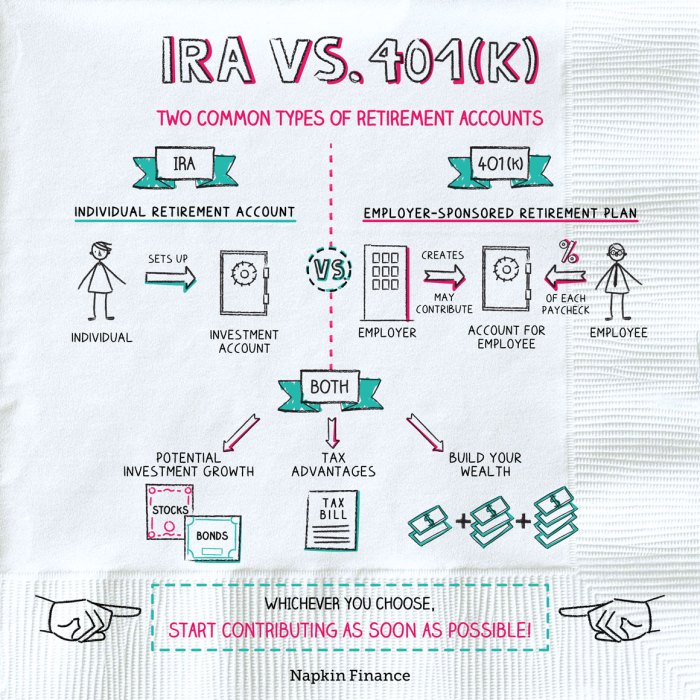

When it comes to planning for retirement, the choice between a 401(k) and an IRA can be a game-changer. Let’s dive into the world of retirement savings and explore the differences between these two popular options. Strap in, folks, it’s about to get interesting!

401(k) Overview

401(k) retirement accounts are employer-sponsored plans that allow employees to save and invest a portion of their paycheck for retirement. This type of account offers tax advantages and helps individuals build a nest egg for their future.

Employer Match:

One of the key features of a 401(k) is the potential for an employer match. This means that employers may contribute a certain percentage of an employee’s salary to their 401(k) account, typically up to a certain limit. This is essentially free money added to the employee’s retirement savings.

Contribution Limits:

There are annual contribution limits set by the IRS for 401(k) accounts. For 2021, the contribution limit is $19,500 for individuals under 50 years old, and $26,000 for those 50 and older. These limits are subject to change based on IRS regulations.

Tax Benefits:

Contributions to a traditional 401(k) are made with pre-tax dollars, reducing the individual’s taxable income for the year. This means that the money contributed grows tax-deferred until withdrawal during retirement. On the other hand, Roth 401(k) contributions are made with after-tax dollars, allowing for tax-free withdrawals in retirement.

Examples of Contributions:

For example, if an employee earns $50,000 annually and contributes 5% of their salary to a traditional 401(k), they would contribute $2,500 pre-tax dollars. If the employer matches 50% of the first 5% of the employee’s contribution, they would receive an additional $1,250 from their employer, totaling $3,750 in contributions for the year.

IRA Overview

An Individual Retirement Account (IRA) is a type of retirement savings account that individuals can open independently of their employer. IRAs offer tax advantages similar to a 401(k), but there are key differences between the two retirement savings options.

Types of IRAs

- Traditional IRA: Contributions are made with pre-tax dollars, and withdrawals in retirement are taxed as ordinary income.

- Roth IRA: Contributions are made with after-tax dollars, and qualified withdrawals in retirement are tax-free.

- SEP IRA: Simplified Employee Pension plan for small business owners or self-employed individuals.

- SIMPLE IRA: Savings Incentive Match Plan for Employees, typically used by small businesses with fewer than 100 employees.

Contribution Limits and Tax Advantages

- Contribution Limits: IRA contribution limits are generally lower than 401(k) limits. For 2021, the contribution limit for both Traditional and Roth IRAs is $6,000 (or $7,000 for those aged 50 and older).

- Tax Advantages: Traditional IRA contributions may be tax-deductible, reducing taxable income for the year. Roth IRA contributions are not tax-deductible, but qualified withdrawals in retirement are tax-free.

Eligibility Criteria

- To open an IRA account, individuals must have earned income for the year, and for a Traditional IRA, they must be under the age of 70 ½. Roth IRA contributions have income limits, meaning not everyone may be eligible to contribute.

401(k) vs. IRA: Eligibility and Access

401(k) plans and IRAs have different eligibility requirements and accessibility features that cater to various individuals’ financial needs.

401(k) Eligibility

To participate in a 401(k) plan, an individual typically needs to be an employee of a company that offers the plan. Employers may have specific requirements, such as a minimum age or length of service, before employees can start contributing to the plan.

IRAs for Self-Employed Individuals

Self-employed individuals can benefit from IRAs as they provide a retirement savings option outside of employer-sponsored plans. They can contribute to a Traditional IRA or Roth IRA based on their income level and tax situation.

Accessibility and Portability

401(k) plans are tied to specific employers, making them less portable compared to IRAs. When individuals change jobs, they can leave their 401(k) with the previous employer, roll it over into a new employer’s plan, or transfer it into an IRA for more control over investment options.

Rollover Options

An example of a rollover option is a direct rollover, where funds from a 401(k) are transferred directly into an IRA without incurring taxes or penalties. Another option is an indirect rollover, where funds are distributed to the individual, who then has 60 days to deposit the funds into an IRA to avoid taxes and penalties.

Investment Options and Flexibility

When it comes to investing for retirement, understanding the investment options and flexibility available in both a 401(k) and an IRA is crucial for maximizing returns and managing risk effectively.

401(k) Investment Options

In a 401(k) plan, investment options are typically limited to a selection of mutual funds, stocks, bonds, and target-date funds. These options are chosen by the employer and may vary depending on the plan provider. While the choices are somewhat restricted, they are usually well-diversified to cater to a broad range of risk tolerances and investment goals.

IRA Flexibility and Diversification Strategies

IRAs, on the other hand, offer a wide array of investment choices, including individual stocks, bonds, mutual funds, exchange-traded funds (ETFs), real estate, and more. This flexibility allows individuals to tailor their investment portfolio to their specific preferences and risk tolerance. Diversification strategies can be more customized in an IRA, as investors have the freedom to allocate their funds across various asset classes and industries.

Control Over Investments

In a 401(k) plan, individuals have limited control over their investment options as they are typically pre-selected by the employer. On the other hand, IRAs provide investors with full control over their investment decisions, allowing them to actively manage their portfolio and make changes as needed. This level of control can be beneficial for those who prefer a hands-on approach to investing.

Managing Risk and Maximizing Returns

Both 401(k)s and IRAs offer opportunities to manage risk and maximize returns through different investment options. In a 401(k), individuals can diversify their portfolio by choosing from the available investment options provided by the employer. In an IRA, investors can implement more sophisticated diversification strategies by selecting a combination of assets that align with their risk tolerance and investment objectives. By actively monitoring and adjusting their investments, individuals can work towards optimizing their returns while mitigating potential risks.