With Understanding credit reports at the forefront, this paragraph opens a window to an amazing start and intrigue, inviting readers to embark on a storytelling journey filled with unexpected twists and insights. Credit reports play a crucial role in our financial lives, offering a peek into our financial health and guiding our decisions. Let’s dive into the world of credit reports and unravel their importance, generation, interpretation, and ways to monitor and improve them.

Importance of Credit Reports

Credit reports play a crucial role in determining an individual’s financial health and overall creditworthiness. These reports provide valuable information to lenders, creditors, and even employers to assess a person’s ability to manage credit responsibly. Understanding credit reports is essential for maintaining a good financial standing and making informed financial decisions.

Key Components of a Credit Report

- Personal Information: Includes name, address, social security number, and date of birth.

- Credit Accounts: Details of current and past credit accounts, including payment history and credit limits.

- Public Records: Information on bankruptcies, liens, and court judgments that may impact creditworthiness.

- Inquiries: Records of who has requested a copy of the credit report, which may affect credit scores.

How Credit Reports Impact Financial Decisions

- Creditworthiness Assessment: Lenders use credit reports to evaluate the risk of lending money to an individual.

- Interest Rates: Credit reports influence the interest rates offered on loans and credit cards.

- Employment Opportunities: Some employers review credit reports as part of the hiring process to assess financial responsibility.

- Loan Approvals: A good credit report increases the likelihood of loan approvals and favorable terms.

How Credit Reports are Generated

Credit reports are generated through a detailed process that involves compiling information from various sources to create a comprehensive financial profile for an individual. These reports play a crucial role in determining a person’s creditworthiness and financial responsibility.

Compilation of Information

Credit reports are compiled by gathering data from different sources, including:

- Financial institutions: Information from banks, credit unions, and other lenders regarding a person’s loan repayment history, credit card usage, and overall debt management.

- Public records: Details from court records, such as bankruptcies, tax liens, and judgments, that can impact a person’s financial standing.

- Credit card companies: Data on credit card payments, balances, and credit limits are collected to assess an individual’s credit utilization and payment behavior.

- Collection agencies: Information on any outstanding debts that have been sent to collections, indicating potential financial struggles or delinquencies.

The compilation of this data helps create a comprehensive picture of an individual’s financial health and creditworthiness.

Role of Credit Bureaus

Credit bureaus are responsible for collecting and maintaining credit information from different sources to generate credit reports. These bureaus, such as Equifax, Experian, and TransUnion, play a vital role in ensuring the accuracy and reliability of the data used to evaluate an individual’s credit profile.

- Credit bureaus use algorithms and statistical models to analyze the data collected and generate credit scores, which provide a quick snapshot of a person’s creditworthiness.

- They also facilitate the sharing of credit information among lenders, helping them make informed decisions when assessing loan applications and determining interest rates.

- Consumers can request a free copy of their credit report from each of the major credit bureaus annually to review their financial standing and address any inaccuracies or discrepancies.

Understanding Credit Score

A credit score is a three-digit number that represents an individual’s creditworthiness and financial responsibility. It is used by lenders to determine the risk of lending money to a borrower.

Factors Influencing Credit Score

Several factors influence a person’s credit score, including:

- Payment history: Timely payments positively impact the credit score.

- Credit utilization: The amount of credit used compared to the total available credit affects the score.

- Length of credit history: Longer credit history can improve the score.

- Types of credit: Having a mix of credit types like credit cards and loans can be beneficial.

- New credit inquiries: Multiple inquiries within a short period can negatively impact the score.

Importance of Maintaining a Good Credit Score

Maintaining a good credit score is crucial for several reasons, such as:

- Access to better loan terms: A higher credit score can lead to lower interest rates and better loan terms.

- Approval for credit: Lenders are more likely to approve credit applications from individuals with good credit scores.

- Rental approvals: Landlords often check credit scores before approving rental applications.

- Employment opportunities: Some employers may review credit scores as part of the hiring process.

