Global investment trends are like the cool kids in the finance world, setting the stage for this enthralling narrative. Get ready to dive into a story rich in detail and brimming with originality from the outset.

As we explore the different facets of global investment trends, you’ll discover the ins and outs of the financial playground where stocks, bonds, and real estate mingle in a high school hip style.

Overview of Global Investment Trends

Investing globally has become increasingly popular due to the potential for higher returns and diversification of risk. Understanding and analyzing global investment trends is crucial for investors to make informed decisions and maximize their returns in the ever-changing landscape of the global economy.

Factors Influencing Global Investment Trends

- Market Conditions: The state of the global economy, interest rates, and inflation rates all play a significant role in shaping investment trends.

- Technological Advancements: Innovations in technology can create new investment opportunities and disrupt existing industries, influencing where investors put their money.

- Regulatory Environment: Changes in regulations and policies by governments can impact investment trends by either creating new opportunities or limiting certain types of investments.

Impact of Geopolitical Events on Global Investment Trends

Geopolitical events such as trade wars, political instability, and natural disasters can have a profound impact on global investment trends. These events can create uncertainty in the market, leading to fluctuations in asset prices and investment strategies. It is essential for investors to stay informed about geopolitical developments to mitigate risks and take advantage of opportunities in the global market.

Types of Global Investments

Investing globally offers a wide range of options for individuals looking to grow their wealth. Let’s explore some of the most common types of global investments and their characteristics.

Stocks

Stocks, also known as equities, represent ownership in a company. By purchasing shares of stock, investors become partial owners and can benefit from the company’s growth and profitability. Stocks are considered to have high return potential but also come with higher risk due to market volatility.

Bonds

Bonds are debt securities issued by governments or corporations to raise capital. When an investor buys a bond, they are essentially lending money to the issuer in exchange for periodic interest payments and the return of the original investment at maturity. Bonds are generally considered lower risk compared to stocks but offer lower returns.

Real Estate

Investing in real estate involves purchasing properties with the expectation of generating rental income or capital appreciation. Real estate investments can provide a steady income stream and potential for long-term growth. However, real estate markets can be affected by economic conditions and local factors, leading to varying levels of risk and return.

Commodities

Commodities are raw materials or primary agricultural products that are traded on exchanges. Examples include gold, oil, and agricultural products. Investing in commodities can offer diversification benefits and a hedge against inflation. However, commodity prices can be volatile, leading to fluctuations in returns.

Importance of Diversification

Diversification is key to managing risk in a global investment portfolio. By spreading investments across different asset classes, regions, and industries, investors can reduce the impact of market fluctuations on their overall returns. Diversification helps balance risk and return, improving the long-term performance of the portfolio.

Role of Emerging Markets

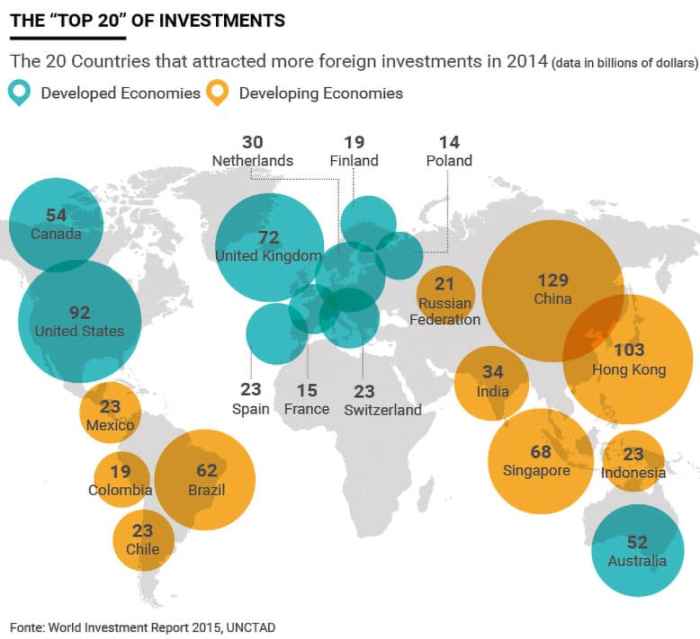

Emerging markets play a crucial role in global investment strategies due to their growth potential and diversification benefits. Investing in emerging markets can offer higher returns than developed markets but also comes with higher risk. Emerging markets are characterized by rapid economic growth, expanding middle-class populations, and increasing consumer demand, making them attractive opportunities for investors looking to capitalize on growth trends.

Technology and Global Investment Trends

Technology plays a crucial role in shaping global investment trends, with advancements like AI and blockchain revolutionizing the way investors make decisions and manage their portfolios. These innovations have not only enhanced efficiency but also opened up new opportunities for investors around the world.

Impact of AI and Blockchain

AI algorithms are being used to analyze massive amounts of data in real-time, helping investors make more informed decisions and predict market trends with greater accuracy. Blockchain technology, on the other hand, has introduced transparency and security to investment processes, reducing fraud and increasing trust among investors.

Role of Data Analytics and Machine Learning

Data analytics and machine learning are being leveraged to optimize global investment strategies by providing insights into market behavior and risk analysis. By analyzing historical data and identifying patterns, investors can make more strategic investment decisions and minimize potential losses.

Risks and Benefits of Technology-driven Investments

While technology-driven investments offer numerous benefits such as increased efficiency and transparency, they also come with their own set of risks. Cybersecurity threats, algorithm biases, and overreliance on technology are some of the potential risks that investors need to be aware of when incorporating technology into their investment strategies.

Sustainable Investing and Global Trends

Sustainable investing, also known as socially responsible investing (SRI), is a strategy that aims to generate financial returns while also making a positive impact on society and the environment. This approach considers environmental, social, and governance (ESG) factors in investment decisions, ensuring that companies adhere to ethical practices and contribute to sustainable development goals. As concerns about climate change and social responsibility continue to grow, sustainable investing has gained traction in the global investment landscape.

ESG Factors and Global Investment Trends

ESG factors play a crucial role in influencing global investment trends by shaping investors’ decisions based on companies’ sustainability practices. Environmental considerations focus on a company’s impact on the planet, such as carbon emissions, resource conservation, and waste management. Social factors assess how a company manages relationships with employees, customers, communities, and other stakeholders. Governance factors examine the company’s leadership, executive compensation, shareholder rights, and transparency in decision-making processes.

Impact of Climate Change and Social Responsibility

Climate change and social responsibility have become key drivers of investment decisions globally, prompting investors to align their portfolios with sustainable practices. Companies that prioritize environmental sustainability, social impact, and ethical governance are increasingly viewed as more resilient and attractive investments. As the world faces pressing environmental and social challenges, sustainable investing offers a way to address these issues while seeking financial returns.

Performance of Sustainable Investments

Sustainable investments have demonstrated competitive performance compared to traditional investment approaches, debunking the myth that pursuing sustainability comes at the cost of returns. Research shows that companies with strong ESG profiles tend to outperform their counterparts over the long term. By integrating sustainability criteria into investment strategies, investors can not only drive positive change but also achieve financial success in a rapidly evolving global market.