Get ready to dive into the world of debt repayment strategies. From the snowball method to debt consolidation, we’ve got you covered with tips and tricks to help you tackle your finances like a pro. So, grab your favorite study buddy and let’s start this journey to financial success!

In this guide, we’ll break down different debt repayment strategies, discuss their benefits, and provide practical advice to help you choose the right approach for your financial situation.

Debt Repayment Strategies

When it comes to managing debt, having a solid repayment plan is crucial. Debt repayment strategies are the specific approaches individuals can take to pay off their debts in a structured and efficient manner. These strategies help individuals prioritize their debts, manage their finances effectively, and work towards becoming debt-free.

Common Debt Repayment Strategies

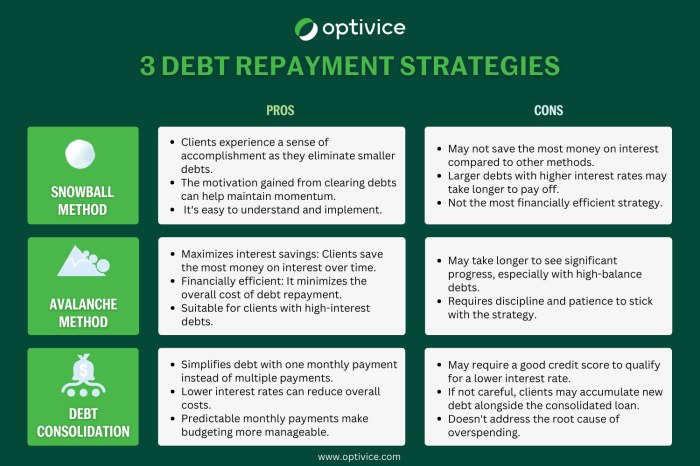

- Snowball Method: This strategy involves paying off the smallest debt first while making minimum payments on larger debts. Once the smallest debt is cleared, the amount previously allocated to it is added to the next smallest debt, creating a snowball effect.

- Avalanche Method: With this strategy, individuals focus on paying off debts with the highest interest rates first. By tackling high-interest debts first, individuals can save money on interest payments in the long run.

- Debt Consolidation: This strategy involves combining multiple debts into a single loan or credit line with a lower interest rate. This can simplify repayment and potentially reduce the overall interest paid.

Importance of Having a Debt Repayment Plan

Having a debt repayment plan is essential for several reasons. It helps individuals stay organized, motivated, and focused on their financial goals. A structured plan can also prevent missed payments, late fees, and damage to credit scores. By having a clear strategy in place, individuals can track their progress and adjust their repayment approach as needed.

Choosing the Right Debt Repayment Strategy

- Evaluate Your Debts: Start by understanding the total amount of debt you owe, along with interest rates and repayment terms for each debt.

- Assess Your Financial Situation: Consider your income, expenses, and financial goals to determine how much you can allocate towards debt repayment each month.

- Consider Your Preferences: Choose a strategy that aligns with your personal preferences and financial habits. Whether you prefer quick wins or saving on interest, select a strategy that suits your needs.

- Seek Professional Advice: If you’re unsure about the best approach, consider consulting a financial advisor or credit counselor for personalized guidance.

Snowball Method

The snowball method is a debt repayment strategy where you pay off your debts starting with the smallest balance first, regardless of interest rates. Once the smallest debt is paid off, you move on to the next smallest debt, and so on, creating a snowball effect.

How the Snowball Method Works

- List all your debts from smallest to largest balance.

- Make minimum payments on all debts except the smallest one.

- Put any extra money you can towards paying off the smallest debt.

- Once the smallest debt is paid off, take the amount you were paying towards it and apply it to the next smallest debt.

- Repeat this process until all debts are paid off.

Comparison with Other Debt Repayment Strategies

- The snowball method focuses on small victories, providing motivation to continue paying off debt.

- Unlike the avalanche method, which prioritizes high-interest debts first, the snowball method targets small balances regardless of interest rates.

- The snowball method may result in paying more interest over time compared to the avalanche method, but the psychological benefits can be significant.

Step-by-Step Guide for Implementing the Snowball Method

- Create a list of all your debts from smallest to largest balance.

- Determine how much extra money you can put towards debt repayment each month.

- Make minimum payments on all debts except the smallest one.

- Put all extra money towards paying off the smallest debt first.

- Continue this process until all debts are paid off.

Psychology Behind the Snowball Method and Its Effectiveness

The snowball method leverages the power of small wins to keep you motivated on your debt repayment journey. By focusing on paying off smaller debts first, you can experience a sense of accomplishment and progress, which can help you stay committed to your goal of becoming debt-free.

Avalanche Method

The avalanche method is a debt repayment strategy where you focus on paying off the debt with the highest interest rate first, while making minimum payments on all other debts. Once the debt with the highest interest rate is paid off, you move on to the next highest interest rate debt, and so on.

Benefits of Using the Avalanche Method

- Save Money: By tackling high-interest debt first, you can save money on interest payments in the long run.

- Faster Debt Payoff: Prioritizing high-interest debt helps you eliminate debt quicker compared to other methods.

- Motivation Boost: Seeing progress by eliminating high-interest debt can motivate you to continue working towards becoming debt-free.

Real-life Scenario for the Avalanche Method

Imagine you have credit card debt, a car loan, and student loans. The credit card has the highest interest rate, followed by the car loan and student loans. By using the avalanche method, you focus on paying off the credit card debt first, followed by the car loan and student loans in order of decreasing interest rates. This approach helps you save money on interest and pay off debt efficiently.

Challenges of Implementing the Avalanche Method

- Requires Discipline: It can be challenging to stick to the avalanche method as it may take longer to pay off the first debt with the highest interest rate.

- Emotional Impact: If the debt with the highest interest rate is also the largest debt, it can be emotionally draining to see slow progress initially.

- Potential for Discouragement: Some individuals may feel discouraged if they don’t see immediate results compared to other debt repayment methods.

Debt Consolidation

Debt consolidation is a strategy where multiple debts are combined into a single loan with a lower interest rate. This can simplify the repayment process by reducing the number of monthly payments and potentially lowering the overall interest paid.

Comparison with Other Strategies

- Debt consolidation combines multiple debts into one, while the snowball and avalanche methods focus on paying off individual debts separately.

- Debt consolidation may offer a lower interest rate compared to the original debts, potentially saving money in the long run.

- Unlike the snowball method that prioritizes small debts first, debt consolidation treats all debts equally.

Pros and Cons of Debt Consolidation

- Pros:

- Lower interest rates can save money over time.

- Simplified repayment with a single monthly payment.

- Potential improvement in credit score with timely payments.

- Cons:

- May require collateral, such as a home or car, for a secured loan.

- Extended repayment period could result in paying more interest overall.

- Risk of accumulating more debt if spending habits are not addressed.

Tips for When Debt Consolidation is Suitable

- Consider debt consolidation when you have multiple high-interest debts to simplify repayment.

- If you can secure a lower interest rate through consolidation, it may be a good option.

- Ensure you have a plan to avoid accumulating more debt after consolidating.