Get ready to dive into the world of financial tools for budgeting and take control of your money like a boss. We’re about to break down the different types of tools, key features to look for, budgeting strategies, and how to integrate these tools into your personal finance game plan. So, grab your virtual calculator and let’s get started!

Types of Financial Tools

Budgeting is an essential aspect of managing personal finances effectively. There are various types of financial tools available to help individuals create and stick to a budget. Let’s explore some popular options and how they can assist in budgeting effectively.

Spreadsheets

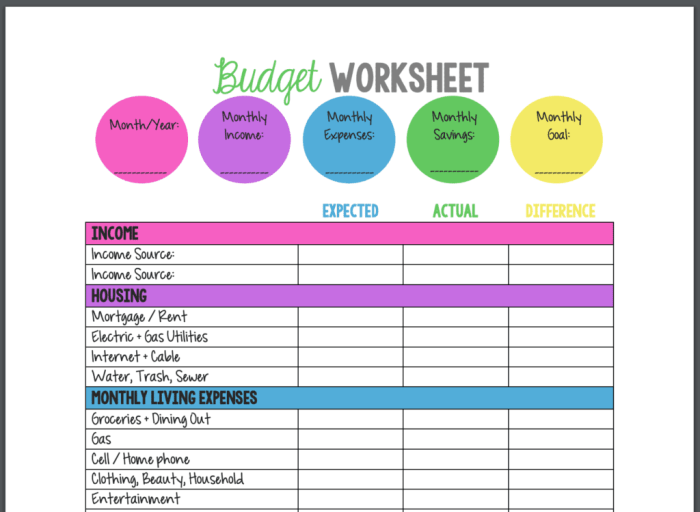

Spreadsheets like Microsoft Excel or Google Sheets are versatile tools that allow users to create customizable budget templates. Users can input their income, expenses, and savings goals to track their financial progress. Spreadsheets are beneficial for individuals who prefer a hands-on approach to budgeting and want full control over their financial data.

Budgeting Apps

Budgeting apps such as Mint, YNAB (You Need A Budget), or PocketGuard are convenient tools that sync with users’ bank accounts to automatically categorize transactions. These apps provide real-time updates on spending habits, track bills, and set financial goals. Budgeting apps are ideal for individuals who prefer a more automated approach to budgeting and appreciate visual representations of their financial data.

Specialized Software

Specialized budgeting software like Quicken or Personal Capital offer advanced features for comprehensive financial planning. These tools provide in-depth analysis of income, expenses, investments, and retirement planning. Specialized software is suitable for individuals with complex financial portfolios or those looking for detailed financial insights and forecasting capabilities.

Features to Look for in Financial Tools

When choosing a financial tool for budgeting, it is essential to consider specific key features that can make managing your finances easier and more effective. Features such as customizable categories, goal setting, expense tracking, automation, and synchronization with bank accounts can significantly impact how well you can stay on top of your budget.

Customizable Categories

Having the ability to create and customize categories in your financial tool is crucial for tailoring your budget to your specific needs and spending habits. This feature allows you to allocate funds to different areas of your life, such as groceries, entertainment, bills, and savings, making it easier to track where your money is going.

Goal Setting

Setting financial goals is an essential part of budgeting, and a good financial tool should allow you to input and track these goals. Whether you are saving for a vacation, paying off debt, or building an emergency fund, being able to set specific targets and monitor your progress can help you stay motivated and focused on your financial objectives.

Expense Tracking

Tracking your expenses is key to understanding your spending patterns and identifying areas where you can cut back or adjust your budget. Look for a financial tool that offers robust expense tracking features, such as the ability to categorize transactions, set spending limits, and generate reports that provide insights into your financial habits.

Automation and Synchronization

Automation and synchronization with your bank accounts can streamline the budgeting process by automatically importing transactions and updating your budget in real-time. This feature eliminates the need for manual data entry and ensures that your financial information is always up-to-date, allowing you to make informed decisions about your money management.

Budgeting Strategies with Financial Tools

Creating a budget is essential for managing your finances effectively, and financial tools can make the process easier and more efficient. By utilizing these tools, you can track your expenses, set financial goals, and monitor your progress towards achieving them. Here are some tips on how to create a budget using financial tools effectively:

Zero-Based Budgeting

Zero-based budgeting is a method where your income minus your expenses equals zero. Every dollar you earn is allocated towards a specific purpose, whether it’s savings, bills, or discretionary spending.

50/30/20 Rule

The 50/30/20 rule suggests allocating 50% of your income towards needs, 30% towards wants, and 20% towards savings and debt repayment. Financial tools can help you categorize your expenses accordingly and ensure you’re following this guideline.

Monitoring Spending Habits

Financial tools can track your spending habits and provide insights into where your money is going. By analyzing this data, you can identify areas where you can cut back and save more effectively.

Integrating Financial Tools with Personal Finance

Integrating financial tools with personal finance can significantly enhance your overall financial management and help you achieve long-term financial goals.

Benefits of Integrating Financial Tools

- Automated tracking of expenses and income for better budgeting.

- Visual representation of financial data for easy analysis and decision-making.

- Alerts and reminders for bill payments and upcoming financial obligations.

Assistance in Long-Term Financial Planning

Financial tools can assist in creating and monitoring long-term financial plans by providing:

- Tools for setting financial goals and tracking progress towards them.

- Retirement planning calculators to estimate future financial needs.

- Investment tracking features to monitor portfolio performance.

Saving for Emergencies and Investing

Financial tools play a crucial role in encouraging saving for emergencies and investing by:

- Setting up automated savings contributions for emergency funds.

- Providing investment analysis tools to make informed investment decisions.

- Offering retirement planning simulations to optimize investment strategies.

Improved Financial Health and Stability

By integrating financial tools into your personal finance management, you can experience:

- Reduced financial stress through better budgeting and planning.

- Increased savings and investments leading to greater financial security.

- Improved credit scores and overall financial well-being.