With capital appreciation strategies at the forefront, this paragraph opens a window to an amazing start and intrigue, inviting readers to embark on a storytelling journey filled with unexpected twists and insights.

Capital appreciation strategies are like the secret sauce of investing, the key to unlocking potential growth and maximizing returns. From navigating market fluctuations to understanding risk tolerance, these strategies are a game-changer in the world of finance.

Definition of Capital Appreciation Strategies

Capital appreciation strategies refer to investment techniques used by investors to increase the value of their assets over time. These strategies focus on the goal of generating profits through the growth in the market value of the investments rather than relying on regular income streams like dividends.

Types of Capital Appreciation Strategies

- Growth Investing: This strategy involves investing in companies that are expected to grow at an above-average rate compared to the overall market.

- Value Investing: Value investors seek out undervalued stocks with the potential for long-term growth, aiming to buy low and sell high.

- Market Timing: Investors using this strategy try to predict the market’s movements to buy and sell assets at the most opportune times for capital appreciation.

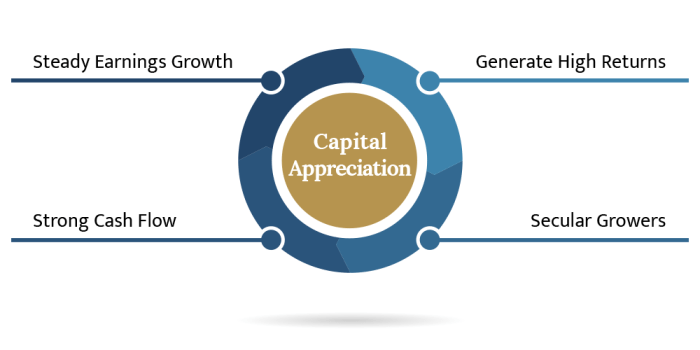

Primary Goal of Capital Appreciation Strategies

Capital appreciation strategies aim to achieve significant growth in the value of investments over time, exceeding the initial purchase price. By implementing these strategies effectively, investors can build wealth and achieve their financial goals through the appreciation of their assets in the market.

Factors Influencing Capital Appreciation

When it comes to capital appreciation strategies, there are several key factors that can influence their success. Factors such as market conditions and risk tolerance play a crucial role in determining the effectiveness of these strategies.

Market Conditions

Market conditions have a significant impact on capital appreciation strategies. Factors such as economic indicators, interest rates, and overall market sentiment can affect the performance of investments. For example, during a bull market, where stock prices are rising, investors may see higher returns on their investments. On the other hand, during a bear market, where stock prices are falling, investors may experience losses. It’s important for investors to analyze market conditions and adjust their strategies accordingly to maximize capital appreciation.

Risk Tolerance

Risk tolerance also plays a vital role in implementing capital appreciation strategies. Investors with a high risk tolerance may be more willing to take on riskier investments in pursuit of higher returns. On the other hand, investors with a low risk tolerance may prefer safer investments with lower potential returns. Understanding one’s risk tolerance is essential in designing a capital appreciation strategy that aligns with their financial goals and comfort level.

Common Techniques for Capital Appreciation

When it comes to capital appreciation, there are various techniques that investors can utilize to potentially increase the value of their investments over time.

Active vs. Passive Capital Appreciation Strategies

Active capital appreciation strategies involve frequent buying and selling of assets in an attempt to outperform the market. This approach requires a hands-on approach and a higher level of involvement from the investor. On the other hand, passive capital appreciation strategies involve investing in a diversified portfolio and holding onto those investments for the long term, aiming to match the market returns. While active strategies can potentially yield higher returns, they also come with higher risks and costs compared to passive strategies.

Diversification in Capital Appreciation

Diversification is a key strategy in capital appreciation that involves spreading investments across different asset classes, sectors, and geographic regions to reduce risk. By diversifying their portfolio, investors can potentially minimize the impact of negative events on a particular investment and increase the chances of achieving long-term capital appreciation. It allows investors to capture gains from multiple sources and balance out potential losses in specific areas.

Evaluating Performance of Capital Appreciation Strategies

When it comes to evaluating the performance of capital appreciation strategies, investors need to look at various metrics and benchmarks to determine the success of their investments.

Metrics for Evaluation

- One common metric used is the compound annual growth rate (CAGR), which calculates the mean annual growth rate of an investment over a specified period of time.

- Another important metric is the Sharpe ratio, which measures the risk-adjusted return of an investment compared to a risk-free asset.

- Investors also look at the total return, which includes both capital appreciation and dividend payments, to assess the overall performance of their investments.

Benchmarks for Evaluation

- A common benchmark used to evaluate the success of capital appreciation strategies is the S&P 500 index, which represents the performance of the 500 largest publicly traded companies in the US.

- Another benchmark is the Russell 2000 index, which tracks the performance of small-cap stocks and can be used to compare the performance of a capital appreciation strategy focused on smaller companies.

- Investors may also compare their investment performance to industry-specific indices or peer group averages to gauge how well their capital appreciation strategies are performing relative to similar investments.