If you’re looking to tackle credit card debt head-on, you’re in the right place. From understanding the ins and outs of credit card debt to exploring effective strategies for repayment, this guide has you covered. So, let’s dive in and start your journey to financial freedom!

In this guide, we’ll break down the complexities of credit card debt, provide actionable tips for paying it off, and offer insights into developing healthier financial habits. Get ready to take control of your finances and say goodbye to debt!

Understanding Credit Card Debt

Credit card debt is the money you owe to your credit card issuer for purchases made using the card. It accumulates when you carry a balance from month to month rather than paying it off in full. High-interest rates on credit card balances can make it challenging to pay off the debt quickly, leading to a cycle of debt accumulation. Carrying a high credit card balance can negatively impact your credit score and financial health, making it harder to secure loans or favorable interest rates in the future.

Impact of High-Interest Rates

- High-interest rates can cause your debt to grow rapidly, especially if you only make minimum payments.

- Interest charges can make it difficult to pay down the principal balance, prolonging the time it takes to become debt-free.

- Over time, you may end up paying significantly more than the original amount borrowed due to interest accumulation.

Consequences of Carrying a High Credit Card Balance

- Increased financial stress and anxiety from the burden of debt.

- Higher likelihood of missing payments or defaulting on your credit card, leading to further damage to your credit score.

- Limited access to credit in the future, as lenders may view you as high risk.

Common Reasons for Accumulating Credit Card Debt

- Emergency expenses such as medical bills or car repairs.

- Living beyond one’s means and overspending on non-essential items.

- Using credit cards to cover basic living expenses due to insufficient income.

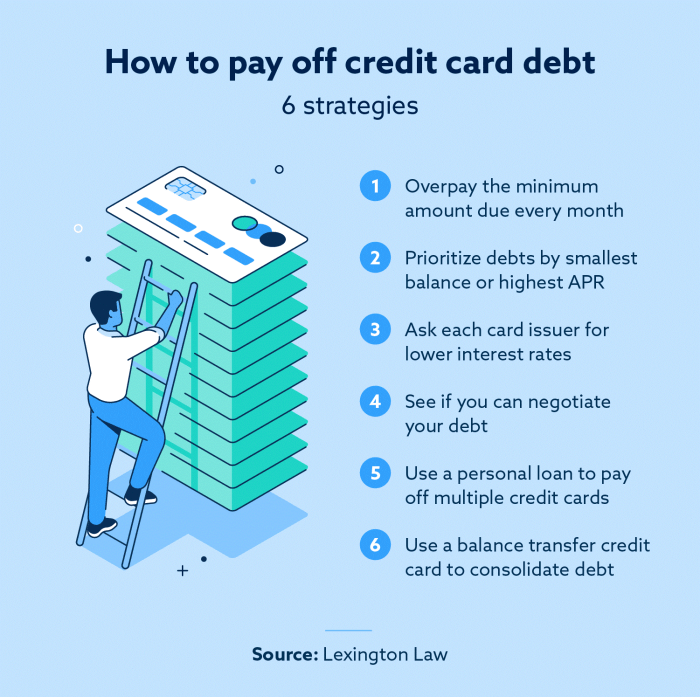

Strategies for Paying Off Credit Card Debt

Paying off credit card debt can be overwhelming, but with the right strategies, it is possible to get back on track and achieve financial freedom. Here are some effective methods to consider:

Snowball Method

- The snowball method involves paying off the smallest debt first while making minimum payments on all other debts.

- Once the smallest debt is paid off, the amount you were paying toward it is then added to the minimum payment of the next smallest debt.

- Repeat this process until all debts are paid off, gaining momentum like a snowball rolling down a hill.

Avalanche Method

- The avalanche method focuses on paying off debts with the highest interest rates first, while making minimum payments on other debts.

- By tackling high-interest debts first, you can save money on interest payments in the long run.

- Continue this process until all debts are cleared, starting with the highest interest rate and working your way down.

Debt Consolidation

- Debt consolidation involves combining multiple debts into a single loan with a lower interest rate.

- This can make it easier to manage payments and potentially reduce the overall interest paid on the debt.

- However, it is important to carefully consider the terms of the consolidation loan and ensure it is truly beneficial in the long term.

Creating a Budget

- Creating a budget is essential for allocating funds towards debt repayment.

- Track your income and expenses to identify areas where you can cut back and increase your debt repayment amount.

- Stick to your budget to ensure you are consistently making progress towards paying off your credit card debt.

Negotiating Lower Interest Rates

- Contact your credit card companies to inquire about lowering your interest rates.

- Explain your situation and express your commitment to paying off the debt.

- Some companies may be willing to reduce your interest rate, making it easier for you to pay off your debt faster.

Financial Habits and Behavior Modification

Changing financial habits and behavior is crucial when it comes to paying off credit card debt and avoiding future financial struggles. By understanding the psychology behind overspending and implementing strategies to modify behavior, individuals can take control of their finances and work towards a debt-free life.

Exploring the Psychology of Overspending

- Many people overspend due to emotional triggers such as stress, boredom, or social pressure.

- Overspending can also be a result of poor money management skills or lack of financial literacy.

- Understanding why you overspend is the first step towards making positive changes to your financial habits.

Tips for Changing Spending Habits

- Create a budget and track your expenses to identify areas where you can cut back.

- Avoid impulse purchases by implementing a 24-hour rule before making non-essential purchases.

- Practice mindful spending by considering if a purchase aligns with your financial goals before making it.

Setting Financial Goals for Debt Repayment

- Establish clear and achievable financial goals for paying off credit card debt, such as setting a target payoff date or amount.

- Break down your goals into smaller milestones to track your progress and stay motivated.

- Consider rewarding yourself when you reach a debt repayment milestone to reinforce positive financial habits.

Strategies for Staying Motivated

- Visualize the benefits of being debt-free, such as financial freedom and reduced stress.

- Join a support group or find an accountability partner to share your progress and challenges with.

- Celebrate small victories along the way to keep yourself motivated and focused on your financial goals.

Seeking Professional Help

When facing overwhelming credit card debt, it may be necessary to seek help from a credit counselor or financial advisor to navigate the best path towards financial stability. These professionals can provide valuable insight and guidance tailored to individual circumstances.

Role of Credit Counseling Agencies

Credit counseling agencies play a vital role in assisting individuals in paying off credit card debt. They offer personalized financial advice, budgeting assistance, and debt management plans to help clients regain control of their finances. These agencies can negotiate with creditors to lower interest rates and create a manageable repayment plan.

Debt Management Plans

Debt management plans are structured repayment programs designed by credit counseling agencies to help individuals pay off their debts. These plans typically involve consolidating multiple debts into a single monthly payment, often at a reduced interest rate. By following the plan, individuals can gradually eliminate their debt and improve their financial situation.

Impact of Debt Settlement or Bankruptcy

Debt settlement and bankruptcy are options for individuals struggling with credit card debt, but they can have significant impacts on credit scores. Debt settlement involves negotiating with creditors to pay a reduced amount, which can result in a negative mark on credit reports. Bankruptcy, while providing a fresh start, remains on credit reports for several years and can make it challenging to access credit in the future.