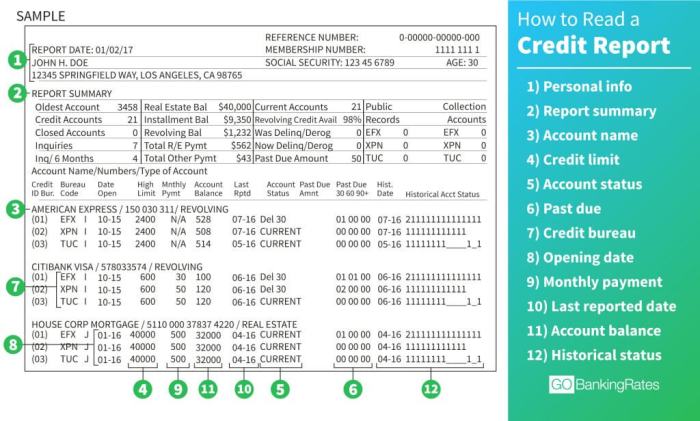

Reading and Interpreting Credit Reports

Understanding how to read and interpret your credit report is crucial for managing your financial health and making informed decisions. Here is a step-by-step guide on how to navigate through your credit report and interpret the information you find.

Step-by-Step Guide

- Obtain a copy of your credit report from one of the major credit bureaus – Equifax, Experian, or TransUnion.

- Review the personal information section to ensure all details are accurate, including your name, address, and Social Security number.

- Check the account information section for any open accounts, balances, and payment history. Make sure all information is correct and up to date.

- Look at the public records section for any bankruptcies, liens, or judgments that may negatively impact your credit score.

- Review the inquiries section to see who has requested your credit report. Too many inquiries in a short period can lower your score.

Interpreting Credit Report Information

- Understanding Credit Utilization: This is the ratio of your credit card balances to your credit limits. A high utilization ratio can negatively impact your credit score.

- Payment History: Your payment history shows whether you have paid your bills on time. Late payments can significantly lower your credit score.

- Length of Credit History: The longer your credit history, the better it is for your score. It shows lenders that you have a track record of managing credit responsibly.

- Credit Mix: Having a mix of different types of credit accounts, such as credit cards, loans, and mortgages, can positively impact your score.

- New Credit: Opening multiple new credit accounts in a short period can be seen as risky behavior by lenders and may lower your score.

Common Errors and Discrepancies

- Incorrect Personal Information: Mistakes in your name, address, or Social Security number can lead to confusion and possible identity theft.

- Outdated Account Information: Closed accounts showing as open or incorrect balances can negatively impact your credit score.

- Fraudulent Accounts: Accounts that you did not open or unauthorized inquiries could be a sign of identity theft and should be reported immediately.

Monitoring and Improving Credit Reports

Regularly monitoring your credit report is essential to ensure accuracy and identify any issues that may affect your credit score. Improving your credit report involves taking proactive steps to address negative items and demonstrate responsible financial behavior. Here are some strategies for monitoring and improving your credit reports:

Monitoring Credit Reports Regularly

- Check your credit report from all three major credit bureaus (Experian, Equifax, TransUnion) at least once a year for free at AnnualCreditReport.com.

- Consider signing up for credit monitoring services that provide regular updates on changes to your credit report.

- Set up fraud alerts and credit freezes to protect your credit information from identity theft.

Improving Credit Report and Boosting Credit Score

- Pay your bills on time to establish a positive payment history.

- Reduce your credit utilization ratio by paying down credit card balances.

- Avoid opening multiple new credit accounts in a short period, as it can lower the average age of your credit accounts.

Resolving Issues or Inaccuracies in Credit Reports

- Dispute any inaccuracies or errors on your credit report by contacting the credit bureau and providing supporting documentation.

- Follow up with creditors to ensure that any negative items are resolved and updated on your credit report.

- Consider working with a credit repair company if you need assistance in improving your credit report.