond portfolio.

- Research bond issuers: Assess the creditworthiness of bond issuers to minimize credit risk.

- Consider bond funds: Investing in bond mutual funds or ETFs can provide diversification and professional management.