Diving into the world of personal loan interest rates, we uncover the key factors that borrowers need to know. From understanding how these rates impact borrowing costs to exploring strategies for securing lower rates, this guide has you covered.

Importance of Personal Loan Interest Rates

Personal loan interest rates play a crucial role in the borrowing process, impacting the overall cost and affordability for borrowers.

Effect on Monthly Payments

Understanding how different interest rates can affect monthly payments is essential for making informed financial decisions:

- Low Interest Rate: With a lower interest rate, borrowers can enjoy lower monthly payments, making the loan more affordable over time.

- High Interest Rate: Conversely, a higher interest rate results in higher monthly payments, increasing the total cost of borrowing.

- Example: A $10,000 personal loan with a 5% interest rate would have lower monthly payments compared to the same loan with a 10% interest rate.

Factors Influencing Personal Loan Interest Rates

When it comes to personal loan interest rates, there are several key factors that lenders take into consideration. These factors can greatly impact the interest rate you are offered on a personal loan.

Credit Scores

Your credit score plays a significant role in determining the interest rate on a personal loan. Lenders use your credit score to assess your creditworthiness and determine the level of risk associated with lending to you. A higher credit score typically results in a lower interest rate, as it signifies to lenders that you are more likely to repay the loan on time.

Loan Terms and Amount

The terms of the loan, such as the repayment period and the loan amount, can also influence the interest rate on a personal loan. Loans with shorter repayment periods tend to have lower interest rates, as they are less risky for lenders. Similarly, smaller loan amounts may come with lower interest rates compared to larger loans, as they pose less risk to the lender.

Types of Personal Loan Interest Rates

When it comes to personal loans, borrowers often have to choose between fixed and variable interest rates. Each type has its own set of pros and cons, so it’s important to understand the differences before making a decision.

Fixed Interest Rates

Fixed interest rates remain the same throughout the life of the loan, providing borrowers with predictable monthly payments. This stability can be beneficial for budgeting purposes, as borrowers know exactly how much they need to pay each month. However, if market interest rates decrease, borrowers with fixed rates may end up paying more than those with variable rates.

Variable Interest Rates

Variable interest rates, on the other hand, fluctuate based on market conditions. While this means that borrowers could potentially benefit from lower rates if market interest rates fall, it also means that monthly payments can vary, making budgeting more challenging. Borrowers with variable rates should be prepared for the possibility of higher payments in the future.

In situations where interest rates are expected to rise, opting for a fixed interest rate may be more beneficial to lock in a lower rate. On the other hand, if rates are expected to decrease, choosing a variable interest rate could lead to savings in the long run. Ultimately, the decision between fixed and variable interest rates depends on individual financial goals and risk tolerance.

Strategies to Get Lower Personal Loan Interest Rates

When it comes to securing a personal loan with lower interest rates, there are several strategies that borrowers can employ to improve their chances. From enhancing their credit score to negotiating with lenders, these tactics can make a significant impact on the final interest rate offered.

Improving Credit Score

One of the most effective ways to qualify for lower personal loan interest rates is by improving your credit score. Lenders often use credit scores to assess the risk of lending money to an individual. A higher credit score indicates a lower risk, which can lead to more favorable interest rates. To boost your credit score, make sure to pay bills on time, keep credit card balances low, and avoid opening multiple new accounts at once.

Shopping Around and Comparing Offers

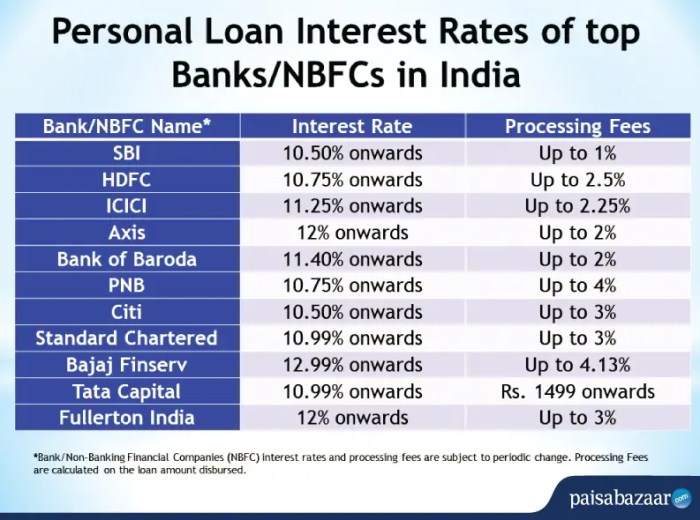

Another crucial strategy is to shop around and compare offers from different lenders. Each lender may have different criteria for determining interest rates, so it’s essential to explore multiple options. By comparing offers, borrowers can identify the most competitive rates and terms available in the market. This process can help them secure a lower interest rate on their personal loan.

Negotiation with Lenders

Negotiation can also play a vital role in potentially lowering the interest rate on a personal loan. Once you have received offers from various lenders, don’t hesitate to negotiate for better terms. You can leverage competitive offers to persuade lenders to provide a lower interest rate. Be prepared to make a case for why you deserve a lower rate based on your creditworthiness and financial stability. With effective negotiation skills, borrowers can often secure more favorable terms on their personal loans.